WhatsApp Deal Bets on a Few Fewer ‘Friends’; Is Facebook’s WhatsApp deal a sign of a tech bubble?

February 27, 2014 Leave a comment

WhatsApp Deal Bets on a Few Fewer ‘Friends’

By JENNA WORTHAMFEB. 21, 2014

The address book is making a billion-dollar comeback.

Weary of noisy social networks filled with mundane updates from the most remote acquaintances, millions of people have turned to their smartphone address books — and the diverse array of messaging services that rely on them, like Snapchat, Secret, Kik and WhatsApp — for more intimate social connections. Now the stampede toward those messaging services has Silicon Valley’s giants scrambling to catch up.

Being able to tap into this address-book messaging is a major reason Facebook decided that WhatsApp, the most popular of these services, was worth as much as $19 billion. In buying WhatsApp this week, Facebook is betting that the future of social networking will depend not just on broadcasting to the masses but also the ability to quickly and efficiently communicate with your family and closest confidants — those people you care enough about to have their numbers saved on your smartphone.

Facebook has long defined the digital social network, and the average adult Facebook user has more than 300 friends. The company’s strategy has mostly been about making that circle of friends even bigger, cajoling users into combining their friends, former friends, co-workers, second cousins and everyone they’ve ever met into a single, ballooning social network.

But the average adult has far fewer friends — perhaps just a couple in many cases, researchers say — whom they talk to regularly in their real-world social network.

“The prominence of the address book simply reflects the shift in relevance on the Internet to cater to the most universal and basic human need: communication,” David Byttow, a founder of a new messaging application called Secret, said in an email. “The address book is a simple, reusable list for any application, and simplicity always wins.”

Services like Instagram, Google Plus, Twitter and Facebook encourage users to share from the rooftop every life event and moment as material to be viewed and commented on. The Internet enabled that sort of broad outreach like never before, and the services continue to grow, as more than a billion people have signed up on Facebook alone.

Yet the popularity of private-messaging applications like WhatsApp, which has more than 450 million users, suggests that despite all the technological advances in recent decades, people still crave to communicate in small groups and often just with one other person at a time.

“There’s a very human need for intimate, one-to-one communications,” said Susan Etlinger, an analyst with Altimeter Group, who studies social technologies.

While the original ideas behind services like Facebook and Twitter may have been to connect people, Ms. Etlinger said, they have “evolved into a news feed,” one that is increasingly clogged by advertisements, brands and near-strangers, all competing to be seen and heard.

In addition, many people may be growing tired of worrying about how an image or status update will be perceived by their broader social network of employers, in-laws and ex-flames.

“Contacting someone on Facebook is the equivalent of opening up the phone book and calling someone,” said Scott Feinberg, 22, a user of WhatsApp. “With WhatsApp you’ve given me your number and actually want me to contact you.”

Facebook and other major tech companies have tried several times to roll out their own messaging applications, but none have caught on like the products introduced by start-ups. Messenger, Facebook’s flagship chat product, was originally conceived as an alternative to email but is primarily used by people on Facebook to send notes to their friends within the network.

Mark Zuckerberg, the chief executive of Facebook, acknowledged those shortcomings in a call to investors and analysts after the WhatsApp announcement. He also said his interest in WhatsApp came from realizing that “it’s a service for very quick and reliable real-time communication with all your contacts and small groups of people.”

Some analysts took Mr. Zuckerberg’s move to buy WhatsApp as a signal that Facebook was vulnerable despite its huge user base. For the most part, though, the new social networks that focus on smaller groups of people are being used in addition to services like Facebook and Twitter, not instead of them, a point that Mr. Zuckerberg made on the call with investors.

“WhatsApp also complements our services and will add a lot of new value to our community,” he said.

Whether the two kinds of social networks can coexist and thrive remains to be seen. It could well be that younger Facebook users, who tend to have more friends on the service than older users, have more of a need for a separate service. But with the addition of WhatsApp, Facebook has positioned itself to be ready if the move away from its core offerings is swift.

It could turn out that the dominant messaging platform has still not emerged. David Lee, an investor who is one of the founders of the prominent Silicon Valley firm SV Angel, said that he was watching the next-generation messaging category with intense interest. But he said it was not yet clear which ones would have long-term staying power.

According to Mr. Lee, these apps take off because people can quickly import their friends. But once people get bored or distracted by the latest hot app, “it’s just easier to switch and move on to the next one.”

The services that stick around, he said, will be the ones that people return to every day.

