Living up to the hype surrounding three-dimensional printing may prove to be a tall order for 3D Systems

September 6, 2013 Leave a comment

September 5, 2013, 4:30 p.m. ET

Reading the Fine Print on 3D Systems

Living Up to the Hype Surround Three-Dimensional Printing May Prove a Tall Order for the Company

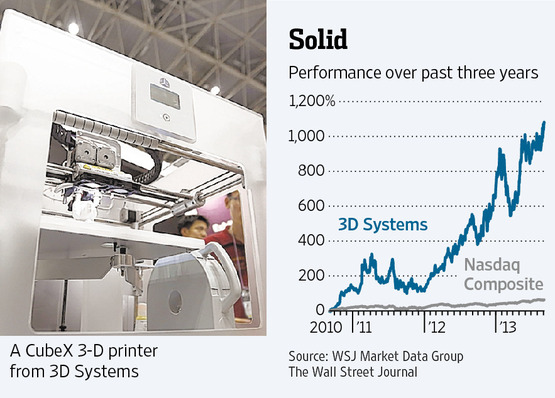

Three-dimensional printing could be as big as the steam engine, the computer or the Internet. So says Abraham Reichental, chief executive of three-dimensional printer maker 3D Systems DDD -0.37% . If that is so, it seems odd that he recently sold a fifth of his own shares in the company. 3D Systems’ stock remains near an all-time high a week after CitigroupC +0.52% issued a “buy” rating. The stock is up more than tenfold in the past three years and trades at more than 90 times expected 2013 earnings. The company says Mr. Reichental sold shares to diversify his holdings and to settle tax expenses.Still, that valuation and the insider selling are potentially worrisome signs that 3-D hype may be outpacing reality.

3-D printers build objects by painting layers of material onto one another. In contrast, traditional manufacturing usually cuts objects from raw materials or injects them into a mold. While 3-D printing is useful for building product prototypes and some tools for factories, hard-core fans suggest it could remake manufacturing. Citigroup goes further, suggesting 3-D printers will be “the next ‘it’ gadget” for consumers. Indeed, shares jumped in May around the time Staples announced that some locations will carry 3D Systems’ cheapest model, the Cube.

But at $1,300 plus the cost of expensive materials needed to “print” objects, it seems unlikely many consumers will buy a Cube. What’s more, it can make only tchotchkes—plastic napkin holders or chess pieces, say—that can be bought cheaply and quickly elsewhere. Even making these can require expertise with sophisticated design software. And while 3D Systems has made printers for consumers since early 2012, they still don’t contribute meaningfully to sales.

As for remaking manufacturing, even Citigroup notes that 3-D printing’s slower speed and higher cost makes it impractical now relative to traditional methods.

At first glance, 3D Systems’ numbers look solid: Revenue rose 45% year over year in the second quarter. But 37 acquisitions since 2009 make it difficult to measure true organic growth, notes William Blair research analyst Brian Drab.

Reported sales growth may not fully reflect customer demand. 3D Systems recognizes a sale when it ships a printer to a reseller, not necessarily when the device goes to an end customer. At the same time, the company said that in the second quarter it took 84 days to collect on customer invoices. That is up from 72 days in the fourth quarter. Among the reasons 3D Systems cites for longer collection times is a shift in its business to resellers.

And lately, 3D Systems appears to be signing up new resellers at an accelerating rate. Wholesale distributor Synnex recently began recruiting new resellers for 3D Systems’ products. Qualified resellers undergo a week of training and are required to invest at least $30,000 and sometimes upward of $200,000 in demonstration equipment. Such demo units count as sales for 3D.

It isn’t uncommon for hardware resellers to make such investments, and the company says such purchases haven’t had a material impact. Yet a rapid increase in distribution risks flooding the market with more printers than there are customers, especially considering 3-D printing technology isn’t actually new: One of 3D Systems’ core technologies dates back to the 1980s.

Another concern: Equipment-sales growth has outpaced that of materials for at least the past six quarters. That also matters because, like the razor-blade business model, sales of printers are meant to generate bigger sales of higher-margin materials. 3D Systems says sales of materials for newer-model printers, which don’t allow use of third-party materials, are increasing faster than the overall rate. Yet these still lag behind overall printer sales.

Weak materials sales could jeopardize 3D Systems’ 2013 earnings target. To reach it, operating-profit margins in the second half must expand to roughly 40% from the first half’s 24%, Mr. Drab estimates.

Investor enthusiasm for three-dimensional printing is likely stoked by the many analysts who have “buy” ratings on 3D Systems. But investors should remember it is a fee-generator for Wall Street.

Like railroads or the Internet, 3-D printing is a genuinely exciting technology. But, just like those, this may not prevent investors from losing money on it.