China falls out of love with cash

March 4, 2014 Leave a comment

February 28, 2014 4:22 am

China falls out of love with cash

By Patti Waldmeir and Simon Rabinovitch in Shanghai

China is rapidly ditching the centuries-old habit of paying its bills with trunkloads of cash, and making the shift to virtual forms of payment faster than any other country on earth.

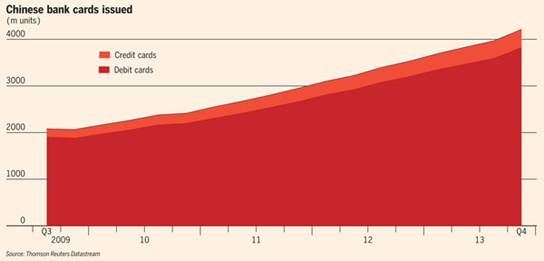

Figures released by the People’s Bank of China show a sharp rise in the popularity of anything other than cash – from debit cards to credit cards to electronic wallet mobile apps. China has a staggering 4.2bn bank cards in circulation, enough for every mainlander to have at least three.

Ten times more of them are debit cards than credit cards (3.8bn compared with 391m), but credit card issuance also rose by 19 per cent in 2013, and Euromonitor predicts credit card usage will grow faster than that of other cards over the next five years. Overdue credit card debt – unpaid after six months – also leapt 72 per cent, but this is hardly US-style household debt: China’s overdue credit card debt is a mere 1.37 per cent of total credit outstanding.

The shift away from cash is remarkable for a country which was the first to print paper money a millennium ago: until recently, cash was so popular in China that even large purchases like cars or houses were paid for with bundles of banknotes bearing the portrait of Mao Zedong.

Very low rates of street crime make China, paradoxically, one of the safest countries for carrying around large wads of cash. And decades of deprivation coupled with an only rudimentary social safety net have left older Chinese with an almost pathological fear of debt – and a fondness for holding their wealth in their hands.

But despite all that, MasterCard found in a recent global study that China is making the shift “from cash to cashless” far more rapidly than any other country surveyed, largely as a result of rapid urbanisation and government policies designed to encourage non-cash payments.

Customers in China buy almost anything online – including fresh vegetables

– Saurabh Sharma of Ogilvy & Mather in Beijing

And urban, affluent, internet-savvy Chinese consumers are even more wild about plastic. A recent Nielsen survey found that 71 per cent of shoppers in China’s top tier cities said they preferred bank cards over cash, compared with an average of half for other countries surveyed.

Zhang Yujia is at the forefront of the shift from paper to plastic. In fact, she is something of a credit card evangelist, having converted her reluctant parents to the use of a low-limit card that they initially did not want.

And she doesn’t stop at cards: over the recent lunar new year, she used Tencent’s social messaging platform WeChat to send traditional red envelopes full of virtual cash to her friends. Tencent says some 8m people sent Rmb400m ($65m) in electronic “hongbao” over the week-long holiday which ended in mid-February.

Mobile payment apps are surging in popularity as an easy way to pay for smaller items such as taxi rides and movie tickets. When dining with friends who want to “go Dutch”, Ms Zhang pulls out her electronic wallet app from Alibaba’s Alipay to transfer her share of the bill to the friend sitting next to her.

“Paper money stinks”, she says. Jason Chu, a Shanghai academic whose online alias is Big Bachelor, says he only carries Rmb100 with him at any one time: cash can be counterfeit and “carries bacteria and viruses”.

Wu Weiyi of AlixPartners in Shanghai, an advisory firm, says it’s not just about convenience or even the extra cash flow that comes with buying goods now that are only paid for later: companies issue cards to staff to control and monitor their cash flow.

But with many people signing up for cards to get the promotional gifts offered by banks, the number of active cards is much smaller than the total outstanding, he says. And in lower tier cities or among the less affluent, cash is still very popular: “Cash is more cost effective, vendors don’t have to pay fees for it, it can’t be so easily tracked and people use cash to avoid paying taxes.”

The meteoric rise of online retail in China is also a big factor, says Saurabh Sharma of Ogilvy & Mather in Beijing. “Credit card adoption has taken off in the past two to three years primarily due to the explosive growth in online retail,” he says, noting “customers in China buy almost anything online – including fresh vegetables”.

Zhang Yujia’s parents were tough converts to the credo of the credit card: “They weren’t accustomed to the concept of spending your money in the future,” she says.

But now she’s got them buying everything from milk to soy sauce and newspapers with plastic. “They use their credit card as much as I do,” she says. These days, it seems, everyone in China is rapidly being weaned off their wallets.

The enthusiast and the holdout

Cory Liu, 40 – the holdout

“Nowadays, I think I am in the minority of people who are still refusing to use cards – except maybe people who live in really remote mountainous areas and don’t need to use them. In a city like Shanghai, I think there are only a few people like me out of 100. If I shop online, I ask my colleagues to help with the (online) payment, and then I pay them in cash.”

Zhang Yujia, 26 – the enthusiast

“I think it’s cleaner and simpler to use a credit card instead of cash: I don’t need to carry a heavy wallet or count out any coins. And it automatically records my bills for me to check easily. It’s also very simple to pay off the bill: I only need to click one button on my phone and it’s done. My parents and I always pay off the bills before the due date. But I think it’s actually more lucrative to pay for big items over Rmb10,000 ($1,600) by instalment – instead of paying in full before the due date – considering renminbi inflation and the depreciation of the product.”

Naomi, 25 – the optimist

“I spend Rmb10,000 with my credit card every month and my salary is only Rmb8,000 a month . . . But I’m not worried because I believe my salary will increase in future. My husband spends even more than I do: we both think it’s cool to spend our money in the future. Even if I had the money, I wouldn’t put it all on the credit card to pay off the debt. That would just make me spend more the following month.”