DeepMind and NaturalMotion lead charge of London’s tech start-ups; Unlike in Silicon Valley, tech start-ups in the UK rarely ascend to the lofty heights of multibillion-dollar valuations

February 12, 2014 Leave a comment

February 10, 2014 7:05 pm

DeepMind and NaturalMotion lead charge of London’s tech start-ups

By Sally Davies

Unlike in Silicon Valley, tech start-ups in the UK rarely ascend to the lofty heights of multibillion-dollar valuations.

But with Google’s acquisition last month of London-based artificial intelligencecompany DeepMind for £400m

– swiftly followed by Zynga’s swoop on graphics company NaturalMotion for more than $500m – Britain’s techies are abubble with talk about the country’s next unsung heroes.

“The quality of raw engineering talent that you get in Europe, and especially in London and Cambridge, is on par with the best in the Valley,” says Debu Purkayastha, formerly a senior mergers and acquisitions executive at Google who has just joined venture capital group Octopus Ventures.

He praises the cosmopolitanism of the UK’s start-ups, which can aspire to have “the DNA of a consumer-savvy Swedish product manager, an Israeli data scientist, a Cambridge or Finnish engineer, [and] a commercially astute London marketer”.

Joanna Shields, chairman of public sector body Tech City UK and a non-executive director at the London Stock Exchange, cites financial technology as an area where London is poised to excel.

“Expertise in clusters tends to reflect the unique culture and strengths of the local economy or – in the case of a university cluster – leverages the knowledge base and expertise of the faculty and student community,” she says. “This entrepreneurial moment reflects the history and culture of the region.”

London venture funds become more active

Well-known technology companies funded by UK venture capitalists include Betfair, Last.fm, Lovefilm and Skype, writes Jonathan Moules.

But there are risks that the momentum will fizzle. Hiram Samel, a professor at Oxford university’s Saïd Business School, warns that laisser-faire venture capital markets and funding which prioritises new technology over market need can promote short-termism.

“This overstimulates short-term innovation so we get thousands of app builders, but does less for the long-term, more complex innovation that yields national competitive advantage and local employment and growth,” says Mr Samel.

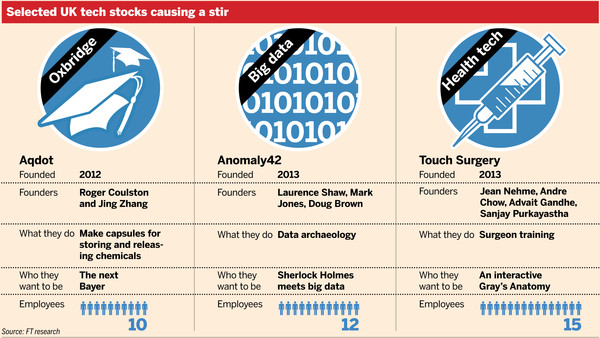

The five start-ups below are just a few examples from a flourishing ecosystem of early-stage companies in areas of particular strength for the UK, from Oxbridge spinouts to the arts and state-backed healthcare.

Health Tech: Touch Surgery

There is a first time for everything – including performing an appendectomy, fixing a cleft palate or reconstructing a breast. It is a rather discomfiting thought for anyone who has been under the knife.

“There’s an old adage in surgery, which is ‘see one, do one and teach one,’” says 29-year-old Jean Nehme, a London-based plastic surgeon. “But it’s not really the best way to train.”

Thankfully, as in so many areas of life, there is an app for that. Last year Mr Nehme and his co-founders launched Touch Surgery, a smartphone and tablet app that helps doctors learn the steps for a host of procedures using 3D visualisations of the human body.

Touch Surgery

Founded: 2013

Founders: Jean Nehme, Andre Chow, Advait Gandhe, Sanjay Purkayastha

Employees: 15

What they do: Surgeon training

Who they want to be: An interactive Grey’s Anatomy

While most people think of surgery as being about the deft use of one’s hands, Mr Nehme says 75 per cent of the skills required are cognitive, such as visual and pattern recognition. Touch Surgery’s app can help new and practised doctors acquire these skills – and the data collected from surgeons using the app will allow Touch Surgery to improve the training.

With a few swipes and pinches, the user is guided where to make incisions, how to remove organs and then sew patients up again. They can also test themselves at each step against a choice of tools and parts of the body.

