Tencent’s worth: A Chinese internet firm finds a better way to make money

September 20, 2013 Leave a comment

Tencent’s worth: A Chinese internet firm finds a better way to make money

Sep 21st 2013 | SHANGHAI |From the print edition

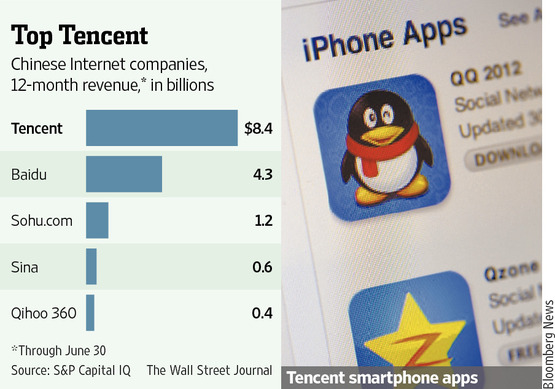

IS TENCENT one of the world’s greatest internet firms? There are grounds for scepticism. The Chinese gaming and social-media firm started in the same way many local internet firms have: by copying Western success. QQ, its instant-messaging service, was a clone of ICQ, an Israeli invention acquired by AOL of America. And unlike global internet giants such as Google and Twitter, Tencent still makes its money in its protected home market.Yet the Chinese firm’s stockmarket valuation briefly crossed the $100 billion mark this week for the first time. Given that the valuation of Facebook, the world’s leading social-media firm, itself crossed that threshold only a few weeks ago, it is reasonable to wonder whether Tencent is worth so much. However, Tencent now has bigger revenues and profits than Facebook. In the first half of this year Tencent enjoyed revenues of $4.5 billion and gross profits of $2.5 billion, whereas Facebook saw revenues of $3.3 billion and gross profits of $935m.

The Chinese firm’s market value reflects the phenomenal rise in its share price. A study out this week from the Boston Consulting Group found that Tencent had the highest shareholder total return (share-price appreciation plus dividends) of any large firm globally from 2008 to 2012—topping Amazon and even Apple.

Tencent has created a better business model than its Western peers. Many internet firms build a customer base by giving things away, be they search results or social-networking tools. They then seek to monetise their users, usually turning to online advertising. Google is a glorious example. Other firms try to make e-commerce work. But as the case of revenue-rich but profit-poor Amazon suggests, this can also be a hard slog.

Tencent does give its services away: QQ is used by 800m people, and its WeChat social-networking app (which initially resembled America’s WhatsApp) has several hundred million users. What makes it different from Western rivals is the way it uses these to peddle online games and other revenue-raising offerings.

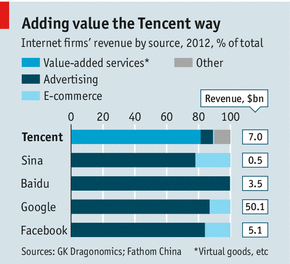

Once users are hooked on a popular game, Tencent then persuades them to pay for “value-added services” such as fancy weapons, snazzy costumes for their avatars and online VIP rooms. Whereas its peers are still making most of their money from advertising, Fathom China, a research firm, reckons Tencent gets 80% of its revenues from such kit (see chart).

This year China has overtaken America to become the world’s biggest e-commerce market, in terms of sales. It is also now the biggest market for smartphones. This means it may soon have the world’s dominant market in “m-commerce”, purchases on mobile devices.

Tencent’s main rivals in Chinese m-commerce are Baidu, which dominates search on desktop computers (helped by the government’s suppression of Google) and Alibaba, an e-commerce giant now preparing for a huge share offering. All three have gone on acquisition sprees, in an attempt to lead the market. The big worry for investors is the cost of this arms race.

Alibaba recently invested $300m in AutoNavi, an online-mapping firm, and nearly $600m in Sina Weibo, China’s equivalent of Twitter. Baidu has been even more ambitious, spending $1.85 billion to buy 91 Wireless, the country’s biggest third-party store for smartphone apps, and $370m for PPS, an online-video firm.

Tencent may have an edge over its two rivals in m-commerce because of the wild popularity of WeChat, which is used on mobile phones. But to ensure it stays in the race, it is also spending heavily. On September 16th it said it will spend $448m to acquire a big stake in Sogou, an online-search firm; it plans to merge its own flagging search engine (aptly named Soso) into the venture. It had previously invested in Didi Dache, China’s largest taxi-hailing app, and is rumoured to be interested in online travel and dating firms too.

The three Goliaths are buying up innovative firms because they are too big and bureaucratic to create things themselves, mutter some entrepreneurs (presumably not those being bought out handsomely). A more pressing worry for Tencent’s shareholders is that its lavish spending, on top of heavy investment in improving its unimpressive e-commerce offerings, will eat into profits. Worse, the m-commerce arms race risks distracting it from gaming and value-added services, the cash cows that are paying for everything else. A $100 billion valuation might then seem too rich

Updated September 17, 2013, 11:46 p.m. ET

China Internet Giants Extend Reach

Team up with one of the big boys or get crushed. That is the message to China’s smaller Internet companies from Tencent’s investment in an also-ran search engine. Tencent Holdings, TCEHY -1.59% a Chinese Internet giant with a market capitalization of more than $100 billion, said Monday that it will spend $448 million to acquire a 36.5% stake in search engine Sogou, which is China’s third most popular by search traffic. Internet portal operator Sohu.com Inc. SOHU -2.66% will retain a majority stake. As in the U.S., where a handful of industry titans compete to dominate the Internet and mobile experience, the Chinese tech sector is increasingly controlled by three powerful players. Tencent dominates online games and operates the hugely popular QQ and WeChat messaging services. Baidu is the top search engine, with a commanding lead over rivals. And e-commerce leader Alibaba Group has recently formed an alliance with portal Sina Corp., SINA +1.82% which operates the ubiquitous Twitter-like Weibo.

The top players are busy making acquisitions to fill out their portfolios. For instance, earlier this year Alibaba invested in a travel site, while Baidu snapped up a mobile-applications store.

Against this backdrop, second-tier portal site Sohu was starting to look like an odd man out. It has Sogou, which had 9% of search traffic at the end of last month, compared with 69% for Baidu and 15% for upstart competitor Qihoo 360, according to research firm CNZZ. It also has online gaming and video businesses, but doesn’t dominate any field.

Now Sohu is throwing its lot in with Tencent. Its search engine should gain traffic as it is featured on Tencent’s sites. And for Tencent, the deal provides inroads into a business that it failed to penetrate with its own search engine. Tencent paid around 6.5 times this year’s revenue for the Sogou stake, according to Barclays estimates, which looks reasonable compared with Baidu’s current valuation at 9.8 times sales.

Turning search eyeballs into yuan may still be a challenge, as advertisers tend to flock to the dominant search engine. Microsoft’s struggle to establish Bing as a meaningful competitor to Google illustrates the challenge in taking on a dominant incumbent, says Nomura analyst Jin Yoon. Sogou captured just 3.6% of China’s total search-engine revenue in the second quarter, according to Analysys International.

But the deal presents a bigger headache for Qihoo, which was in talks to acquire Sogou. Baidu shares were flat on Monday, but Qihoo fell 5.6% as hopes that a Sogou acquisition could help it consolidate its second-place position in search were dashed. Sohu meanwhile soared 7.5%.

Other bit players in Chinese Internet will likely decide that if you can’t beat the heavyweights, you might as well join them.