China’s aluminum producers staggering as factories lack orders

August 27, 2013 Leave a comment

Aluminum producers staggering as factories lackorders

Updated: 2013-08-27 06:50

By Du Juan ( China Daily)

China has invested substantial sums in rawmaterial production such as electrolyticaluminum projects, driven by global demand,but the industry faces serious excesscapacity, experts said.

China has invested substantial sums in rawmaterial production such as electrolyticaluminum projects, driven by global demand,but the industry faces serious excesscapacity, experts said.

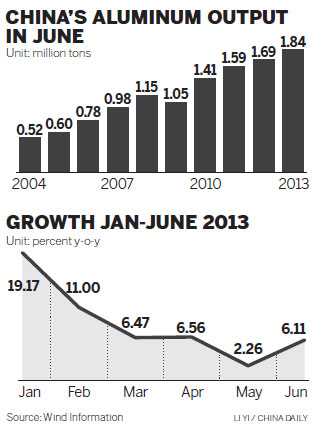

During the first half, China’s nonferrousmetals refining industry experienced “severe”overcapacity, rising power costs and fallingaluminum prices, according to a reportreleased by the National Development andReform Commission, China’s top planningagency, in mid-August.

It said smelting capacity was “extremelyexcessive”, with a lack of stable resourcesupply. Yet the industry doesn’t produceenough high value-added products, whichmust still be imported.

Because there’s so much excess capacity,many electrolytic aluminum producers areshort of orders, said Xu Yongbo, chiefanalyst of the metals industry at JYD OnlineCorp, a Beijing-based bulk commodityconsultancy.

He said that many companies didn’t lookahead to the possibility of shrinking demand when they started investing in the industry a fewyears ago. One option could be “for these producers to turn to the high-end aluminum market,which still has big potential. However, it costs too much to upgrade their production lines,” hesaid.

In the first half, the electrolytic aluminum industry lost a combined 670 million yuan ($109million), forcing several enterprises in central and eastern China to suspend production,according to the Ministry of Industry and Information Technology.

Based on the 12th Five-Year plan (2011-15) for the nonferrous metal industry released by theministry, domestic electrolytic aluminum output must be capped at 24 million tons per year bythe end of 2015.

But data from the China Nonferrous Metals Industry Association shows that China’s electrolyticaluminum output in the past year already reached 20.3 million tons and production capacitystood at 26 million tons.

The combination of excess capacity and rising electricity prices – which account for about 45percent of production costs – led to bitter competition and falling prices.

The sales price of electrolytic aluminum has been below production costs since August 2011

Market data show that aluminum prices fell 9 percent year-on-year to 14,700 yuan a ton inJune this year, according to the NDRC.

In 2012, the national average selling price of electrolytic aluminum was 15,636 yuan a ton,while the average production cost reached 16,200 yuan a ton, putting 93 percent of producersinto the red.

The government has taken several steps, including setting a cap on total output, monitoringfinancing for the industry and environmental standards for new projects. In line with the nationalpolicy, four electrolytic aluminum producers with a total capacity of 260,000 tons were orderedto close in 2013. All four are in Henan province, which account for about one-quarter of China’selectrolytic aluminum output.

Producers in the province face multiple challenges including soaring production costs, decliningproduct prices, shrinking demand and rising inventories.

However, Xu said the “Henan dilemma” is overtaking the industry nationwide.

To cut production costs, many companies are moving their plants from eastern areas withhigher electricity rates to western regions such as Gansu province and the Xinjiang Uygurautonomous region. These local governments welcome the investments, which can push uptheir local GDP levels.

However, the NDRC said, some new electrolytic aluminum projects “did not abide by State rulesin western China”, though it didn’t give further details.

Xu said that relocation for short-term benefits was unwise.

“These companies might make money for one or two years because of cheaper electricity ratesand incentives offered by local governments,” he said. “But then what? Without core productswith competitiveness, it’s still a dead-end.”