Hospital budget cuts and the need for doctors to keep abreast of a rapidly advancing medical technology prompted Mr Nehme and his co-founders to start Touch Surgery, which has been downloaded 160,000 times since it was launched early last year.

They have hired animators from Pixar and are working with specialists at Duke University, Stanford and NYU to create new lessons, as well as introduce the app into their training programs.

Big data: Anomaly 42

If Sherlock Holmes and a Google web-crawler had a baby, it might look something like Anomaly 42 – a new set of software applications that are all about finding unexpected connections between big bundles of information.

Founded by a group of fraud investigators and technology consultants, Anomaly 42 claims to allow “organisations to understand the archaeology of their data,” says chief executive Laurence Shaw. Mr Shaw is also a partner of FusionAI, the private equity group that funded the start-up.

Anomaly 42

Founded: 2013

Founders: Laurence Shaw, Mark Jones, Doug Brown

Employees: 12

What they do: Data archaeology

Who they want to be:Sherlock Holmes meets big data

Total funding: £5.5m

The company recently ran a test of the payday loan market for the Financial Conduct Authority by connecting data in company filings and other internal documents with information in the public domain.

“We found some shocking revelations,” says Mr Shaw. His team found examples of a major UK high street bank being indirect shareholders of payday loan groups, to the order of owning 5 to 7 per cent of those payday loan companies via shell companies, securitised instruments and complex agency agreements.

Anomaly 42’s technology will let a company dump files – from PDFs to spreadsheets to SAP databases – into a big pool. Algorithms then sift through and find links within that pool, and match them against 160 external data sources, including the FBI’s most-wanted list and registers of disqualified directors.

Its clients include the South African fraud prevention service, the New York State senate and one of the financial compliance departments in New York State.

Launched last May, the company expects revenues by the end of March to be between £4.9m-£5.2m, and for profits to be between £2m-£2.4m.

The Arts: Roli

It looks like a squishy grey piano, with keys that curve up smoothly like shortbread wafers lying side by side under a sheet. But the ethos of the Seaboard, the first product from east London start-up Roli, is more complex than it first appears, says founder Roland Lamb.

“Both our minds and computers are incredibly fast, but what connects the two is very problematic,” says Mr Lamb. He points to the contrast between typing on a keypad, on the one hand, with how a violinist uses their instrument.

Roli

Founded: 2009

Founders: Roland Lamb

Employees: 35

What they do: Make smart musical hardware

Who they want to be:Steinway & Sons for the digital age

Total funding: £3m

“We want to apply those principles of muscle memory and subconscious computation to speed up how we input information into computers,” says Mr Lamb.

From a converted space under two railway arches in Haggerston, Roli’s team of engineers, materials scientists and musicians have designed and manufactured soft sensors made from polymers. When integrated as keys on the Seaboard, these devices let musicians control features of sound – such as its loudness or quavering vibrato – using pressure and movement of the fingers.

Before founding the company in 2009, Mr Lamb studied Chinese and Sanskrit philosophy at Harvard, lived in a Buddhist monastery for a year and a half and completed a design degree at Royal College of Art. He is also an accomplished pianist.

Mr Lamb thinks Roli’s technology has applications beyond music, in areas such as mobile technology and robotics. “We can array these sensors into all different kinds of shapes, and by doing so we can make much more subtle, interesting and integrated touch experiences,” he says.

Fintech: Moni

It was just before 2pm. Laurence Aderemi was standing in the driving rain in “crack alley” – the nickname of a sketchy street in central London – with £1,000 in his pocket. He was waiting to enter a cybercafé to use a money transfer service to send part of his salary back to his mother in Nigeria, who recently had a stroke. It was the closest spot he could find to Google’s London headquarters, where he worked as head of mobile partnerships.

This was the moment, Mr Aderemi says, when he came up with the idea for his business, which he has since left Google to work on.

Moni

Founded: 2013

Founders: Laurence Aderemi, Fernando Saturno

Employees: 8

What they do: Remittances

Who they want to be:Western Union for mobile

Immigrants who globally sent back $529bn worth of remittances in 2012 have had to endure similar – or worse – hardships. Mr Aderemi’s app, Moni, aims to help them transfer money quickly and cheaply using a mobile phone.

Moni Technologies, which is part of the TechStarsaccelerator programme

and launches in March, has developed relationships with cross-border payment providers to let people to transfer money across 100 countries. Because the company does not have to siphon off funds to players in a retail network, it can charge about a third of what banks and money transfer companies do.