Ill Wind Blows on Treasurys

September 3, 2013 Leave a comment

September 2, 2013, 7:38 p.m. ET

Ill Wind Blows on Treasurys

Yields Expected to Keep Rising, But at Slower Pace

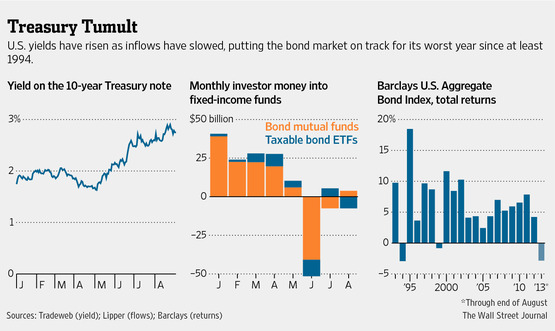

The bond market is likely headed for more pain this fall, as many investors say the prices of ultrasafe U.S. Treasurys will have to decline further before the debt starts looking like a good buy. This year is on track to be the worst for fixed-income investors since 1994, when the Federal Reserve surprised the market with rate increases. Money has flowed out of bond funds in 2013 at the fastest clip in nine years, with $57.3 billion leaving U.S.-listed taxable mutual funds and exchange-traded funds in the past three months alone, according to Lipper. U.S. Treasury yields have increased by more than a percentage point since May, a rise that has caught many analysts and investors off guard.The dynamics driving those trends remain largely in place, and by year-end many players in the $11.3 trillion Treasury market expect the yield on the benchmark U.S. 10-year note to push above 3% for the first time since July 2011. That is up from 2.747% at the end of trading Friday. Prices fall when yields rise.

The expectations are important because rising yields on U.S. government bonds often cascade around the globe. During this spring’s bond-market swoon, dividend-paying stocks saw big price declines and emerging markets from India and Brazil to Thailand and Indonesia suffered notable declines. The latest uptick in yields came as U.S. stocks posted a 4.4% decline in August, their worst monthly showing this year.

“We would look at the 10-year cresting into 3% as a starting point to put some money to work again,” said Richard Sega, chief investment officer at Conning Asset Management, which manages $82 billion for insurance companies.

A major driver: the expectation that the Fed will set plans as soon as this month to begin tapering the $85 billion of monthly bond purchases it has used to support the economy, amid signs that U.S. output continues to expand.

Central-bank officials have made it clear they view strong employment growth as a precursor to reduced support for the economy. As a result, investors say this Friday’s jobs report and a two-day Fed meeting concluding Sept. 18 will play a major role in deciding the course of bond prices.

Even if bond prices continue to tumble, few expect to see a repeat of the spring swoon’s speed and scope. Investors fled Treasurys after the yield hit a recent multiyear low of 1.61%, and pulled back from some riskier asset classes such as low-rated corporate debt deemed “junk.”

The selloff crested in June before sales resumed late in August, with the yield piercing 2.9% at one point last week amid solid U.S. economic data and signs that China’s slowdown was moderating.

Indeed, many investors say the rise in government-bond yields since May will moderate future swoons by making the debt more attractive to income-seeking investors, while fears of a deepening malaise in emerging markets led by India may add to demand for U.S. debt, which typically rallies in price amid global financial upheavals.

Furthermore, U.S. economic growth remains sluggish and inflation remains tame. Investors believe those factors should limit the speed with which the Fed withdraws its stimulus and encourage buyers to step in at the higher yields.

“You’ll likely see a continued drift up in interest rates, but the speed of the ascent will be increasingly slow,” said Matt Toms, head of U.S. public fixed income at ING U.S. Investment Management, which manages $122 billion in fixed-income assets. He said he is holding some cash to deploy when prices fall and prefers corporate bonds to Treasurys now.

A surprisingly weak or strong reading on jobs could alter investors’ expectations about the outlook for the Fed. Economists expect a rise of 173,000 in non-farm payroll employment and the jobless rate to stay unchanged at 7.4%. Still, few investors anticipate the Fed will wait.

In a survey conducted in July by the Federal Reserve Bank of New York, the financial firms that act as primary dealers in government securities said that they expected the U.S. central bank to reduce its asset purchases by $15 billion starting in September.

Analysts at J.P. Morgan & Chase predict the yield on 10-year Treasury notes to hit 3.15% before the end of 2013. That would represent another rise in yield of 0.4 percentage point from current levels, or an additional loss of about 3.6% in the value of the notes. That comes on top of the 6.8% year-to-date decline through August.

The Barclays U.S. Aggregate Index, a broad bond index, is down 2.81% this year. In 1994, the index fell 2.92%, its worst year since it was launched in 1976.

James Camp, managing director of fixed income at Eagle Asset Management Inc., which oversees $21.5 billion in assets, is waiting until the yield reaches 3.1% to buy.

“We’re getting close to being interested in buying Treasurys again,” he said, adding he thinks bonds are starting to look more attractive than stocks.

Few investors are apt to make a large bet on Treasurys until it is clear whether former Treasury Secretary Lawrence Summers, Fed Vice Chairwoman Janet Yellen or someone else will replace Chairman Ben Bernanke, said Rick Rieder, co-head of fixed income for the Americas at BlackRock Inc. BLK -0.08%

“We think rates are going to drift higher, approaching 3%,” he said.