rand Vision for a New Beijing Financial District

August 28, 2013 Leave a comment

August 27, 2013, 2:09 p.m. ET

Grand Vision for a New Beijing Financial District

Lize Project Defies Doubters With Plan to Build 80 Skyscrapers Over 20 Years

RICHARD SILK

Lize would be transformed from one of Beijing’s least-developed districts.

BEIJING—A new financial center planned for Beijing, whose size would top London’s Square Mile and Manhattan’s financial district combined, aims to defy doubters on the sustainability of China’s real-estate boom and the stability of its overstretched banks. If completed as planned, the Lize Financial District on the southern outskirts of Beijing would provide between 8 million and 9.5 million square meters of new floor space, almost doubling the Chinese capital’s current stock of high-grade offices.Eighty skyscrapers are planned to house financial firms, corporations and government entities. Three new subway lines would run under the district, connecting it with the rest of the city.

The ambitious project comes as concerns mount about China’s fragile financial system, a large amount of unsold office towers and rising local-government debt.

But the man responsible for the 20-year project that would turn a swathe of farmland and aging low-rise housing on the southern edge of Beijing into a new financial district brushes away fears of failure.

Sitting in a spartan office on the edge of the development site, Shi Weimin exudes confidence. “The amount of office space that is available to the financial sector in Beijing is far short of what’s needed,” he said. Mr. Shi is chairman of Beijing Lize Financial Business District Holdings Ltd., the government-owned investment vehicle building the new district, and the head of the local government office overseeing the project.

It will be awhile before any of Mr. Shi’s project is available to rent. The district is currently a mix of half-built skyscrapers and ramshackle buildings midway through demolition. The first offices should be up and running by 2018, if all goes according to plan, although it will take another decade or more to finish the job, the company says.

Lize will cost a projected 110 billion yuan ($18 billion) to build, an amount to be raised through a combination of bond issuance, bank loans and wealth-management products—investments that offer savers better returns than available on bank deposits. Lize Holdings declined to say how much cash it has raised so far, but it had assets of 10.9 billion yuan and liabilities of 9.54 billion yuan at the end of 2010, according to a bond prospectus issued by its parent company.

Success appears far from guaranteed. Beijing already has one financial center—with the headquarters of top financial firms such as Industrial and Commercial Bank of China—clustered around the central bank and banking regulator a few kilometers northeast of Lize. Shanghai, the home of China’s equity market, also has ambitions to be the nation’s financial center, and nearby Tianjin wants a piece of the action, too.

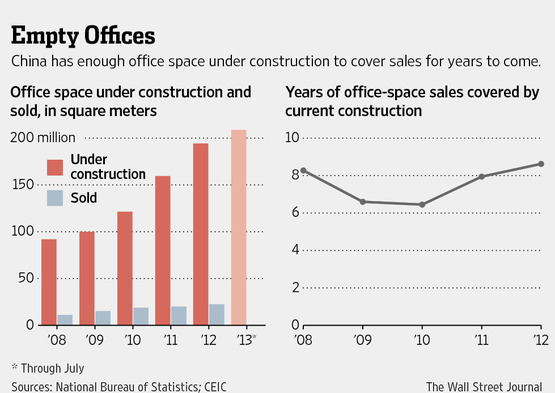

Overcapacity in the commercial property market also is a risk. Government attempts to cool the residential sector have encouraged developers to switch to commercial buildings. There is enough office space under construction nationally to cover sales for more than eight years, according to government statistics.

Finding people to move into the new space will be even more difficult if China’s strained financial system hits the rocks. A cash crunch in June, when interbank rates went through the roof, laid bare the overextension of China’s financial system. Many analysts expect China’s banks to enter a period of painful deleveraging, rather than the kind of expansion that might drive demand for expanded office space.

“Some of these projects will work, for sure, but most of them won’t,” said Gillem Tulloch, founder of Hong Kong-based research firm Forensic Asia and a longtime skeptic of China’s property boom.

Still, the “build it and they will come” camp can point to some successes. Shanghai’s Pudong area, mocked as a white elephant when it was built in the 1990s, soon filled up. A top-tier city like Beijing, which can count on strong demand from government ministries and corporate headquarters, may have a better chance than most of filling the new space. Despite the picture of rampant overcapacity painted by the government’s own data, office vacancy rates in the capital are down to 4.4%, according to Jones Lang LaSalle, a real-estate services firm.

The 170 companies that have signed up to buy or rent space in Lize are mostly domestic Chinese firms, many of them government entities such as the official Xinhua News Agency and Great Wall Asset Management, a state-backed company created to take over banks’ bad loans. Mr. Shi said he is in talks with U.S. real-estate firm Tishman Speyer Properties LP. Tishman declined to comment.

With office space filling up before the first building is even completed, Mr. Shi has little time for doubters.

“For 30 years, the predictions that outsiders have made about China’s economy, China’s political system and so forth have all been wrong,” he said, slapping his desk for emphasis. “The land here is selling very well. If you look at our sales you won’t have the impression that China’s economy is going to decline.”