Investors Arm for Imminent Tremors; Cost to Protect Against Short-Term Volatility Is On the Rise

February 11, 2014 Leave a comment

Investors Arm for Imminent Tremors

Cost to Protect Against Short-Term Volatility Is On the Rise

KAITLYN KIERNAN

Feb. 6, 2014 7:36 p.m. ET

Stocks rose sharply on Thursday but options investors are bracing for more wild swings in the coming weeks.

For the past 10 days, options investors have paid more to protect themselves against volatile share-price moves in the coming weeks than to guard against swings a few months from now.

Usually, this insurance, which comes in the form of options on the S&P 500 stock index, costs more the further out in the future it goes, simply due to greater uncertainty about how events will unfold.

The last time this reversal in options pricing lasted so long was October 2011, when a combination of the euro-zone debt crisis and the downgrade of the U.S. government’s credit rating sent financialmarkets swooning.

Options traders say the unusual state of play suggests investors are especially anxious about where the market may be headed in the coming days and weeks. A holder of an options contract has the right, but not the obligation, to buy or sell stocks at a certain price.

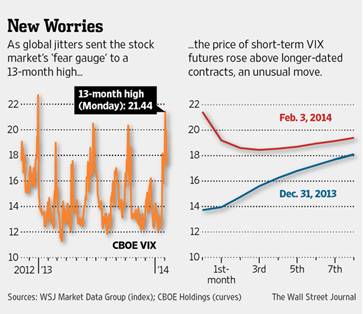

Last year, the stock market‘s so-called fear gauge, the Chicago Board Options Exchange Volatility Index, traded an average of 5% below the front-month futures contract, while over the past 10 days, the VIX traded an average of 6.3% above the front-month contract.

Fund managers are focused on Friday’s monthly U.S. nonfarm-payrolls report, which economists and analysts say should help measure the health of the U.S. economy. As the Federal Reserve scales back its bond-buying program, economic indicators have taken on increased importance, many investors say. But lately, those indicators have been sending mixed signals.

On Monday, a disappointing report on the U.S. manufacturing sector sent the Dow Jones Industrial Average down 2.1%. On Thursday, fewer-than-expected jobless claims sent the blue-chip index rallying 1.2%.

“We can see this volatile market stay around for quite a while,” said Brian Bier, head of equity derivatives sales and trading at Macro Risk Advisors LLC, a broker-dealer and advisory firm.

The VIX jumped to a 13-month high Monday of 21.44 as traders braced for bigger price swings over the next 30 days. While the VIX itself isn’t traded, it tracks shorter-term options contracts.

However, longer-dated options contracts, such as ones for four months down the road, didn’t rise as much, indicating less worry about stocks’ performance over the longer term. As February futures initially jumped 14%, May contracts gained 5.5%.

The VIX fell Thursday as a rise in the market calmed some nerves, but remained at higher levels than in recent weeks. The VIX hit a high of 80.86 on November 20, 2008, in the midst of the financial crisis.

Randy Warren, investment strategist at wealth-management firm Warren Financial Service, which has more than $100 million under management, began buying VIX options Tuesday to protect his stock portfolio. Should the VIX jump again with a big market decline, the profit from those options would help offset declines in his stock portfolio.

“In a down market, you’ve got to be cool and calm, but also smart,” he said. While he is still optimistic about the long-term prospects for stocks, Mr. Warren said he is buying protection in case the economic situation in the U.S. and abroad worsens and leads to greater declines.

On Jan. 24, the first day of the flipped pricing, February VIX futures contracts added 13% to 16.20 as stocks fell the most in seven months, but the VIX index surged 32%, leaving the index about 12% above the first futures contract.

On Monday, the day of the disappointing U.S. manufacturing data, the February futures contract was trading higher than futures contracts as far out as June, according to FactSet data.

Many investors tie the shift in options pricing to the deepening of a selloff in emerging markets last month. Initially, Jared Woodward, principal at Condor Options, an options research and trading firm, thought it would be a short-lived aberration. Now he isn’t so sure.

“The story has changed from emerging markets to U.S. growth,” Mr. Woodward said. “With the shift in focus to U.S. data, volatility can stay higher for a while until investors are reassured,” he said. That reassurance might not come as easily, he said, as global growth remains a concern.

Fed policy is also an issue, says Peter Cecchini, chief strategist at Cantor Fitzgerald.

Mr. Cecchini said the market is nearing a situation comparable to 2011, when the Fed concluded its second round of bond-buying and faced domestic worries as well as concerns about the European debt situation. As the Fed backs away from its supportive measures, prolonged periods of high volatility could again become the norm, Mr. Cecchini said

“Investors have to be sensitive to whether a real change in tone is occurring where we could end up seeing an inversion that lasts for months,” Mr. Cecchini said.