The Slow Rise And Quick Fall Of The SEC’s Enforcements

September 13, 2013 Leave a comment

Updated September 11, 2013, 8:46 p.m. ET

CRISIS PLUS FIVE

SEC Tries to Rebuild Its Reputation

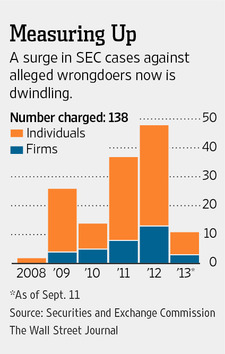

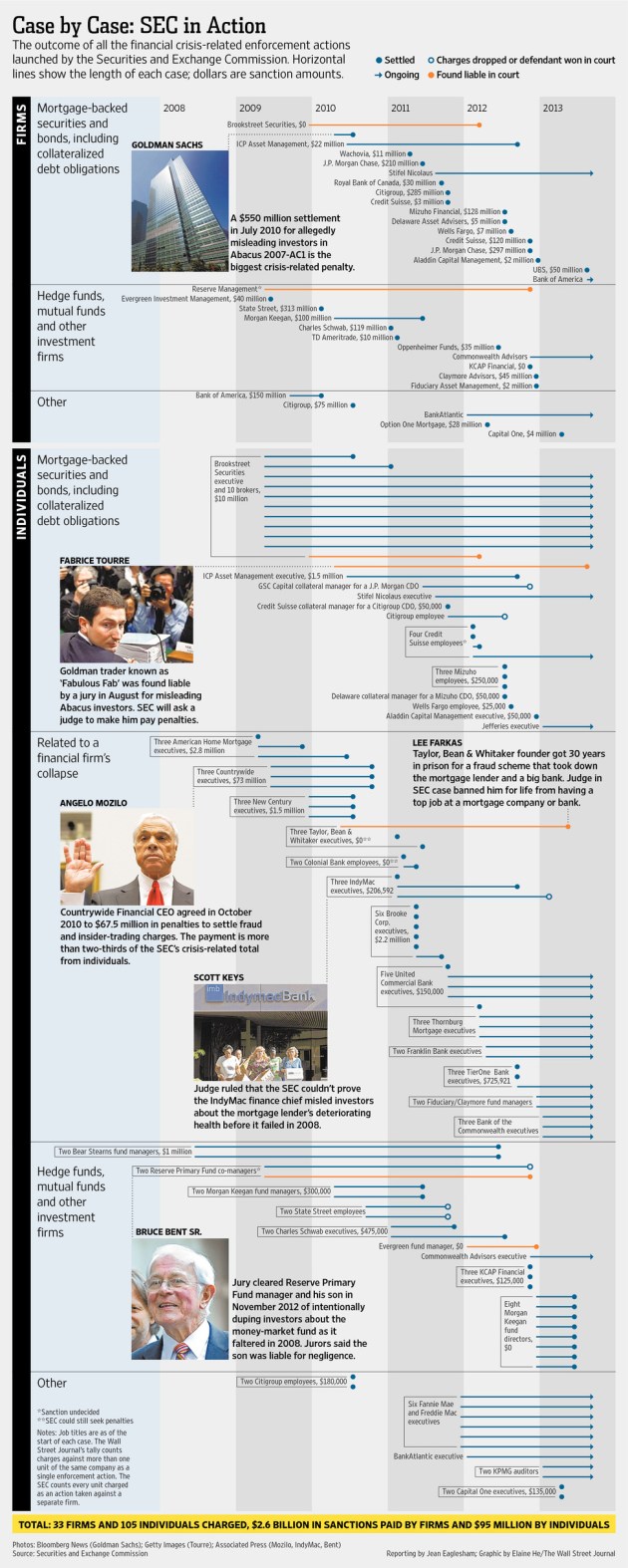

The Securities and Exchange Commission is ending its push to punish financial-crisis misconduct in the same way it started—with a new chairman vowing that Wall Street’s top cop will be tougher in the future. In 2009, at the depths of the recession,Mary Schapiro took the reins at the SEC promising to “move aggressively to reinvigorate enforcement” at the agency. She created teams to target various types of alleged misconduct, including one focused on the complicated mortgage bonds that helped set off a global financial panic. Read more of this post