Real estate top wealth creator in S China

August 28, 2013 Leave a comment

Real estate top wealth creator in S China

Updated: 2013-08-28 07:58

By Shi Jing in Shanghai ( China Daily)

Despite the central government’s tightening policies in the property market, the real estate sector still generates the largest number of billionaires in southern China, according to the Hurun 2013 Pearl River Delta Region Rich List.This is the first time that the Hurun Report, a Shanghai-based magazine that covers wealthy Chinese people, releases a list for the region.

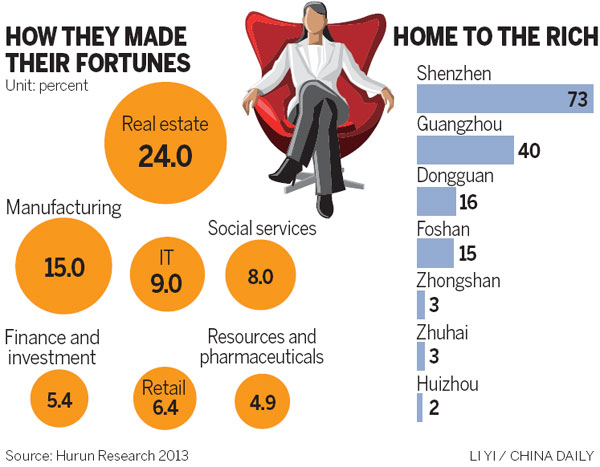

About 24 percent of the billionaires in the Pearl River region, which includes Shenzhen, Guangzhou, Dongguan, Foshan, Zhongshan, Zhuhai and Huizhou, come from the property industry, while 15 percent are in the manufacturing industry. The third-largest group of billionaires in the region is in the information technology industry.

Among the top 1,000 Chinese wealthy people shortlisted by the Hurun Report, 21 percent of them are from the manufacturing industry, the largest group of all. Next comes real estate, with 20 percent of the rich coming from the sector.

Globally, property tycoons also hold most of the world’s wealth, the report said, followed by investors in the telecommunications, media and technology sector.

A total of 152 billionaires were listed on the Hurun 2013 Pearl River Delta Region Rich List, each possessing personal wealth of at least 1.8 billion yuan ($294 million). The report estimated that there are about 8,000 people with a personal wealth of at least 100 million yuan in the region, and the number of rich people with personal assets worth at least 10 million yuan amounts to 13,000.

Shenzhen is home to the largest number of rich people in the region, with 73 billionaires. Guangzhou, which is home to 40 billionaires, dislodged Dongguan from the second position

Xu Jiayin, 55, the chairman of Guangzhou’s Evergrande Real Estate Group, topped the list withpersonal wealth of 48 billion yuan. Second on the list is Pony Ma, 42, the chairman of TencentHoldings Ltd, with personal assets of 47 billion yuan. Thirty-two-year-old Yang Huiyan of theproperty developer Country Garden (Holdings) Ltd is the third-richest person in the region withassets of 43 billion yuan.

“It should be noted that the rich people in the Pearl River Delta region are one year youngerthan the national average, although the companies in the region are more developed and havea longer history,” said Rupert Hoogewerf, chairman and chief researcher of the Hurun Report.

The Pearl River Delta region is also home to more entrepreneurs in the IT industry, which is anemerging industry and has younger billionaires. Therefore, billionaires are younger than thenational average in this area, said Hoogewerf.

Among the top 10 richest people in the region, two are women – Yang Huiyan, executivedirector of Country Garden, and Zhang Yin, chairwoman of Nine Dragons Paper (Holdings) Ltd.The list also revealed that the average ratio of female billionaires in the region is higher thanthe national average.

Real estate is still the most popular investment among billionaires, while stocks come a closesecond. The billionaires’ interest in art investment has also grown rapidly over the years. About70 percent of the billionaires polled said that they are art collectors. On average, they startedto invest in art six years ago.

“The ways to invest in works of art are more transparent and diversified now. Combined withthe growth of the art market, this has increased the number of people who keep an eye on art.The growth has been more significant since 2003. It seems to me that rich people now areclosely associated with art works,” Wang Yannan, China Guardian’s director and president,said earlier.

“Alternative investments, such as art, help to optimize their asset portfolios and reduceinvestment risks. Even though it had a late start in China, alternative investments have becomea very important option among China’s rich, and it will surely become a very promising area inthe future,” said Li Renjie, president of Industrial Bank Co Ltd.