Why Emerging Market FX Has Further To Fall

August 29, 2013 Leave a comment

Why Emerging Market FX Has Further To Fall

Tyler Durden on 08/28/2013 20:14 -0400

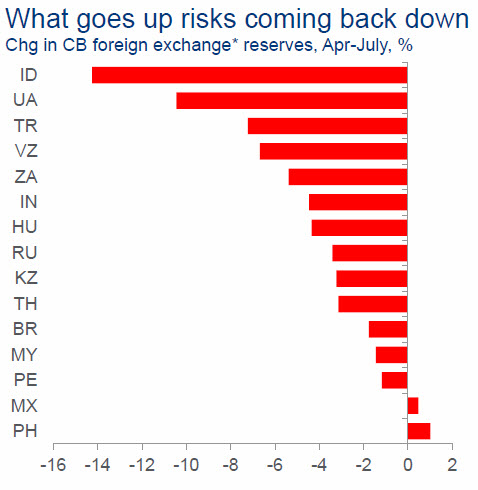

The current external environment and consequence of past policies are limiting options for EM nations (most specifically Indonesia and India). Citi believes the best they can do now is to smooth the (inevitable) macro adjustment (weaker FX, higher risk premiums, slower growth) through improved policy credibility (to curb volatility and overshooting) and find offsets to portfolio flows to ease the pressure. The 4 choices of various rocks and hard places do not hold much hope for anything but further FX devaluation. As Citi’s Matt King points out, what goes up (in terms of Emerging Market central bank FX reserves) risks coming back down with a thud… and in case you were wondering why India, Turkey, and Indonesia were the most-hammered… It’s all about the carry…Top carry currencies ranked by interest rate differential with USD (via Goldman Sachs)

The currency sell-off is likely to go further… (Via Citi’s Matt King)

as policy options are limited…

So, what can Asia’s deficit countries (Indonesia and India specifically) do? (via Citi’s Economics team)

The Bank of Indonesia needs to hike 50bps and signal a more hawkish stance. With reserves declining sharply, CB FX intervention is no longer a credible policy option to anchor expectations on IDR. We think a market stabilization program via SOE funds does not fundamentally address external imbalances. Even while core inflation pressures remain manageable in the 4.5-5% range (we estimate 1% depreciation in IDR will raise inflation by 0.1ppts), the economy already slowing, and some macro-prudential tightening in place, the signaling effect of policy rate hikes should not be underestimated, in our view, especially given still elusive turnaround in the trade/CA deficit.1 ID has two advantages over the pushback IN got from its “surprise” liquidity tightening last month: 1) ID’s portfolio equity flows are far smaller than debt flows, and we think debt investors put greater premium on stabilizing FX than supporting growth; 2) ID has much stronger fiscal accounts than IN, and thus, adverse fiscal consequences of slower growth is unlikely going to be damaging enough to jeopardize ratings.

The Reserve Bank of India needs to keep liquidity tight and mobilize more external funding sources. RBI has recently stepped up FX intervention alongside import curbs and significant liquidity tightening, dampening growth expectations in the process. To avoid loosing credibility on its intervention ammunition and to anchor INR expectations, mobilizing more external funding would help, in our view. With very low sovereign external debt (zero India global bonds), we think NRI-targeted and/or global bond from the sovereign is the more effective (though not costless) way to mobilize more capital inflows than, for example, quasi-sovereign issuance by public sector undertakings (PSUs).

Non-commercial funding sources should be tapped by both countries. ID has been net repaying official (bilateral/multilateral) creditors since 2004. Given market conditions, we believe a shift in financing is warranted. ID has a US$5bn in standby contingency facilities for budget financing (US$2bn from WB, US$1.5bn from Japan, US$1bn from Australia, US$0.5bn from ADB) – a legacy from 2008 – that we think it should tap. IN only funds about 2% of its CAD in FY13 in official loans, and there could be more room here (though negotiating conditionalities and new programs take time).

Unfortunately, existing FX swap arrangements too small (and stigmatized) to matter. ID is in the Chiang Mai initiative (CMIM); maximum drawdown is US$22.8bn, but IMF-delinked portion is only US$6.8bn (30%). Since no country has ever tapped CMIM, there is likely significant political stigma to being the first.2 IN has a US$15bn bilateral swap arrangement (BSA) with Japan, but only 20% (or US$3bn) can be drawn down without an IMF-support program (IMF not an option) – so it’s too little to matter.

BUT… there is still plenty of ‘excess’…