Mortgage Trouble in Chinese City; Borrowers Walk Away From Homes in Wenzhou

September 27, 2013 Leave a comment

Updated September 26, 2013, 7:42 p.m. ET

Mortgage Trouble in Chinese City

Borrowers Walk Away From Homes in Wenzhou

ESTHER FUNG

SHANGHAI—Tighter credit and falling housing prices in the eastern Chinese city of Wenzhou have led to a wave of mortgage defaults and abandoned properties in the city, where persistent property-price drops have flown in the face of a national upturn in prices. Homeowners in the city have abandoned 580 homes and there are another 15 cases of mortgages in default, according to a national state-radio broadcast citing a local official in charge of investigating mortgage defaults. The broadcast, which followed local-media reports of more widespread defaults, didn’t give a timeframe for the cases cited, and the official numbers are hardly staggering.But the trend is noteworthy because Chinese property buyers have typically preferred to hang on to their investments rather than surrender to a sinking market. Credit problems are the key reason behind the rising number of buyers who walk away from their purchases, the official said.

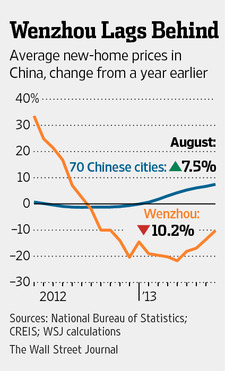

Speculation had helped drive up Chinese property prices, prompting a government clampdown that briefly brought some price stability, but prices in most Chinese cities have been climbing this year. Last month, new-home prices in 70 Chinese cities rose at their fastest pace since January 2011, according to official data.

Wenzhou, known as the birthplace of Chinese entrepreneurship, is an outlier. Known for abundant lending fueled by trust-based financing networks, much of it without collateral, the city has posted year-on-year declines in housing prices every month since August 2011. It was the only city among the 70 included in the official price survey to do so, though private-sector data tracker China Real Estate Index System, has seen price drops in Haikou and Sanya, both on the resort island of Hainan, where speculation was also rife prior to the property-tightening campaign.

Wenzhou, which had built export industries around cigarette lighters, buttons and zippers, has been hit extra hard by the slowdown in China’s export sector and controls on informal financing.

“The loose credit environment in the previous years caused many people in Wenzhou to be excessively leveraged. The party is over and some people are being forced to sell off their assets,” said Johnson Hu, an analyst at CIMB Securities.

At its peak, average home prices in the city were almost at par with first-tier cities like Beijing and Shanghai and 160% above second-tier cities, according to brokerage CLSA. Prices in Wenzhou started to correct in 2012 as a result of a liquidity crunch and government curbs on multiple home purchases, while resilient demand in major Chinese cities kept prices relatively firm there.

Price drops in Wenzhou have moderated recently. According to data from Creis, the private-sector data tracker, prices for new homes in Wenzhou last month fell by 10.2% year on year, compared with a 21.7% fall recorded in April.

The price declines in Wenzhou have meant that many of those who borrowed heavily to make purchases mainly for investment now owe more on their mortgages than the homes are worth, making them more inclined to give up their property.

There were 2,584 nonperforming loans out of 210,000 existing mortgages in Wenzhou, “so the risk isn’t big.” the radio report said, citing the official. At the end of July, mortgage loans in the city totaled 247.7 billion yuan ($40.5 billion), while nonperforming loans totaled 5.29 billion yuan, making the nonperforming-loan ratio a still manageable 2.13%, the report added. A total of 3.85% of all loans in Wenzhou, including mortgages and other borrowings, are nonperforming, it said.

A spokeswoman at the Wenzhou branch of the China Banking Regulatory Commission declined to answer questions and directed queries to the broadcast for details.

In August, Wenzhou was allowed to ease restrictions on purchases of second homes, amid concerns over slowing economic growth, while most other cities had to keep existing curbs in place.

Wenzhou, in coastal Zhejiang province, said at the time that the restriction was lifted because prices had been kept at reasonable levels since the second half of last year, and that the property sector still has a role in driving the economy.

Beijing has maintained property-market controls for nearly four years in a bid to keep prices from spiraling higher and triggering social unrest. For home buyers, curbs include limits on credit and higher down-payment requirements. For developers, they include restrictions on stock and bond offerings and on bank borrowing.