11 Inspiring Quotes From WhatsApp’s Billionaire Co-Founders

February 27, 2014 Leave a comment

11 Inspiring Quotes From WhatsApp’s Billionaire Co-Founders

JILLIAN D’ONFRO TECH FEB. 22, 2014, 1:49 AM

Jan Koum and Brian Acton founded WhatsApp in 2009 and became filthy rich fewer than five years later when they sold the company to Facebook for $19 billion.

The pair met while working as Yahoo engineers. They are both part of the “Facebook reject club.” They both hate advertising, and they both feel strongly about having WhatsApp remain independent even though Facebook now owns it.

Koum moved to the U.S. from communist Ukraine when he was 16. Acton was born in Michigan. Both are now billionaires.

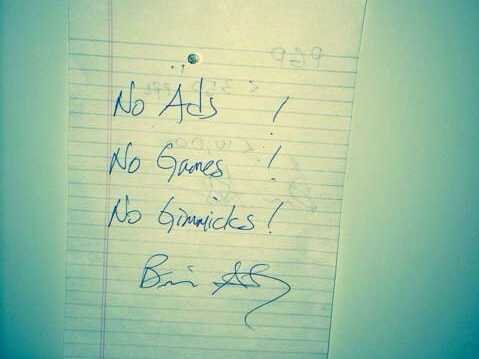

Acton on advertising: “Dealing with ads is depressing. You don’t make anyone’s life better by making advertisements work better.”

Koum on focus: “I want to do one thing, and do it well.”

Acton on WhatsApp’s mission: “We don’t want to build a hookup app so you can find someone weird to talk to. It’s not what we’re about. We’re about your intimate relationships.”

Koum on traditional SMS: “It stinks. It’s a dead technology like a fax machine left over from the seventies, sitting there as a cash cow for carriers.”

Acton on the company’s history: “We’re the most atypical Silicon Valley company you’ll come across. We were founded by thirtysomethings; we focused on business sustainability and revenue rather than getting big fast, we’ve been incognito almost all the time, we’re mobile first, and we’re global first.”

Koum on metrics: “Comparing total registered users and active users is like comparing Ferrari 250 GTO with a skateboard.”

Acton on Snapchat: “It’s not 100 per cent clear to me what’s working about Snapchat. Great, teenagers can use it to get laid all day long. I don’t care. I’m 42, essentially married with a kid. I don’t give a s— about this.”

Koum on his childhood: “It was so run-down that our school didn’t even have an inside bathroom. Imagine the Ukrainian winter, -20°C, where little kids have to stroll across the parking lot to use the bathroom. …I didn’t have a computer until I was 19–but I did have an abacus.”

Koum on user privacy: “We want to know as little about our users as possible. We don’t know your name, your gender… We designed our system to be as anonymous as possible. We’re not advertisement-driven so we don’t need personal databases.”

Koum on their no-nonsense style: “Neither of us has an ability to bull—-.”

Koum on ambition: “We won’t stop until every single person on the planet has an affordable and reliable way to communicate with their friends and loved ones.”