Chinese brand equity makes for stock hits

February 27, 2014 Leave a comment

Chinese brand equity makes for stock hits

Feb 21, 2014 1:35pm by James Kynge

Chinese brands may not yet be world beaters, but it looks as though they are making waves among stock pickers.

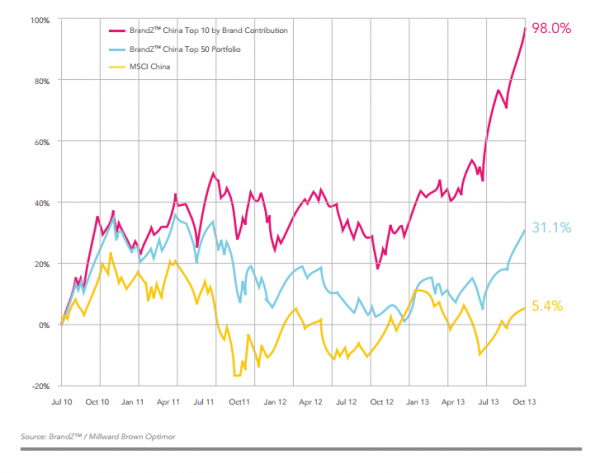

Research from WPP, the advertising and public relations company, shows that a group of “Top 10″ Chinese brands – ranked by what they call “brand contribution” – sharply outperformed market indices (see chart).

Source: BrandZ

The share prices of the companies that own these “Top 10″ brands rose 98 per cent over the 36 months between July 2010 and October 2013, according to WPP. By comparison, the MSCI China index increased by just 5.4 per cent.

Source: BrandZ

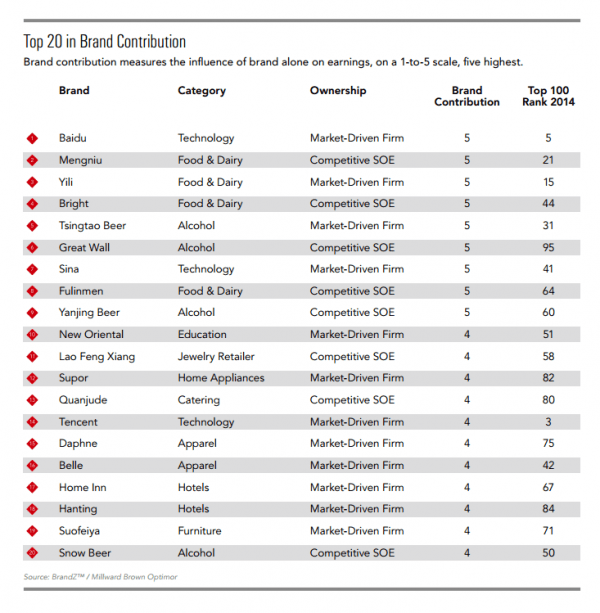

The companies included in the Top 10 chosen by WPP are the first 10 listed in the chart below.

But what does brand contribution mean, and how is it calculated? WPP is keeping mum on detailed methodologies, but defines the concept as the contribution that brand equity makes in selling a product, discreet from other factors such as price, market positioning and others. Thus, if a company’s product flies off the shelves because of the allure of its brand alone, that company is said to have a “brand contribution” of five. A reading of one, by contrast, denotes an ugly duckling.

The Top 10 companies by brand contribution is a subset in a wider study into the “Top 100″ most valuable Chinese brands. The whole study drew on the knowledge of 125 brand experts at 23 WPP companies in China and separate research by Milward Brown – so it sounds as if significant qualitative judgments were involved.

Interestingly, the Top 10 companies ranked by brand contribution is very different from the Top 10 companies ranked by “most valuable” brand. In fact, there is only one company that makes both lists – Baidu, the internet search engine. The other Top 10 in the “most valuable” list – which takes into account total revenues – are predictable enough: China Mobile, the Industrial and Commercial Bank of China (ICBC), Tencent, China Construction Bank (CCB), the Agricultural Bank of China (ABC), the Bank of China (BOC), PetroChina, Sinopec and China Life.

Of these, ICBC, CCB, ABC, BOC, PetroChina and Sinopec all received a lowly “brand contribution” reading of two – recognition of that they are relatively unloved.

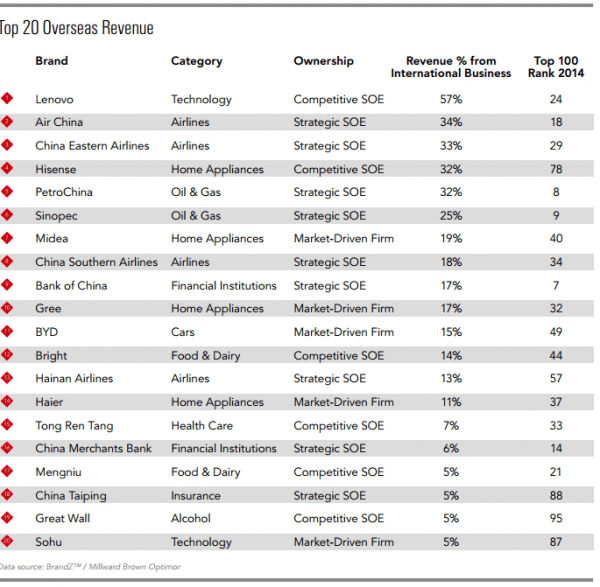

In terms of recognition beyond China’s borders, the line-up is again very different from the rankings by “brand contribution” and “most value” (see chart).

Source: BrandZ