Sarawak abuzz over Chief Minster Taib’s future; Counters linked to Taib see selling pressure on news he may step down

February 7, 2014 Leave a comment

Sarawak abuzz over Chief Minster’s future

Thursday, February 6, 2014 – 11:05

Dennis Wong and Goh Pei Pei

New Straits Times

KUCHING – For many Sarawakians, there is nothing new in the latest speculation of Chief Minister Tan Sri Abdul Taib Mahmud calling it quits soon.

To them, it is just a rumour that has been circulating over the past four years.

The only difference this time was that the rumour was given a degree of credence with the tenure of Yang di-Pertua Negeri Tun Abang Muhammad Salahuddin Abang Barieng due to expire at the end of the month.

Talk of Taib taking over as the new Yang Dipertua Negeri is rife as the 93-year-old Abang Muhammad Salahuddin has been in office since 2001 and will not extend his tenure.

Almost all Malaysian political pundits are expecting a major announcement at the state Barisan Nasional meeting on Sunday.

Taib, who served as chief minister for the past 33 years since 1981, had been hinting on this since 2011, the year the last Sarawak state election was held.

At that time, Taib said he would retire in “two or three years” and leave “mid-term” without mentioning any specific dates.

But that plan may have got into a twist as the 78-year-old chief minister led the state BN to a convincing win in GE13 , with Taib’s Parti Bumiputera Bersatu Sarawak winning all 14 parliament seats it contested and forming the bulk of the 25 BN parliament seats in the state.

Taib’s brand of leadership, which focuses on politics of development and power-sharing among the ethnic groups, was credited as the main driving force for BN’s electoral success in the state.

Three names has been bandied as Taib’s possible replacement since the last state election.

They are Special Affairs Minister Tan Sri Adenan Satem who is also PBB information chief, Tourism Minister Datuk Amar Abang Johari Openg and Second Resource Planning and Environment Minister Datuk Amar Awang Tengah Ali Hassan who is also PBB senior deputy president.

When contacted, Johari who is also PBB vice-president, declined comment.

PBB will hold a special supreme council meeting on Saturday before the state BN’s meeting on Sunday.

Leaders of PBB and other state BN component parties are keeping mum about the agenda of both meetings.

Regardless of the outcome of the speculation, Taib’s success in leading Sarawak over the years was evident in its rapid growth since the expansion of its economic potential particularly in the industrial sector.

Since the start of the Sarawak Corridor for Renewable Energy initiative five years ago, the state’s economy had grown to be the third largest in the country with a real gross domestic product of RM71.9 billion (S$27.5 billion), which accounted for 10 per cent of the national GDP.

Updated: Thursday February 6, 2014 MYT 8:10:52 AM

Counters linked to Taib see selling pressure on news he may step down

BY YVONNE TAN

Sarawak abuzz over Chief Minster Taib’s future; Counters linked to Taib see selling pressure on news he may step down

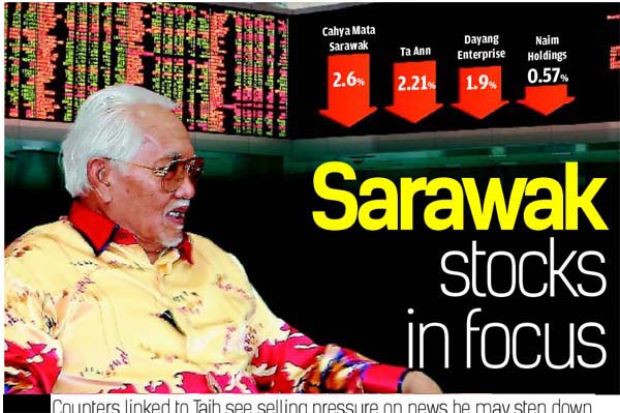

PETALING JAYA: Sarawak-linked counters were sprinkled across the loser’s list of stocks on Bursa Malaysia following news that Chief Minister Tan Sri Abdul Taib Mahmud(pic) might step down soon.

Cahya Mata Sarawak Bhd (CMSB), which is some 43% owned by Taib’s family, was among the biggest losers of the lot, finishing 2.6% down to RM7.24.

The company, which started out as a cement manufacturer and has since moved into other industries such as construction, property and financial services, has often been seen as the main beneficiary of large projects in the state by virtue of its political connections.

A top performer last year, CMSB appreciated by some 105% last year alone. The stock remains 6% higher year to date.

Apart from CMSB, another Sarawak-linked counter, property developer Naim Holdings Bhd also finished yesterday’s trade 0.57% lower to RM3.50.

Additionally, shares of Naim’s unit – oil and gas-related outfit Dayang Enterprise Holdings Bhd – finished 1.91% lower to RM3.60. Dayang shares had also performed well last year after clinching some significant oil and gas services-related contracts from oil majors.

Other counters which reflected the same weak sentiment were timber companies Ta Ann Holdings Bhd, Jaya Tiasa Holdings Bhd and WTK Holdings Bhd, which all closed trading yesterday lower by at least 0.44% each.

A local daily, quoting a source, reported yesterday that Taib would announce his decision to retire at Barisan Nasional’s central working committee meeting this weekend.

Analysts said while yesterday’s fall in most Sarawak counters could be merely a knee-jerk reaction, some investors were using the opportunity to take profit, especially in counters like CMSB which was among the star performers of the stock market last year.

“Furthermore, the outlook of the market remains murky for now largely as a result of external factors, so it’s better to take profit,” said another market analyst.

He said it was unlikely that a major sell-down in Sarawak counters would occur, if Taib were to step down as he had already expressed his intention to step down from politics as early as 2011.

Danny Wong, fund manager at Areca Capital which has investments in certain Sarawak counters including CMSB, told StarBiz that he was not switching or selling down any Sarawak stock just yet.

“We buy on fundamentals, not on politics and besides, this is not official news,” he said,

Still, in the event the news becomes official, Wong said he would re-visit his entire Sarawak investment theme to assess the impact on the investments.