Dollar General Is Paying Its Way; Shareholders Should Be Concerned About Its Dwindling Edge Over Larger-Format Competitors

September 4, 2013 Leave a comment

September 3, 2013, 5:45 p.m. ET

Dollar General Is Paying Its Way

Shareholders Should Be Concerned About Its Dwindling Edge Over Larger-Format Competitors

For retailers who obsess about a few cents here or there, there is nothing more painful than seeing an item walk out the door at a margin of negative-100%. Discussing a tepid fiscal first quarter, management at Dollar General Corp.DG -0.17% cited such “shrinkage” as a factor behind weaker margins. A euphemism for loss of inventory, mainly due to theft, it is a cost of doing business for a retailer found largely in low-income neighborhoods.

The sort of shrinkage Dollar General’s shareholders should be more concerned about as it unveils fiscal second-quarter results Wednesday is its dwindling edge over larger-format competitors.

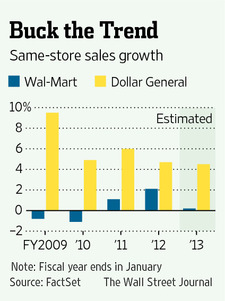

Dollar stores overall have had a fantastic run against Wal-Mart Stores Inc., WMT -0.41%which caters to overlapping demographic groups. If both companies’ guidance holds through the end of this year, Dollar General’s five-year compound annual growth rate for same-store sales will have been 5.9%, while Wal-Mart’s will be just 0.3%.

In the next few years, though, that difference is seen narrowing. This raises the question of Dollar General’s premium valuation. The stock trades at 15.1 times the next 12 months’ estimated earnings, almost two points higher than Wal-Mart. Since Dollar General went public again in late 2009, after being bought two years earlier, its stock has beaten Wal-Mart’s by nearly 100 percentage points.

Even with a more modest growth differential, though, it is hard to call Dollar General pricey in absolute terms. Unless Wednesday’s sales and earnings for the period through July echo Wal-Mart’s disappointing results for that quarter, growth remains attractive. Management’s cautious outlook three months ago led analysts to cut earnings expectations for Dollar General in the latest quarter to 74 cents a share from 76 cents, versus 64 cents a year ago.

Besides its still-decent top-line growth, Dollar General continues to enjoy a boost from its own rapidly improving finances. When its private-equity owners threw Dollar General back onto the market in 2009, it was loaded with debt. The company recently retired borrowings with interest rates of around 12% for others 10 percentage points cheaper and is buying back shares at a furious pace.

Investors late to the dollar-store phenomenon or wondering whether to jump off now shouldn’t let valuation scare them. Dollar General looks good, even if it is no longer a steal.