Adam Ludwin, a serial entrepreneur who is working on a new messaging application, Ether, said that Facebook was future-proofing itself for a coming sea change in social media: In the near term, a person’s mobile number will be as tied to their digital identity as their Facebook, Google or Twitter account.

“The address book is a very unique thing that sits on the phone and isn’t available to the desktop world,” Mr. Ludwin said. “It allows you to build services that have the potential to grow very fast.”

Chiqui Matthew, 35, who works in finance, said he preferred services like WhatsApp. “I fear all communication in the digital age is being reduced to shouting in a crowded theater,” he said in an email. “Everything is absolute, declarative, exclaimed, public and generally lacking in the nuance of face-to-face conversation. I like the digital version of a ‘cocktail party whisper.’ An intimation meant to be intimate.”

But even Mr. Matthew has not given up on Facebook completely. He made his comment after responding to a Facebook post.

Is Facebook’s WhatsApp deal a sign of a tech bubble?

Dealmaking now at highest level since dotcom crash of 2000

7:39PM GMT 20 Feb 2014

Facebook’s shock purchase of the smartphone messaging service WhatsApp has pushed technology deal-making to the highest levels since the dotcom bubble burst at the start of the century.

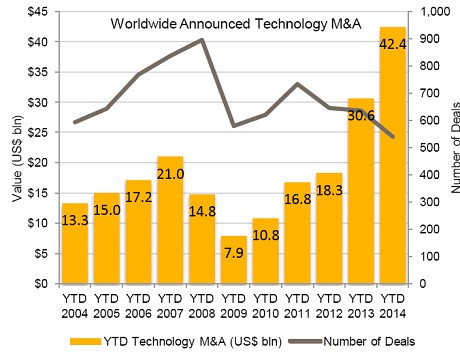

The $19bn (£11.4bn) takeover is the fourth biggest technology acquisition in history, and means that $42.4bn-worth of mergers and acquisitions have been agreed in the first month-and-a-half of 2014 – a 14-year high – according to data from Thomson Reuters.

The extravagant valuations of technology companies have seen dozens of founders turned into millionaires overnight, but have also fuelled fears that the crash of 2000 will be repeated, with WhatsApp just the latest example that the sector is overheating.

On Wednesday night, Facebook chief executive Mark Zuckerberg announced the takeover, a radical move to protect his company’s status as the world’s dominant social service.

WhatsApp, a mobile application that allows people to send messages, photos and sound clips, has 450m subscribers less than five years after launching.

This figure is expected to reach 1bn within a few years, making WhatsApp one of the world’s biggest companies in terms of user numbers. However, its low fees – it charges users just 99 cents a year – and a promise not to add adverts have led to questions about whether WhatsApp can ever achieve the revenues to justify its valuation.

A host of companies are looking to cash in on the growing demand for technology investments.

Twitter floated on the New York Stock Exchange in November, with the social network now valued at $30bn despite losses widening last year; King, the British games maker behind the phenomenally-successful Candy Crush Saga, has filed for a New York listing; and Snapchat, a photo-sharing app without any revenue, is believed to have rejected a $3bn bid from Facebook.

The tech-heavy Nasdaq index has risen by a third in the past year and is at its highest level since the dotcom crash.

To some commentators, parts of Wall Street are now starting to feel like they did 14 years ago. In the space of a few months in the second half of 2000, hundreds of internet companies went bankrupt or saw values plummet as shareholders fretted that their billion-dollar investments would fail to create returns.

The price Facebook is paying for a company that charges users less than a dollar a year is just the latest indication that the bubble is inflating again, sceptics say.

Ian Maude, of Enders Analysis, says Facebook’s latest deal is an attempt to nullify one of its biggest threats. WhatsApp has grown rapidly among teenagers, who are using Facebook less, and in emerging markets, the next frontier for Mr Zuckerberg’s company.

“[He] has shown his willingness to act when there is a threat to his core business,” Mr Maude says. “Services like WhatsApp have the potential to do much more than just messages.

“They could become the social media platform of tomorrow, which is a strategic threat to Facebook. Strategically the deal makes sense, but we probably won’t ever know if it’s a good deal [financially].”

However, although technology values are rising rapidly, the $42bn of deals so far this year is still some way off the $79.6bn at the same point in 2000, and rising valuations may just be a reflection of the increased size of the industry.

“There are some fundamental differences [between now and then],” says Mr Maude. “Back then a lot of companies had massive valuations but no business model, and clearly a lot of them do now. Google and Facebook have achieved massive profits and they also have a broader reach.

“In 2000 [internet companies] had tens of millions of users. Now it is hundreds of millions, and in some cases billions.”