With the magic of tracking “cookies,” however, companies like Rocket Fuel can build more accurate profiles of Web surfers, follow them around the Internet, and help advertisers target them more effectively regardless of what website they are currently visiting

September 22, 2013 Leave a comment

Updated September 20, 2013, 6:30 p.m. ET

Don’t Bask in Rocket’s Red Glare

A Stunning Debut, Yes, but Threats Loom

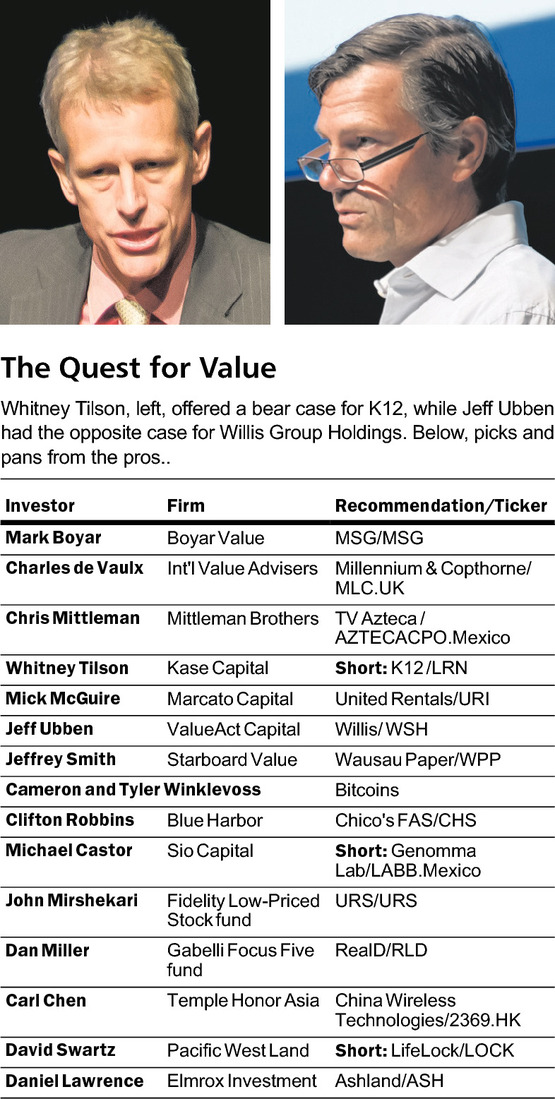

Lots of people watch football. Not all of them drive pickup trucks and drink Coors Light. Fixing that problem online is why shares of online-ad technology firm Rocket Fuel FUEL +93.45% soared more than 90% Friday after its initial public offering. Online advertising can be just as inefficient as TV advertising, argues Matt Ackley, chief marketing officer at digital ad-management company Marin Software MRIN -1.54% . Web publishers often sell ads in one-time deals to advertisers based on the content on their sites. Read more of this post