Pandora Should Watch the Throne; Company’s Spending Plans Betray Fears Over Apple

August 24, 2013 Leave a comment

Updated August 23, 2013, 4:43 p.m. ET

Pandora Should Watch the Throne

Company’s Spending Plans Betray Fears Over Apple

Pandora Media P -12.90% may be girding for a fight. Or at least investors seem to be reading it that way. The Internet-radio company reported quarterly earnings and revenue late Thursday that beat expectations. Mobile revenue almost doubled year over year. And content costs as a share of revenue fell. Even so, Pandora’s shares tumbled 13% Friday. A big reason: The company tightened the range of its third-quarter and full-year projections due to increasing investment. Pandora now expects full-year earnings to be between zero and five cents a share, compared with an earlier projection of a loss of two cents up to a profit of eight cents.Over the long term, Pandora still aims for the 20% operating margins it laid out ahead of its 2011 initial public offering. But its current focus is boosting sales. So investors who had just begun to glimpse the potential leverage in Pandora’s business model saw hopes dashed for higher profits in the near term.

They may also regard higher investment as a sign that Pandora is bolstering itself ahead of the expected September rollout of Apple‘s AAPL -0.39% iTunes Radio. Pandora said it would lift its 40-hour monthly listening cap for free mobile users Sept. 1, also a possible defense against Apple.

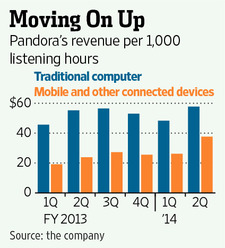

Pandora says this is the first time it has been in a position to invest and that it has developed several technologies that help it curb listening hours. Those, and higher mobile revenue per 1,000 listening hours, have made the cap unnecessary, according to Pandora.

Pandora insists Apple won’t dent its dominance. But there are clear reasons to mount extra defenses. With its preinstalled base of iPhone and iTunes users and mountains of cash, Apple is far more formidable than previous would-be usurpers of the Internet-radio throne.