CVS chief shakes up business model of US pharmacies

February 9, 2014 Leave a comment

February 7, 2014 4:48 pm

CVS chief shakes up business model of US pharmacies

By Anjli Raval and Shannon Bond in New York

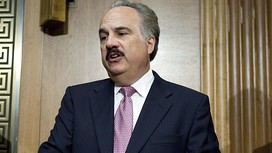

Chief executive of CVS Caremark Larry Merlo

For Larry Merlo the decision to stop selling cigarettes at US pharmacy chain CVS Caremark was not just about business. “My father was a smoker and died of cancer at the young age of 57,” said the former pharmacist, who rose through the ranks to become chief executive of the company.

Mr Merlo captured headlines this week for shaking up the business model of US pharmacies. From October, the chain’s 7,600 stores – which offer Marlboro cigarettes and Budweiser beer alongside NyQuil flu medicine and Maybelline make-up – will no longer sell tobacco products.

“Everyone has a personal story, a friend or loved one who was killed by smoking,” said Mr Merlo of the leading cause of premature death in the US.

CVS expects to lose about $2bn in annual revenues from the decision, just a fraction of its total 2012 sales of $123bn. Although the financial stakes are not large, Mr Merlo’s move sets his company apart from its peers by choosing to forgo short-term profits for a long-term vision of the company as a healthcare provider.

“Tobacco was always a sticking point when it came to building relationships with hospitals and physicians’ practices,” said the mustachioed 58-year-old chief, who has helped turn CVS into an immense retail presence with a near-$80bn market capitalisation.

“They asked if we were really committed to this vision as we sold tobacco products. It had become a complete contradiction to the health outcomes we were trying to achieve,” he added.

CVS is looking to take advantage of a growing demand for health services as tens of millions of Americans gain insurance as a result of President Barack Obama’s signature healthcare reform and as the country’s elderly population balloons.

As more people need medical care, the US is facing a shortage of doctors. That is where CVS sees an opportunity. The company plans to open 1,500 in-store ‘MinuteClinics’ by 2017 that offer basic services such as immunisations, minor wound treatment and preventive care for chronic illnesses.

“Pharmacies are an extension of a physician’s office,” Mr Merlo said. “It’s about more than just dispensing a prescription.”

Mr Obama – a former smoker – was among the cheerleaders who lined up to praise CVS, alongside former New York City mayor Michael Bloomberg, who led the charge to ban smoking in public places.

A cultural shift has taken place in the US, said Mr Merlo. “Twenty years ago you could smoke on an aeroplane. Many things that were commonplace are not today. As a company we decided now was the right time to make this decision.”

Mr Merlo, who started out on the frontline of the retail pharmacy business, is pushing a strategy that takes him back to his roots.

The only child of a homemaker mother and Corning Glass factory worker father, he grew up in Pennsylvania and was the first person in his family to go to university. He initially had ambitions to become a doctor, but was persuaded by his chemistry teacher to study pharmacy.

A University of Pittsburgh graduate, Mr Merlo began his career at Peoples Drug, a regional chain later bought by CVS, and moved up the corporate ranks. The US pharmacy industry has seen massive consolidation since his early days in a white coat, with most independent and local chains being absorbed into market leaders CVS,Walgreens

and Rite Aid.

CVS’s own acquisitions have helped to propel sales and earnings and since Mr Merlo became chief executive in March 2011, the company’s share price has doubled.

As for whether CVS will continue to sell alcohol and junk food as the company pivots towards health and wellness, Mr Merlo said those indulgences were fine in moderation. “But no amount of tobacco is safe.”