Baidu’s Search for Elusive Profit Growth

March 4, 2014 Leave a comment

Baidu’s Search for Elusive Profit Growth

AARON BACK

Updated Feb. 27, 2014 11:41 a.m. ET

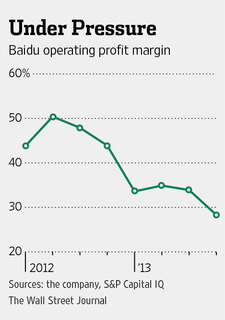

China’s online-search behemoth Baidu BIDU +3.48% is doing what it must to stay competitive. But in a theme Chinese Internet investors should get used to, profit growth isn’t going to be as bubbly as previously hoped.

That was the company’s message to investors Thursday. Revenue surged by 50% from a year earlier in the fourth quarter while profits were flat, as expected. But in a conference call with analysts, Baidu Chief Financial Officer Jennifer Li dropped a bombshell, saying the company doesn’t expect any increase in profit this year as it continues to invest. Pity the analysts, who according to FactSet had optimistically forecast a 31% rise in 2014 net profit. Now they are asking where the money will be spent.

The answer is, on more of the same. The company has been spending heavily to migrate its desktop search advertising prowess to mobile, such as by paying phone makers to preinstall its search app. Baidu also plunked down $1.9 billion to acquire 91 Wireless, a mobile-application store similar to Apple‘s AAPL +1.99% and Google‘s GOOG -0.08% , which aren’t widely used in China. The good news is that Baidu’s toehold in the crucial mobile space is growing. Mobile services accounted for 20% of total revenue in the fourth quarter, compared with 10% just two quarters ago.

Baidu has little choice but to invest in mobile, or risk becoming a desktop dinosaur. The hope had been that last year’s investment would start yielding profits this year. But the investment treadmill continues.

Baidu is fighting in a hugely competitive Internet market, where a handful of giants vie for control. It has a leading map application, but faces rising competition from AutoNavi, part-owned by e-commerce giant Alibaba Group, which is now seeking full control. Games and messaging colossus Tencent 0700.HK +0.97% last year infringed on Baidu’s core business by buying a stake in upstart search engine Sogou.

Investors are pricing high profit growth into shares, but competitive pressures could squeeze margins across the sector as everyone is forced into defensive investments. Sina told investors this week it also plans to step up spending on its portal business and its Weibo microblog. The stock fell 9% the following day. Baidu’s relatively modest ratio of 26 times next year’s earnings jumps to 35 times on the company’s latest guidance.

On the Chinese Internet, the profits needed to sustain such high valuations remain elusive