Nintendo Remains Defiant Against Smartphone Revolution; Fails to Propose Aggressive New Steps, Despite Dismal Earnings

February 1, 2014 Leave a comment

Nintendo Remains Defiant Against Smartphone Revolution

Fails to Propose Aggressive New Steps, Despite Dismal Earnings

MAYUMI NEGISHI and KANA INAGAKI

Updated Jan. 30, 2014 2:27 a.m. ET

TOKYO—Battling to stay relevant amid a gaming revolution, Nintendo Co.7974.TO +0.16% failed to release aggressive new proposals Thursday to turn around its business strategy as the latest quarterly results suggest the floor may be falling from underneath its console-based approach.

Speaking at a special business strategy meeting a day after slashing his own pay in half and offering a share buyback to calm investors, Nintendo President Satoru Iwatasaid the world’s biggest videogame company would develop a new app to help promote its games on smart devices and license more rights to its characters.

Nintendo, which is heading for its third straight year of losses, said it would also focus on developing more innovative games for its flagship console, the Wii U, and that a lineup of new games would help boost sales of its hand-held 3DS.

But Nintendo stopped short of the measures industry watchers believe are necessary to turn around the Japanese videogame giant, as it insisted it wouldn’t put its iconic Mario franchise on smartphones and tablets.

“We are not going to just put our games on smart devices,” said Mr. Iwata said. “We need our unique position as a developer of both hardware and software to maintain the scale of business Nintendo aspires to.”

The company has been struggling as free or inexpensive games, available on mobile devices players already own, transform users’ willingness to pay upfront for games or consoles dedicated to games.

The measures unveiled by Mr. Iwata did little to boost Nintendo shares on the Tokyo Stock Exchange, as they fell 3.5% during the morning session. The Nikkei Stock Average was down 3.3%.

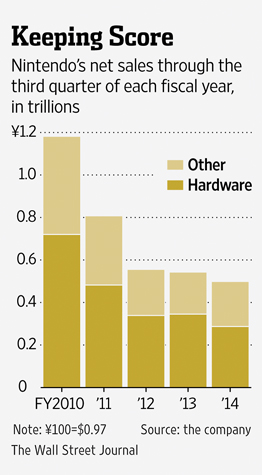

Nintendo posted an operating loss of ¥1.58 billion ($15.3 million) for the April-to-December period, from a loss of ¥5.86 billion a year earlier. That loss is expected to balloon to ¥35 billion by March, when its fiscal year ends, as sales suffer their usual postholiday plunge.

In the first nine months of the fiscal year, a rapid weakening of the yen helped Nintendo keep a lid on its losses, thanks to a valuation increase in its large foreign-currency holdings. But a small anticipated rise in the yen in the current quarter will remove the masking effect of the exchange rate.

“We completely missed our earnings forecast, and the responsibility of management is extremely large. I felt we had to take some form of responsibility,” said Mr. Iwata, who will get a pay cut through June.

The year-end holiday season and a lineup of titles like the latest “Super Mario Bros.” franchise failed to give Nintendo the boost it had hoped for. Two weeks ago, the company cut its annual sales target to 2.8 million Wii U consoles—less than a third of its initial estimates—and 19 million Wii U videogames, or half what it targeted in April.

Mr. Iwata attributed the grim figures to the failure of Nintendo’s games to gain traction in the U.S., saying the Wii U lost momentum after it failed to provide an adequate lineup in the first half of the year. Still, he said a big price cut wasn’t the answer to weak sales.

Investors and analysts have called for the company to make its prized game franchises, such as “Super Mario,” “Pokémon” and “Zelda,” more widely available and release them on mobile platforms. Some investors have said that releasing Nintendo’s content on mobile apps could double or even triple the company’s share price.

In a peek into what he has lined up for Thursday’s strategy briefing, Mr. Iwata said Nintendo needs to do more to draw consumer attention to its products. Earlier this month, he said he is looking into ways to promote Nintendo games on phones and tablets, such as by allowing users to try playing a demo of games.

“TV commercials alone will not convince customers to buy our products. Users now want more information, and many different things now vie for customers’ attention,” he said. “It is more difficult now to get customers to notice our products.”

In spurning smartphones and tablets, the Kyoto-based company so far has argued that its success has always rested on building its own hardware and providing a gaming experience not available elsewhere.

It has said that sharing that experience on smartphones could erase the company’s edge, discouraging people from buying Nintendo devices and killing its game franchises.

While changing Nintendo’s business model may upset its loyal customer base, Paul Thelen, chief executive of U.S. videogame maker Big Fish Games, said changes need to come.

“To be competitive in the new world, you have to pick a lane,” Mr. Thelen said. “Trying to build hardware and have a proprietary software system, it’s difficult.”

Still, some veteran Nintendo investors aren’t counting on Mr. Iwata to make drastic changes to its closed business model soon.

