China’s Banking Thriller Is Missing Pages; It’s what investors can’t see that should worry them more

August 30, 2013 Leave a comment

Updated August 29, 2013, 9:10 p.m. ET

China’s Banking Thriller Is Missing Pages

The most recent earnings for China’s banks depict a financial system under rising but manageable strain. It’s what investors can’t see that should worry them more.

The quarter to June showed nonperforming loans rising at many of China’s banks. And loans that are merely overdue, even if not yet technically nonperforming, grew at an even brisker clip. At state-owned China Construction Bank, 601939.SH +0.24% for instance, overdue loans rose by 21% from the end of last year to June. At smaller, non-state-owned China Minsheng Banking,600016.SH -0.22% overdue loans rose 47% in the first half.till, the total amount of overdue loans remains low. At Minsheng, they came to just 1.9% of total loans. But the trend is clear: As China’s growth slows, borrowers are finding it harder to keep up on payments. That should be a worry, especially given the risks banks have taken off their balance sheets.

And those are tougher for investors to see and gauge. This is particularly regrettable following June’s cash crunch, when many Chinese banks had to scramble for funds in the interbank market, a warning that confidence is fragile at best.

One of the biggest areas of concern is so-called wealth-management products. These are a kind of high-yield deposit that Chinese banks market to customers, investing the proceeds in anything from bonds to loans to property developers.

Chinese banks, and their customers, have embraced these products because they allow both to sidestep caps on yields for traditional bank deposits. Such products come in two varieties, those where the depositor’s principal is guaranteed, which are kept on a bank’s books, and those where it isn’t, which are held in off-balance-sheet vehicles

Customers, however, don’t often understand the difference. If wealth-management products start defaulting, banks will be under pressure to make depositors whole even though there isn’t an explicit guarantee. That would mean taking the products onto balance sheets while booking losses. This could result in hits to equity, potentially causing leverage ratios to rise.

The experience of the U.S. financial crisis is illustrative. Banks such as Citigroup, for instance, suddenly found themselves constrained or facing big losses as they had to either stand behind products with implicit guarantees or absorb others they had unwittingly backstopped.

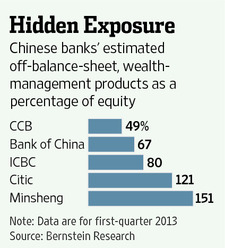

At China Construction Bank, which gives more details than most of its peers, total off-balance-sheet wealth-management products stood at 526 billion yuan ($85.94 billion) at the end of June. While that amounts to just 3.5% of total assets, it is equal to 53% of shareholder equity.

At other banks, the picture is harder to discern. Industrial & Commercial Bank of China, the country’s largest lender by assets, didn’t give figures for its off-balance-sheet wealth-management products. Its disclosures state that total off-balance sheet credit risk came to 1.17 trillion yuan at the end of June, equivalent to just over 100% of equity, with no further explanation.

Smaller banks are an even bigger question mark. Minsheng says it had 300.5 billion yuan of wealth-management products at the end of June, but like ICBC it doesn’t say how much was off-balance-sheet. Bernstein Research analyst Mike Werner estimates that 268 billion yuan was off-balance-sheet in the first quarter, equal to 151% of total equity.

If wealth-management products start going bad, China’s banking system could come under stress. What should really worry investors is that they don’t know how real or potentially far-reaching such a threat could be.