Smartphone Makers Aim at Emerging Markets With Low-End Devices; Companies Introduce Phones With Limited Internet Capability, Some Priced Under $100; For Smartphones, Price Is the New X Factor

March 2, 2014 Leave a comment

Smartphone Makers Aim at Emerging Markets With Low-End Devices

Companies Introduce Phones With Limited Internet Capability, Some Priced Under $100

SVEN GRUNDBERG and TOM GRYTA in Barcelona and WILL CONNORS in Toronto

Feb. 25, 2014 1:36 p.m. ET

High-end smartphones from Samsung Electronics Co. 005930.SE -0.07% and Apple Inc.AAPL -1.04% tend to hog the spotlight, but companies eager to capture growth in emerging markets are working off another benchmark: Which phone is least expensive.

At the annual Mobile World Congress show in Barcelona this week, several established companies have been showing off phones priced below $200.

Nokia Corp. NOK1V.HE +1.45% , which for years dominated that so-called feature-phone market, this week introduced a new line of phones running on Google Inc.GOOG +0.62% ‘s Android operating system, starting at around $120. BlackBerryLtd. BB.T +7.91% , having lost its once-strong position in the high-end market, on Tuesday unveiled the Z3, which will retail for less than $200 and go on sale this spring in Indonesia before expanding to the rest of Southeast Asia.

But other companies are already moving the low end lower still, below $100.

China’s ZTE Corp. 000063.SZ +0.38% introduced a phone running on Mozilla’s Firefox operating system that will cost $80. Mozilla says it will introduce a phone made in conjunction with a Chinese chip maker this year that will cost just $25.

High-end phones from Apple and Samsung dominate developed markets. But as component costs drop and features get more similar, making it harder to distinguish between smartphones, pressure on those companies’ pricing power and profit margins could intensify.

About 800 million phones with more limited functions than smartphones were sold in 2013 globally, according to Rajeev Chand, a managing director at boutique investment bank Rutberg & Co. “The lower end of the segment is where all the growth is,” Mr. Chand said.

Nokia, for one, agrees. “The fastest growth really is in the affordable smartphone space,” said Timo Toikkanen, the company’s head of mobile phones. “Something that’s not fully appreciated in the Western world is that a couple of bucks makes a huge difference in developing markets.”

Nokia now has some limited-capability, Internet-enabled phones that cost as little as $40. For its new Android-powered Nokia X line, which starts at about $120, the Finnish company has emphasized that it will charge consumers for applications and content from the Nokia app store. The low credit-card penetration in places such as India and Indonesia means Nokia will charge for content through consumer’s phone bills or prepaid contracts.

Mozilla, best known as the maker of the Firefox Internet browser, has been most aggressive about pushing prices down.

“We’re targeting people who never had this kind of Internet access before,” said Johnathan Nightingale, who heads Mozilla’s Firefox browser and operating system business. “Maybe they had a basic feature phone before. And for them, even a $70 smartphone is a substantial investment. As close we can get that to zero dollars, the better.”

Mozilla’s $25 phone, which the company is building with Chinese chip maker Spreadtrum Communications Inc. and expects to release this year, will have just 128 megabytes of random-access memory, a far cry from the 2 gigabytes found in Samsung’s latest Galaxy S5 flagship phone. The Mozilla phone’s low-resolution screen will measure just 3.5 inches diagonally. Samsung’s latest phone has a high-resolution screen that is bigger than 5 inches.

“Our prototype doesn’t feel like a Galaxy S5, and it’s not supposed to, either,” Mr. Nightingale said. “But it has apps, it can use the Web.”

Mario Zanotti, head of operations at Millicom International Cellular SA, MIC-SDB.SK -1.31%which operates in Africa and Latin America, said he has seen “decent” Android-powered smartphones made by little-known Chinese companies that are selling for around $45. And prices continue to drop, he said.

But a cheap phone is just half the answer, he said. “The key in all this is making sure our data charges are affordable too. A smartphone without data is like a car without an engine.”

More customers are signing up for mobile data in recent years. By the end of last year, 20% of the company’s 50 million customers were subscribing to data, up 50% for the year. About 70% of its subscribers are prepaid customers, typically paying $3 to $5 a week for data and voice services.

It isn’t just small companies racing to meet demand for inexpensive phones.