“We expect Nintendo to adapt to changes such as the growing popularity of smartphones and tablets but not to change the basic tenets of its business model,” Michael Lindsell, portfolio manager and co-founder of London-based investment manager Lindsell Train Ltd.LTI.LN 0.00% , said by email. Mr. Lindsell, whose company has been investing in Nintendo shares for 13 years, added that he also expects the company to reveal its strategy to expand its franchises in emerging markets.

Nintendo Tries to Reinvent Itself Again

Nintendo to broaden core business as it heads for more losses

MAYUMI NEGISHI and KANA INAGAKI

Jan. 30, 2014 9:32 a.m. ET

TOKYO— Nintendo Co. 7974.TO +1.22% , the videogame firm that started out in 1889 as a playing card maker, may be trying to reinvent itself again.

In a surprising but still nebulous strategy shift, Nintendo said it is broadening its core business beyond games, as it heads for a third straight year of losses under siege from smartphones, tablets and free-to-play games.

Details are few. At a strategy meeting Thursday, chief executive Satoru Iwata said only that the company was working on a new nongame product–to launch in the year beginning April 2015—that would make taking care of one’s health as fun as playing a Nintendo game.

In a cryptic series of hints, Mr. Iwata said the new product wouldn’t be wearable, that it wasn’t an extension or version of the Wii Balance Board–which players can use to measure their weight or posture while playing on a Nintendo exercise game–and that it wouldn’t be used in the living room.

“We have now redefined entertainment to mean making it fun for people to improve the quality of their lives,” Mr. Iwata said.

Investors weren’t impressed. Nintendo shares fell 4.3%, versus the benchmark Nikkei average’s 2.5% decline. Analysts noted that the iconic Japanese game maker said little about how it would fix its core game business, and snubbed suggestions that it should release hit game franchises like Mario Brothers, Pokemon and Legend of Zelda so they can be played on other devices than Nintendo’s.

“They have imagination where other companies don’t. The question is, can they translate the imagination into higher future returns?” said Peter Boardman, a portfolio manager at Los Angeles-based value investor TradeWinds Global Investors LLC, which manages over $6 billion.

Even competitors, though, warn that the Kyoto-based Nintendo, which has reinvented itself time and time again through experimentation–at various points dabbling in taxis, instant rice and even a love-hotel chain–can’t be easily discounted.

“Nintendo is wildly creative about how they think through issues like hardware and games,” said Owen Mahoney, chief financial officer of Tokyo-based Nexon Co.3659.TO +1.23% , a pioneer of free-to-play games. With its recent handhelds and consoles that include innovative features like touch screens and motion-sensor wands, “Nintendo took very key insights on how people play games to create something that was truly differentiated.”

From the outside at least, it is hard to believe Nintendo is an innovation powerhouse, with its septic, white-walled offices. Employees from Mr. Iwata on down wear navy or light-blue uniform jumpers–similar to the ones that Japan’s factory workers wear–and take lunches in a cafeteria when a bell signals lunch time.

Citing a need to keep details of its next games and consoles away from copycat competitors, Nintendo has cultivated a secretive and insular corporate culture at its headquarters. Developers who worked on games for the Wii and Wii U consoles complain about the slowness of the company to reveal coding to assist game development, and about the company’s disdain for external input.

“Priority goes to the Nintendo games. Code information comes late and slowly, and it is a scramble to make games in time,” said an engineer at a software house that has made games for Nintendo consoles in the past.

Mr. Iwata likes to remind reporters of the company’s a track record of proving its doubters wrong. Few believed Nintendo could survive the spread of computers–and later, laptops–with powerful graphics capabilities. Yet Nintendo resisted designing games for the PC.

When Nintendo’s GameCube struggled against much more powerful consoles fromMicrosoft Corp. MSFT +0.55% and Sony Corp. 6758.TO +0.36% in the early 2000s, analysts clamored for the company to follow in the footsteps of Sega Sammy Holdings Inc.6460.TO +0.41% by scrapping the console business, and focusing its resources on developing games.

In both cases, company executives repeated Nintendo former president Hiroshi Yamauchi’s mantra: “The worst thing for an entertainment company is do the same thing as someone else.”

Instead, Nintendo developed the Wii console in Nov. 2006, upstaging its far more powerful rivals with a lower-tech but more intuitive approach to games. The Wii’s sales topped 100 million world-wide and “Wii Sports” became the world’s best-selling game of all time with 82 million copies sold.

“What I like about Nintendo is that it does adapt, and I’m waiting for it to adapt,” said Michael Wood-Martin, a portfolio manager of Japanese equities at London-based Henderson Global Investors, which manages about $118 billion in assets.

Mr. Wood-Martin said he has been investing in Nintendo shares for about a decade. “I do trust that at some point, they will come up with something dynamic and impressive,” he said. “I’ll stay an investor for the time being.”