Brazil Index to Drop Penny Stocks; Plan to Remove Shares Trading for Less Than One Real Could Mean OGX Is Ejected From Ibovespa

September 13, 2013 Leave a comment

Updated September 12, 2013, 4:56 p.m. ET

Brazil Index to Drop Penny Stocks

Plan to Remove Shares Trading for Less Than One Real Could Mean OGX Is Ejected From Ibovespa

ROGERIO JELMAYER

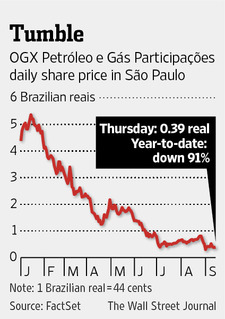

SÃO PAULO—Brazil’s stock-exchange operator said it planned to remove penny stocks from the Ibovespa index as part of a change in methodology, a move that could result in the exclusion of shares in troubled oil firm OGX Petróleo e Gás ParticipaçõesSA OGXP3.BR +2.63% from the country’s benchmark index. The rapid slide in shares of companies controlled by Brazilian businessman Eike Batista was a factor, but not the only reason behind the decision by South America’s largest stock-exchange operator to remove penny stocks from the index,BM&FBovespa SA’s BVMF3.BR -2.14% chief executive said Thursday.

The methodology changes, announced late Wednesday, will bring the exchange in line with global peers such as the New York Stock Exchange NYX -0.69% . In making the adjustments to the index, BM&FBovespa accepted several recommendations made last month by a working group that included portfolio managers, companies, banks and brokerages. It will exclude from the Ibovespa all shares worth less than one Brazilian real, or about 44 U.S. cents, and will also modify the way a company’s market value is calculated in the index.

The changes are due to go into effect in January 2014 and will be fully implemented by May, according to the exchange.

Shares of OGX have pulled down the Ibovespa in recent months. The highly indebted oil firm controlled by Mr. Batista ran into trouble last year after missing production goals, sparking concerns about its solvency. Because the composition of the Ibovespa is defined in part by trading volume, a huge selloff of OGX shares ended up increasing the stock’s weight on the index.

“We were already working on a revision of the Ibovespa, and when OGX shares in April started to impact the index more and became one of the five most traded, without a doubt we started to take that into consideration,” BM&FBovespa Chief Executive Edemir Pinto told reporters. “But to say that this measure is a result of OGX isn’t true.”

Shares of Mr. Batista’s companies helped drive the index higher in recent years on investor optimism that his conglomerate, which includes oil, energy, mining, shipbuilding and transportation companies, would benefit from rapid economic growth in Brazil. The firms, several of which were capital-intensive startups without significant revenue, also dragged the index down when the economy began sputtering and they ran into financial problems. Mr. Batista is now shedding assets and is in talks with creditors as part of an effort to avoid bankruptcy proceedings.

OGX’s share price has fallen nearly 90% over the past 12 months, to 0.39 real, making the stock the lowest-priced in the index. The Ibovespa index has lost nearly 11% in the same period.

Other listed firms owned by Mr. Batista also are at risk of being dropped from the index. Port operator LLX Logistica SA LLXL3.BR +4.58% has the second-lowest share price in the index, recently trading at 1.58 reais. A spokeswoman from EBX, the conglomerate that groups Mr. Batista’s companies, declined to comment.

Even if OGX’s share price remains below one real, however, the company can remain on the index by grouping shares into a unit, Mr. Pinto said Thursday. A number of companies have units—often with voting and nonvoting shares trading together as one asset—listed on São Paulo’s stock exchange.

“Because they are introducing the changes gradually, the whole process will not cause much volatility,” said Alvaro Bandeira, a partner and equity analyst at Rio de Janeiro-based investment firm Órama Investimentos. “The index will now offer a better reflection of what’s actually happening in the market.”

The Ibovespa is made up of stocks from 63 companies, including local heavyweights such as sate-run oil firm Petróleo Brasileiro SA PETR4.BR -2.19% and mining titanVale VALE -0.37% SA.

OGX has a market value of 2.2 billion reais, and represents 4.3% of the index. By comparison, Petróleo Brasileiro and Vale, with market values of 220 billion reais and 172 billion reais, respectively, each represent about 10% of the index.

Switching to a weighting that gives more importance to market value would put the Bovespa in line with other major benchmarks, said Geoffrey Pazzanese, who manages about $611 million in global equities for Federated Investors in New York. “I think it is a positive for investors, as it will help reduce volatility for index-aware investors,” he said.

The exchange will also suspend from the index shares of any companies that enter into bankruptcy proceedings, according to Andre Demarco, a director at the exchange.