When Google last fall released the latest version of its mobile operating system, a large part of the update was an initiative engineers at Google dubbed Project Svelte. It was an effort to reduce the memory needs of the Android OS so it could run on a broader range of devices, including entry-level devices with as little as 512 megabytes of RAM.

Microsoft Corp. MSFT -0.40% this week said it would lower the hardware requirements for its Windows Phone operating system to support less expensive chips, fewer buttons and less built-in memory, enabling cheaper devices for emerging markets.

The trend toward less-expensive phones soon may even take root in the U.S., where carriers have been resisting the long-held practice of subsidizing smartphone purchases in exchange for locking customers into long-term contracts.

T-Mobile US Inc. TMUS -5.69% last year dropped subsidies altogether in favor of lower-price plans paired with customers paying full price for phones. AT&T Inc. T -0.92% andVerizon Communications Inc. VZ +0.13% recently began offering service discounts to customers who already have or buy their own device.

As subsidies drop, device prices will likely come under pressure from consumers, said Rutberg’s Mr. Chand.

The new crop of inexpensive phones also come as makers of premium devices struggle to differentiate their products. The new Samsung Galaxy S5 was widely cited by analysts as an incremental improvement on the previous model.

“How do you get someone to buy your product?” Mr. Chand said. “You lower the price.”

For Smartphones, Price Is the New X Factor

DAN GALLAGHER

Feb. 25, 2014 3:08 p.m. ET

It is telling that one of the devices garnering much attention at this week’s Mobile World Congress is a phone that will start at an unsubsidized price of about $122.

Even more telling: the device is from Nokia, NOK1V.HE +1.45% using the Android operating system that is owned by Google, GOOG +0.62% rival to Nokia’s soon-to-be parent Microsoft. MSFT -0.40% Another twist is that smartphone buyers in established markets such as North America may never see it. The Nokia X is targeted at regions including India, Latin America, Africa and the Middle East where consumers have limited funds for wireless gizmos.

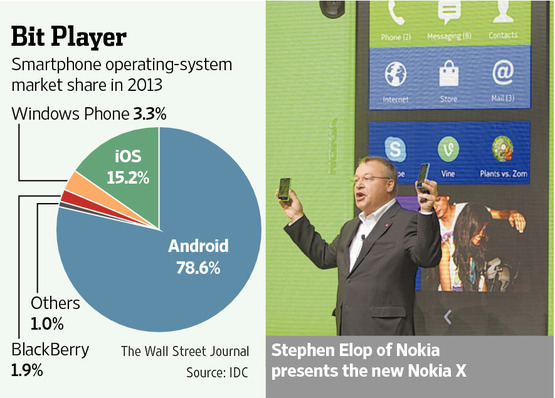

Microsoft may feel a bit unsettled by the move, but it is illustrative of the limited options available to companies in the smartphone business whose names aren’t Apple,AAPL -1.04% Google or Samsung. The Android and iOS platforms accounted for nearly 96% of all smartphones shipped last year, according to IDC. Samsung and Apple together accounted for more than 46% of global shipments by vendor, with everyone else getting single-digit market shares.

This is why many observers write off other companies as also-rans. But it is important to realize that smartphones are unlike the PC market that Microsoft has dominated with Windows.

Compared to PCs, smartphones have a shorter replacement cycle and are often not locked down by employers, which often allow staff to choose their own devices. So customers aren’t permanent; they can shift to new devices and platforms.

In this light, a bet like the one being placed by Microsoft and Nokia isn’t a surefire loser. Microsoft will try to sell Nokia X buyers on its own software and services, with hopes of converting them to a Windows Phone down the road. The dynamics of the smartphone market are also why new entrants including Lenovo 0992.HK +0.26% and Asus2357.TW 0.00% still smell opportunity despite their late start.

But it remains a stretch. The easy money is gone, and profits will be harder to come by. IDC forecasts the smartphone market to grow at 18.4% per year to 2017, after averaging 46.5% over the last three years. Handset average selling prices, meanwhile, are expected to hit about $265 by 2017—down 21% from 2013, IDC predicts. Apple and Samsung still claim most of the available profits given their ability to squeeze large price subsidies from wireless carriers.

New entrants will need to prove their devices can sell volumes big enough to maintain support from carriers and retailers. More of those sales will be made on price rather than features—and there is no app that makes that easy.