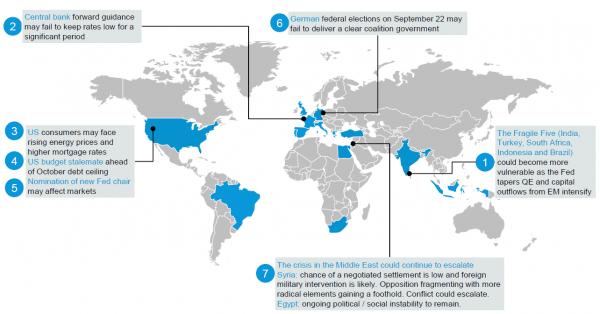

Mapping The 7 “Risk” Horsemen Of The Sept-ocalypse

September 5, 2013 Leave a comment

Mapping The 7 “Risk” Horsemen Of The Sept-ocalypse

Tyler Durden on 09/04/2013 21:50 -0400

Ahead of September, historically the worst month for stocks, Deutsche Bank notes that volatility has picked up and corporate bond issuance has slowed. There are several possible risks over the next few weeks that could trigger a further escalation in market volatility…

Via Deutsche Bank,

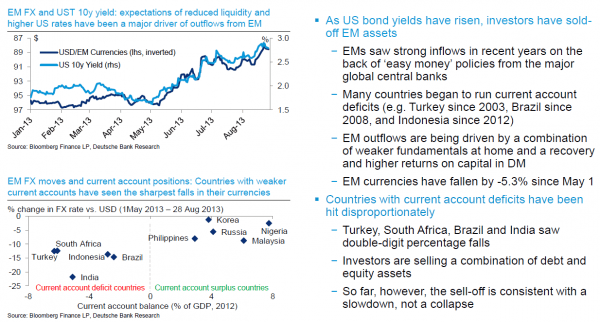

1. Emerging markets could become more vulnerable as the Fed tapers QE and capital outflows from EM intensify

2. Central banks forward guidance may fail to keep rates low for an extended period

2. Central banks forward guidance may fail to keep rates low for an extended period

3. US consumers could come under pressure from higher energy costs and rising mortgage rates

4. Political deadlock amid US budget talks and the mid-October debt ceiling could rattle markets

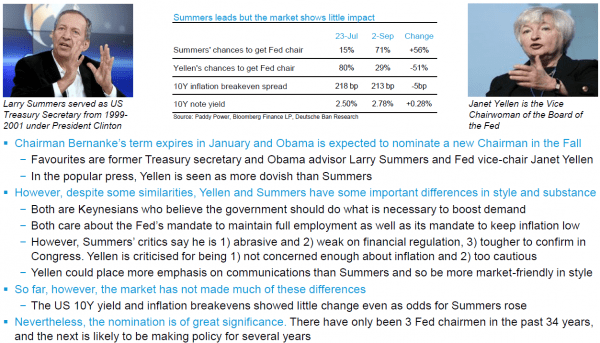

5. The next Fed chair will soon be nominated and the main candidates differ in style and policy. The markets may take note

6. While Chancellor Merkel is on track for re-election on September 22, the governing coalition may change

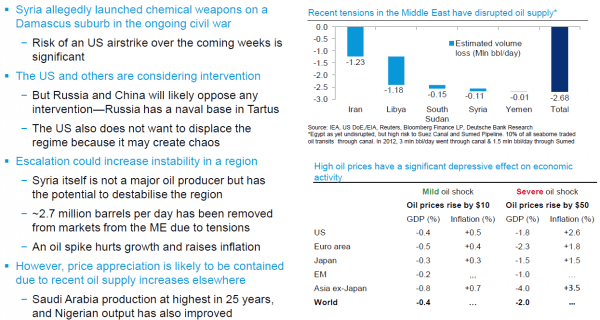

7. The crisis in the Middle East may escalate, impacting oil prices, inflation and growth

But Deutsche’s Base Case is that none of these risks pose a systemic threat…

and yields will ‘normalize’ higher gradually…