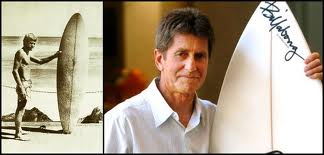

The day Gordon Merchant’s Billabong dream crumbled to nothing

August 28, 2013 Leave a comment

James Thomson Editor

The day Gordon Merchant’s Billabong dream crumbled to nothing

Published 27 August 2013 11:59, Updated 28 August 2013 07:40

Gordon Merchant’s Billabong pain continues to mount. Hidden within Billabong International’s ugly profit result which was announced on Tuesday morning is an awful little fact: Billabong now thinks the flagship surfwear brand that Gordon Merchant started from his kitchen table in 1973 is worth nothing. Billabong lost $859.5 million in 2013 – taking losses in the last two years to $1.13 billion – after writing off $867.2 million from the value of its brands and goodwill.While these are non-cash writedowns, they do reflect how far Billabong has fallen.

The value of the Billabong brand itself was written down in today’s full-year results from $252.1 million to zero.

In one way, it’s a purely theoretical statement of the brand’s value – it’s not as if Billabong branded stores or clothes will suddenly become worthless.

But for Merchant, who remains a director and major shareholder of the beleaguered company, it must be a slap in the face.

He has driven the business from its early days when it was based in Merchant’s flat above the Gold Coast’s famous Burleigh Heads beach, through its expansion into the United States and Europe and to the fateful sharemarket listing in 2000.

A connection lost

Billabong International might have added a swag of different brands over the years – many of which have also seen their value written down in today’s profit report – but at the core stood the Billabong brand, with its connection to the surfer community that Merchant was a part of.

That connection may not be severed, but it certainly is terribly frayed.

Of course, Merchant himself must wear some of the blame for this.

Back in February 2012, Merchant, who retains about 15 per cent of Billabong, decided he would defiantly block a $3.30-a-share takeover bid from private equity group TPG, which valued Billabong an $842 million.

Merchant, who had seen Billabong shares sink from as high as $12 back in 2010, appeared to believe better times were ahead. In a strident letter written from his lawyers, released by the Billabong board, he said: “[We] do not support Billabong taking any steps to assist or facilitate a proposal by TPG Capital, including allowing TPG Capital to commence due diligence on Billabong, even if the price TPG Capital offered was $4.00 per share.”

Fast forward a little over a year and several buyout deals have fallen over. Billabong shares have this morning fallen another 11.5 per cent to 50c.

Merchant’s pain is financial, as well as emotional.