Nike’s Fans Should Start Sweating; At Its Richest Valuation in Several Years, Nike Can’t Afford to Slow Down

September 26, 2013 Leave a comment

Updated September 25, 2013, 6:01 p.m. ET

Nike’s Fans Should Start Sweating

At Its Richest Valuation in Several Years, Nike Can’t Afford to Slow Down

Nike Inc. NKE -0.73% is flying high these days—maybe too high. The last time its stock fetched the same multiple of forward earnings, 23 times, Michael Jordan was suiting up for NBA All-Star game. It most recently fetched today’s price-to-sales ratio even longer ago, when he had one more NBA championship ahead of him. “His Airness” turned 50 earlier this year. The sportswear giant and its pitch man are both known for improbable comebacks. And a company, unlike even an exceptional athlete, is immune to the ravages of age.

It is prone to the whims of fashion, though. Right now, brands such as Nike Free are leaving competitors gasping. Maintaining that pace will be a challenge.

Nike’s fiscal-first-quarter results for the period through August are due Thursday. If they show a slowdown in North America or a failure to resume modest growth in the key Chinese market, that could sow unease, says Brian Yarbrough, an analyst at Edward Jones.

A key measure is “futures,” indications of customer orders Nike gives for the following six months. Mr. Yarbrough says investors expect 3% to 5% growth from Greater China and a rise in the low-teens from the U.S.

In June 2012, when Nike reported futures in China had slipped and earnings disappointed, the stock fell 9.4% on results day. Another weak report in March 2011 saw the stock slip by 9.2%.

That sort of disappointment probably didn’t repeat last quarter: Earnings estimates of 78 cents a share, up from 62 cents a year earlier, look achievable.

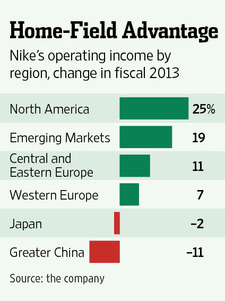

Optimists point to robust growth in emerging markets and sponsorship of upcoming events such as the FIFA World Cup in 2014 being enough to maintain momentum. Weakness in China was chalked up to overzealous inventory purchases by local merchants. During the fiscal year in May, operating income rose by 25% in North America but slipped by 11% in Greater China.

China was thought a potential stumbling block a quarter ago, too. But modest futures growth there sparked further gains for the stock, up 46% in the past year. Less bad news, however, isn’t much of a foundation for Nike’s now-rich