Why Google’s latest acquisition could be good for the whole online ad industry

February 27, 2014 Leave a comment

Why Google’s latest acquisition could be good for the whole online ad industry

By Leo Mirani @lmirani February 21, 2014

Half the ads on the internet are never seen by anybody, according to ComScore, a web traffic measurement company. And of those ads that are seen, it’s not clear how many are seen by human beings. Last year, the London-based start-upSpider.io, which tracks ad fraud, revealed a network of 120,000 infected computers (paywall) that together “viewed” ads billions of times, meaning that advertisers were paying millions of dollars for fake views. Today, Google announcedthat it had acquired Spider.io for an undisclosed amount.

Google and other online advertising companies don’t like fake ad views any more than the people paying for them. It affects their credibility, lowers prices, and weakens confidence in the online ad market as whole. As the biggest firms try to entice valuable brand advertisers away from established mass media such as television, the Googles and Facebooks of the world need to have solid metrics to prove not only that the ads being seen, but that they’re being seen by the relevant audience. And unlike other spheres of online competition, this is one where a solution would profit everybody: Increased confidence in online advertising will send dollars flowing to all advertisers, not just one.

Underlying the push for better measurement and cleaner ad views is a fundamental shift in the nature of online advertising. While most online ads today resemble the classifieds section of a newspaper and are generally measured on a per-click basis, the big money lies in brand advertising—an area where most of the dollars are spent offline. Unlike search ads, where the purpose is to get you to click and follow through with a purchase immediately, brand ads—which in the offline world include long TV spots and magazine spreads—are there to influence and touch you. Online, these are measured on a per-view basis, and the more accurate the targeting, the more valuable the views. According to ComScore, brand advertising accounts for70% of all traditional advertising.

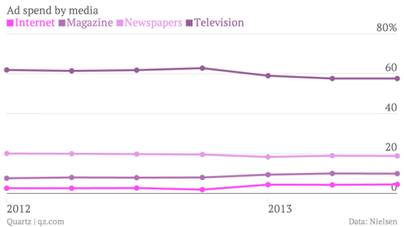

Convincing big-money brand advertisers of the value of digital ads will not be easy. According to Nielsen’s third-quarter 2013 report on media ad spending trends, released last month, the internet’s share of global display advertising—creative, image-based ads or video ads, a major component of brand advertising—grew slightly, from 4.3% in the second quarter of 2013 to 4.5% in the third. But as the chart below shows, television gobbled up 57.6% of advertising dollars for the second straight quarter. Magazines attracted twice as much advertising as the web.

For the internet to increase its share of this lucrative market, ensuring that online ads reach the right people is an important step. Google already has teams of people working on ad fraud and spam in its offices. Today’s acquisition, destined to be buried under the avalanche of Facebook-WhatsApp news, will only strengthen its efforts—and be good for the industry as a whole.