Wondering What Weibo Is Worth

March 2, 2014 Leave a comment

Wondering What Weibo Is Worth

AARON BACK

Feb. 25, 2014 5:54 a.m. ET

Sina’s microblog Weibo, once the hottest thing going in China’s Internet, has been battling perceptions that it’s in decline. Now Sina management hopes to turn that narrative around, and capitalize on sky-high tech valuations, with a partial listing of the Twitter TWTR -1.47%-like service.

Sina is publicly traded, but management apparently believes that Weibo, in which they own a 71% stake, is being undervalued by the market, especially when they look around at the eye-popping prices paid for other social-media properties.

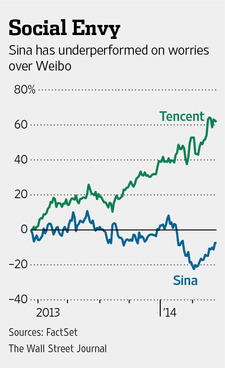

Sina shares are down over 10% since a January government report said China’s total microblog users fell last year. Some whispered that Weibo could be the MySpace of China. Investors fretted the decline was due to a government crackdown on politically outspoken bloggers who are some of Sina’s biggest, though far from its only, draws. Worse is the fear that users are migrating to rival Tencent’s mobile-messaging platform WeChat. Tencent’s shares are up 17% in the meantime.

Sina put those fears to rest when it reported 61.4 million daily active users at the end of December, up 4.2% from three months earlier. The government’s overall declining China figures likely reflected competing microblogs withering away.

Weibo does seem to be losing some growth momentum to WeChat, which is hipper and more mobile-focused. But Weibo is no MySpace. It remains important to discourse of all kinds in China, from celebrities to major media outlets. The country’s central bank recently started announcing some financial market interventions solely through its Weibo account.

What valuation Weibo deserves is an open question, made harder because Sina only discloses daily active users, as opposed to the industry standard of monthly active users. With many traditional company metrics thrown out the window in today’s bubbly atmosphere, this oversight makes it even more difficult to compare Weibo with peers. It’s reasonable to worry Sina doesn’t disclose the figure because it isn’t flattering.

The guesses vary substantially. In January, Barclays BARC.LN -0.42% assigned a value of $5.8 billion to Weibo with 191 million monthly active users, or around $30 per head. Credit Suisse CSGN.VX -0.11% figured in November it was worth $4.7 billion, or $39 per user with 120 million users. These estimates suggest a deep discount to Twitter, whose monthly users are currently valued by the market at $126 each. It is also significantly lower than analyst estimates for WeChat of around $95 a user.

A precise comparison is difficult until Sina releases better figures. To the extent that it pressures Sina into offering greater transparency, a Weibo listing could indeed unlock value. That is, of course, if investors like what is revealed.