Facebook Mobilizes Its Ad Army

February 1, 2014 Leave a comment

Facebook Mobilizes Its Ad Army

MIRIAM GOTTFRIED

Jan. 30, 2014 5:17 p.m. ET

In the battle for mobile-advertising market share, Facebook‘s FB +14.10% army is advancing on multiple fronts.

Just how far was shown by the social network’s fourth-quarter results after the market close on Wednesday. These sparked a 14.1% jump in the company’s shares Thursday, adding about $17 billion to its market value. The two salient points exciting investors: Facebook has tremendous pricing power among advertisers, and it isn’t about to run out of new ad slots to sell them.

The danger is that the latest gains are adding to an already steep valuation. Facebook trades at 49.3 times 2014 earnings estimates, compared with 21.8 times for Google, GOOG +2.57% which has more than double the mobile-ad market share.

That premium is based on the notion that Facebook is rapidly closing the gap with Google. The social network accounted for 18.44% of the world-wide mobile ad market in 2013, up from 5.35% in 2012, eMarketer estimates. That compares with a climb to 53.17% from 52.35% for Google.

Facebook’s valuation hinges on growth continuing at this rate but there are plenty of risks—for example, that Facebook is supplanted by upstarts among young, fickle social-media users or that growth of the mobile-ad market doesn’t live up to expectations.

Still, Facebook’s latest moves show it is seizing opportunities and trying to create new ones. And its results will cement the idea that alongside Google and Twitter,TWTR +6.76% Facebook will reap the biggest gains from the shift to mobile.

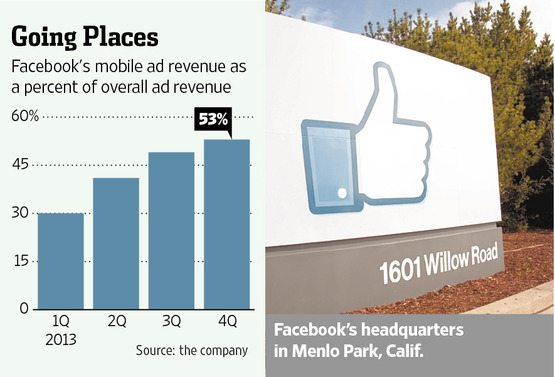

Facebook’s performance provided reassurance in several ways. Mobile-ad revenue as a percentage of overall ad revenue climbed to 53%, from 49% the prior quarter and 23% a year earlier. This was due to the ongoing shift of ad dollars to mobile away from more traditional media and Facebook’s ability to capture a bigger slice of the fast-growing pie.

Meanwhile, Facebook’s pricing power, one point cheering investors, was far stronger than expected. That reflects the effectiveness of its mobile ads, which are mixed into a stream of user content. So far, this is one of the few mobile formats advertisers have shown a willingness to pay for.

Underscoring this, the improvement came as total ad impressions at Facebook fell 8% year over year in the fourth quarter. That encompassed both impressions for desktop and mobile. While the latter is growing faster, it has less room for ads. But the average effective price per ad at Facebook was up a whopping 92% versus the prior year.

Importantly, Facebook also found a way to put to rest concerns about its ability to continuously generate new real estate for ads, the second reason investors were so exuberant. In the third quarter, the ability to grow ad slots became a worry after Facebook said it would cap the number of ads as a percentage of posts in users’ news feeds at about 5%.

Yet Facebook emphasized its commitment to creating new platforms aside from its core news feed to fuel user engagement and eventually open up new ad slots. Its Messenger app and Instagram are examples. Facebook followed this up Thursday with the announcement of a new app, Paper.

This app will let users explore and share stories from “well-known publications,” as well as their own news feeds. This could draw users away from their news feeds. But it also shows Facebook is willing to try to usurp its main platform itself rather than wait for rivals to do so—creating more space for new ads.

Like other Facebook efforts, Paper will launch without ads. But once it has a significant user base, the company will likely begin gradually testing ads as it has done with Instagram and auto-play video ads.

Of course, as the company’s own experience has shown, promising initiatives such as new apps can easily flop. And there is still the risk users will rebel against too many ads on new platforms. But by refusing to rest on its laurels, the now-10-year-old Facebook has a better chance of growing into its outsize valuation.