Malaysia Attempts to Spur Private Equity

September 11, 2013 Leave a comment

Sep 10, 2013

Malaysia Attempts to Spur Private Equity

Malaysia is taking baby steps in trying to kick-start its private-equity industry, after years of cheap credit and a buoyant stock market limited its growth. The government, which aims to reduce the domestic economy’s dependence on state-owned companies, is encouraging private-equity financing to help small businesses expand, and the country’s largest state-run pension fund is leading the way by allocating more funds to private-equity investments.Entrepreneurs in Malaysia seeking capital to fund growth have often shunned private equity in favor of bank loans and initial public offerings. But the door to deals appears to be opening for private-equity firms, which usually offer cash in exchange for a significant stake or control.

Bank loans have been a popular funding avenue, because Malaysia’s central bank has held the interest rate at about 3% in the past decade.

“Naturally, many entrepreneurs typically prefer to maximize debt funding, and many of them are typically hesitant to share control of their company,” said Abdul Wahid Omar, minister for economic planning.

But private equity is slowly gaining attention as entrepreneurs refrain from piling on too much debt, private-equity managers say. Moreover, volatile stock markets mean IPOs are looking less attractive. The country ranks fifth in Southeast Asian IPOs by deal value this year, down from first last year, according to data provider Dealogic.

In March, the Employees Provident Fund said it planned to expand its private-equity investments. Despite an average annual increase of 50% over the past four years, private-equity investments accounted for less than 1% of its $161.58 billion under management at the end of 2012. It didn’t specify the amount it aims to allocate to private-equity investments and wasn’t available for comment.

Apart from offering cash, private-equity firms also share business know-how and help build companies’ businesses before exiting by launching initial public offerings or selling their stakes to other private-equity investors.

The government is also trying to encourage private-equity financing by allowing state-run investment companies such as Ekuiti Nasional to appoint external fund managers to manage a portion of funds.

At the same time, several state-owned companies, including Retirement Fund Inc. and Pilgrims Fund Board, are setting aside small pools of cash to provide funding for Malaysian companies, which are warming up to private-equity investments.

“Many family-controlled businesses are now considering professional management outside the family,” said Rodney Muse, co-founder and managing partner of private-equity firm Navis Capital.

Navis has completed more than 60 buyouts in Southeast Asia, Mr. Muse said, half of which were signed with the companies’ founders. In 2010, it bought a controlling stake in Alliance Cosmetics Group from the founding shareholders.

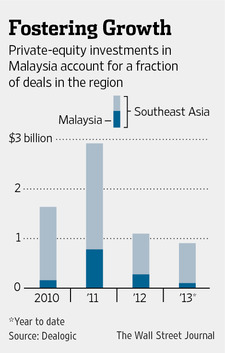

But deals involving private-equity firms still aren’t plentiful in Malaysia. There have been three major investments this year totaling $100 million, according to Dealogic. In 2012, there were seven deals totaling $277 million, a fraction of the $1.1 billion in Southeast Asia.

Hundreds of listed companies don’t appear on private-equity firms’ radars, because many fund houses have internal guidelines that prohibit them from investing in small publicly traded enterprises. Although there were 900 listed companies in Malaysia at the end of July, the top 24 companies on the Malaysian stock exchange account for about 62% of market capitalization, according to Malaysia-based private-equity firm Creador Sdn. Bhd.

“A lot of the Malaysian companies should’ve stayed private a little longer,” said Brahmal Vasudevan, founder and chief executive of Creador, which has about $250 million under management.

Creador recently exited its $15 million investment in OldTown Bhd. The firm, which bought a 10% stake in the restaurant chain in April last year, exited the investment in August for returns twice its original investment, Mr. Vasudevan said.