These drugs are the cash cows of big pharma

August 22, 2013 Leave a comment

These drugs are the cash cows of big pharma

By David Yanofsky @YAN0 August 20, 2013

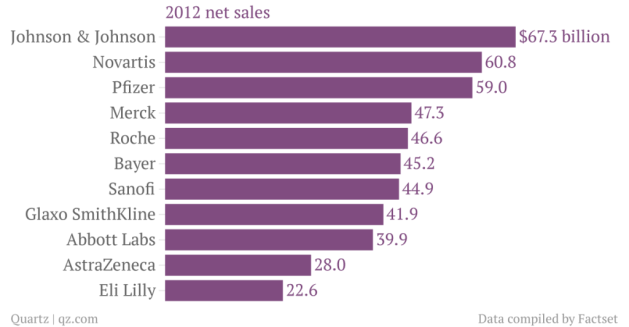

It is not uncommon for single drugs to account for a large share of a drug company’s business. Of the world’s 11 largest pharmaceutical companies in 2012, six had single drugs bring in more than 10% of total sales. Bayer was the only drug maker without a single treatment grossing more than 5% of total sales. Bayer’s business is also the most diverse of the lot. Where other top drug companies stick to pharmaceuticals and personal care, Bayer’s products encompass crop and materials science units. Ely Lilly was in US Federal Court yesterday (Aug. 19) to defend a patent on administering its lung-cancer therapy Alimta with certain vitamins to temper the prescription’s side effects. A victory for Lilly in the lawsuit could put off competition from generic drug makers until 2022, who would need to imitate the vitamin regimen to gain approval from regulators. (The chemistry of Alimta itself is covered by a different Ely Lilly patent which expires in 2017.) Patenting the way a drug is taken is taken is an unusual move, and a sign of how far drug companies will go to prolong their patents, though most analysts doubt it will succeed. Alimta purchases made up 11.5% of Ely Lilly’s net sales last year, making it the most important drug to the company after Cymbalta, an antidepressant, which accounts for 22.1%. Cymbalta’s patent expires in December. Cymbalta has the second largest portion of sales from any of the top 11 companies. The largest is Abbott Laboratories’ Humira, a rheumatoid arthritis treatment, which makes up 23.2% of Abbott’s sales. Humira’s $9.3 billion in sales last year exceeded those of any other drug on the market.