China SUV Maker Has Great Wall to Climb

August 28, 2013 Leave a comment

August 27, 2013, 11:00 a.m. ET

China SUV Maker Has Great Wall to Climb

China can boast that it is home to the world’s most profitable car maker. But the company may soon run out of open road. Hong Kong-listed Great Wall Motor GWLLY +8.01% has the fattest margins in the auto world, says Sanford C. Bernstein’s Max Warburton. It posted an operating profit margin of 18.4% in the first half of 2013. That tops even Ferrari, which was at 14.9% in the same period. Great Wall’s secret sauce is that sport utility vehicles, which typically yield higher profits, account for half of the autos it sells. In contrast, SUVs on average make about a third of an auto maker’s volumes in North America, according to research firm LMC Automotive. That sector is about a fifth in China.Great Wall also runs a lean operation by spending little on research and development or marketing. It has become one of a handful of Chinese companies to build a domestic brand, rather than rely on foreign partners like General Motors GM -3.52% .

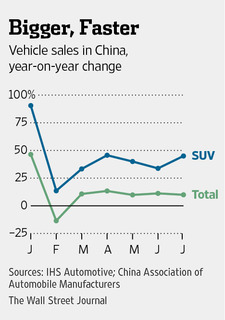

China’s insatiable demand for SUVs has also helped Great Wall. Despite the economic slowdown, sales of these vehicles are projected to grow 22% this year, compared with 13% for passenger cars overall, says LMC Automotive. Consumers want these larger cars either as trophies or to navigate the country’s rough roads.

Great Wall’s SUV sales soared 78% year-on-year in the first half, mostly by catering to the lower end of the market with vehicles priced below $30,000. It leads China’s SUV market along with Volkswagen VOW.XE -3.31% and Honda, 7267.TO -3.24%according to Nomura.

The next test for the company: Can it move up the product ladder? It plans to launch a bigger and more expensive SUV next year. But Great Wall’s low research and development budget, at just 2.2% of sales, may prove a stumbling block. While this helps flatter its margin, it also means the company’s technological capabilities are limited, says Mr. Warburton. Toyota spends almost double that on R&D. And at the higher end of the market, Great Wall will also encounter stiffer foreign competition.

Quality is another concern. There are already complaints Great Wall’s engine is underpowered. To address these problems and further automate its production, Great Wall may have to increase costs, sacrificing some of its margin.

Great Wall’s Hong Kong-listed shares are up 64% this year, while the benchmark Hang Seng index is down 3%. The stock trades at 10.5 times estimated earnings for the next 12 months. In comparison, Geely, 0175.HK -3.18% which owns Volvo, trades at a multiple of 9.3 times, while Nissan Motor‘s 7201.TO -2.97% local partner Dongfeng is valued at just 7.6 times forward earnings.

For now, Great Wall’s higher margins can help justify the premium. To maintain its lead, though, it will have to keep evolving. China boasts money-making car companies, but not yet one that is world class.