Do ETFs Turn Investors Into Market Timers?

March 4, 2014 Leave a comment

Do ETFs Turn Investors Into Market Timers?

MARK HULBERT

Feb. 28, 2014 9:19 p.m. ET

There is a downside to how cheap and easy exchange-traded funds make it to buy or sell broad baskets of stocks: the danger of becoming a short-term market timer, a losing proposition for most individual investors.

If you want to invest in the broad stock market for the longer term, you may want to favor traditional open-end index funds.

ETFs can be bought or sold as easily as a stock and at any time. Open-end funds, by contrast, typically can be bought or sold just once a day—at the market’s close—and many fund companies restrict the frequency of transactions involving them.

These differences might not seem large enough to change investor behavior. But there is evidence that suggests they do.

Consider what is perhaps the most comprehensive study of ETF investor behavior, conducted by Vanguard Group. The study analyzed the transactions in nearly 400,000 retail accounts between 2007 and 2011 of four different Vanguard funds that give investors the choice of either an ETF or an open-end share class.

The individuals owning ETFs were more than twice as likely to fall outside the “buy and hold” category than those who owned open-end share classes—39% versus 19%. Investors were excluded from the buy-and-hold category if they reversed their fund investments—buying after previously selling, or vice versa—more than two times in a given 12-month period, or completely liquidated their position during the period covered by the study.

Some of this difference was certainly because the ETFs attracted investors already predisposed toward active trading. But Vanguard—applying a statistical model that relates frequency of trading to various investor characteristics—found that this accounted for less than half of the more-frequent trading activity of ETF investors.

Furthermore, the Vanguard study may have underestimated the true extent of the increased trading activity to which ETFs can lead, according to John Bogle, Vanguard’s founder. In an interview, he contended that the typical investor in the firm’s ETFs trades less actively than investors in ETFs sold by other fund firms.

Though Vanguard’s study doesn’t report the relative returns of Vanguard’s retail investors in ETFs and open-end funds, Mr. Bogle says he is confident that the more-frequent trading of the ETF investors led to lower returns on average.

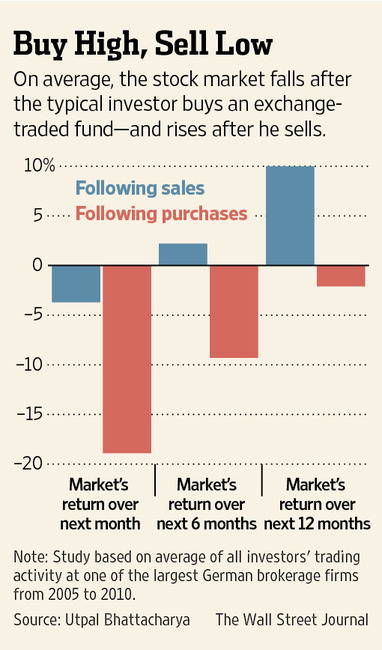

This suspicion is strengthened by the findings of a 2013 study of all the portfolio transactions between 2005 and 2010 from one of the largest brokerages in Germany. The researchers found that performance deteriorated for the average investor after he or she began investing in “easy-to-trade index-linked securities” such as ETFs.

Utpal Bhattacharya, a finance professor at Indiana University’s Kelley School of Business and one of the co-authors of this study, said that the cause of this deterioration was the “bad market timing” that the typical investor engaged in after investing in ETFs.

For example, the average investor tended to buy an ETF right before the market fell, and to sell just before a rise—just the opposite of the buying-low/selling-high behavior that would improve performance.

Investment advisers also appear to be struggling with ETFs, according to a Hulbert Financial Digest study of 23 monitored advisers who maintain both a model portfolio of ETFs as well as one focusing on open-end funds. Their ETF portfolios over the past five years trailed their non-ETF fund portfolios by an average of 2.5 percentage points on an annualized basis.

Terrance Odean, a finance professor at the University of California, Berkeley, said in an email that it would be unfair to blame just the ETFs when investors trade too much. A big share of the blame for the overtrading of ETFs also goes to their marketing, which encourages speculation, he said.

Mr. Bogle points out that 81% of ETF assets in the U.S. aren’t benchmarked to the broad stock market. One purpose of a more narrowly focused ETF “is to enable investors to speculate on future returns in industry and country segments, and on the momentary movements of stock prices,” he says.

ETFs do possess some real advantages over open-end funds. They often have lower management fees than comparable open-end funds for investors wishing to invest a relatively small amount, for example. And they offer greater “tax efficiency”—which means that an ETF investor could have lower taxes than if he had instead invested in comparable open-end funds.

Yet those advantages can be more than erased by excessive trading. If you don’t think you can resist the urge to trade, then stick with open-end funds. For almost every ETF there is a corresponding open-end index fund that invests in virtually the same stocks.

The following four open-end stock funds with low expense ratios currently are most recommended for purchase by the Hulbert Financial Digest-monitored investment advisers who have beaten the stock market over the past 15 years. All are from Vanguard: Total Stock Market Index, with an expense ratio of 0.17%, or $17 for every $10,000 invested; Dividend Growth, with expenses of 0.29%; International Growth, which charges 0.48%; and Small-Cap Index, which charges 0.24%.

The four most-recommended bond funds with low expense ratios are Fidelity Floating Rate High Income, which charges annual fees of 0.7%; Osterweis Strategic Income, which charges 0.91%; and two from Vanguard: Intermediate-Term Investment-Grade andShort-Term Investment-Grade, which both charge 0.2%.