Making law school cheaper; For many, two years is plenty

August 29, 2013 Leave a comment

Making law school cheaper; For many, two years is plenty

Aug 28th 2013, 18:36 by The Economist | NEW YORK

“THIS is probably controversial to say, but what the heck,” said Barack Obama on August 23rd. “[L]aw schools would probably be wise to think about being two years instead of three.” Mr Obama once taught constitutional law; his proposal could put many of his former colleagues out of work. Yet he has a point. For most of the 1800s, would-be lawyers (such as Abraham Lincoln) learned the trade as apprentices. Law schools sprouted up late in the century, in two main flavours. Elite universities set up legal departments for posh students; night schools catered to the sons of immigrants.To stop the proles from sullying the image of the bar—ahem, to provide sufficient instruction in the intricacies of the law—the snootier institutions convinced the American Bar Association (ABA) to limit its accreditation to schools that offered only a costly three-year degree.

It still requires accredited schools to offer three years’ worth of courses. Yet most of the basic principles of law can be learned in a year, and law schools are reluctant to teach practical skills, so students tend to fill their final year with classes on curious or obscure topics.

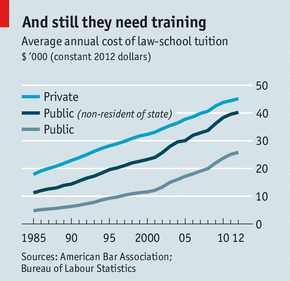

Over the past decade, however, fees have soared, requiring students to borrow ever-greater sums: the average graduate this year will be $140,000 in hock, by one estimate. At the same time, firms have cut back on hiring, leaving many debt-laden young lawyers unemployed. That has led critics—now including Mr Obama—to suggest that law schools pare their coursework down to two years, enabling students to save money and start earning sooner. Reducing the price of education would also allow more graduates to take lower-paying jobs in public-interest law, or serving poor clients.

That would benefit students and poor clients, but not law schools. Already suffering from declining enrollment, they would not be able to pay so many professors so much if they lost a third of their tuition revenue. So some schools are trying to reinvent the final year: New York University is placing students in foreign universities or in government, while Stanford has emphasised interdisciplinary classes and clinical training. “We can use that time to prepare them for practice better and cheaper than firms can,” says Larry Kramer, the former dean of Stanford Law.

But despite Mr Obama’s words, even schools that make no such effort are still shielded by the three-year requirement. The ABA has set up a task force on legal education, and its commission on standards for accreditation is now conducting a quinquennial review. Ten of the council’s 21 members come from the legal academy, which wants to maintain the status quo. James Silkenat, the association’s president, says he supports “innovation” to reduce costs—but still believes schools yield “a better product with the full three years”.

Many advocates for reform are turning to the judiciary, which sets the rules for bar admission. Last year Arizona began allowing students to take the test while still in law school. If more states follow its lead— and if firms will hire lawyers without an ABA-approved degree, then adventurous law schools might offer a two-year option.

Or perhaps Mr Obama could tell the Department of Education to strip the ABA of its role as the federally sanctioned accreditor if it does not give schools the “flexibility” Mr Silkenat says he favours.