China and India: The Roadster and the Minivan; China Beats India Hands Down When It Comes to Growth in Vehicle Demand, but Profits Are Another Matter

September 5, 2013 Leave a comment

September 4, 2013, 12:51 p.m. ET

China and India: The Roadster and the Minivan

China Beats India Hands Down When It Comes to Growth in Vehicle Demand, but Profits Are Another Matter

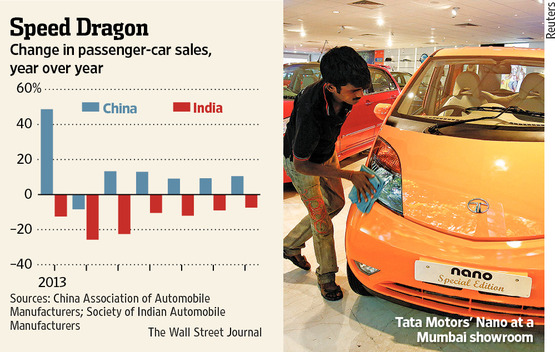

China’s car industry is running much faster than India’s right now. But down the road, Indian auto makers may find the going smoother. Though both emerging-market giants are slowing, China’s demand for cars is stronger. The number sold there will rise 13% this year, against a 7% drop in India, according to research firm LMC Automotive. That gap mirrors the big difference in each country’s economic performance. India’s gross-domestic-product growth in the June quarter was 4.4%, whereas China’s was 7.5%. Meanwhile, India’s inflation rate of 9% is almost three times that of China. And while both countries import oil, the rupee’s 19% fall against the dollar this year, compared to the yuan’s 2% rise, increases fuel costs in local terms.Little wonder India’s drivers feel like staying at home. What makes it worse is that they can’t finance themselves. Whereas only 15% of Chinese car buyers use loans, three-quarters of Indian buyers rely on them. So vehicle demand suffers as India’s central bank raises rates to combat inflation and stem the rupee’s slide. State Bank of India,500112.BY +3.99% the country’s largest lender by assets, is tightening criteria for car loans, as well.

The good news for India is that demand should be cyclical. LMC expects sales there to rebound by 9% next year as the economy recovers.

Chinese volume growth looks set to stay around 14%. However, its car makers suffer from a structural problem that is familiar in other Chinese industries such as steelmaking and constrains the benefit from fast-rising demand: excess supply.

Last year, local Chinese auto makers used only 65% of their capacity on average, when levels around 75% and up are needed to make profits, says Ivo Naumann at advisory firm AlixPartners.

The natural solution to overcapacity is consolidation, but this may not happen with provincial governments often backing manufacturers.

As the precrisis U.S. car industry’s experience shows, overcapacity can compel firms to push out cars at lower prices. This could raise competitive pressure among local brands such as Geely 0175.HK +0.73% . Companies tied to outsiders, like Brilliance China Automotive‘s 1114.HK +0.18% joint venture with BMW, may be less affected as they run more efficiently and compete more on branding than price.

In contrast, Indian utilization levels will go down to roughly 75% this year from around 85% last year. But that is largely because of poor demand, says IHS Automotive’s Puneet Gupta. Once demand picks up, utilization and margins should rise, too. Maruti Suzuki, 532500.BY +1.91% India’s largest car maker by sales, should be among those that benefit.

Both China’s and India’s car markets have room to grow. Yet in the longer run, India has relatively more, since it has about a quarter of the cars per capita that China has. Moreover, India’s car makers stand a better chance of turning a decent profit on each vehicle.