Household debt – Korea’s Achilles’ heel

March 7, 2014 Leave a comment

2014-03-03 17:21

Household debt – Korea’s Achilles’ heel

Gov’t urged to focus on supporting low-income people

By Kim Rahn

Debt is a big part of life for most Koreans. Many borrow to purchase or lease houses, start or grow businesses, or pay for their college tuition.

While the nation’s total household debt exceeded 1 quadrillion won last year, experts are warning that the most insidious dimension is the rapidly increasing quantity of the debt held by those in lower-income brackets coupled with the increasing trend of people taking out high-interest loans from second-tier financial firms.

The highest percentage of household debt comes primarily from borrowing to finance housing purchases or leases. To complicate matters, indebted households eventually have to cut their spending, which slows domestic demand and consequently, the nation’s economy.

Experts are concerned that the massive household debt problems will negatively and significantly affect Korea’s economic growth. Although the government has developed countermeasures, experts doubt their effectiveness.

Fast-growing debt

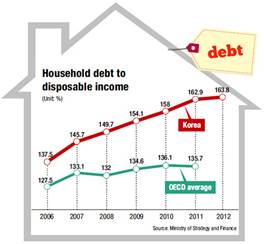

Korea’s household debt level is high compared to those of other major economies.

According to the Ministry of Strategy and Finance, Korea’s household debt to disposable income was 163.8 percent in 2012. This was higher than the OECD average of 135.7 percent in 2011, the latest figure available, and higher than the figures for other major economies, such as the 120.1 percent for the U.S., 160.4 percent for Britain, 131.7 percent for Japan and 95.1 percent for Germany.

Korea’s household debt to GDP was 91.1 percent, also higher than the OECD average of 76 percent. While the debt-to-GDP ratios of some nations have declined in recent years after the global financial crisis, Korea’s has kept rising, from 81.5 percent in 2007 to 84.3 percent in 2008, 87.1 percent in 2009, 86.6 percent in 2010, 89.5 percent in 2011 and 91.1 percent in 2012.

“Since the global financial crisis, household debt growth in the U.S. and many OECD member states has slowed down. But Korea still has a high growth rate, with debt having increased 6 percent in 2013 from a year earlier,” said Lim Jean, researcher at the Korea Institute of Finance (KIF).

“U.S. private consumption is recovering because households have deleveraged smoothly and now have money for consumption. But Korean households’ deleveraging has not been enough. In that sense, Korea’s household debt issue is more serious than those of other major economies,” he said.

Experts say that Korea’s household debt is closely linked to housing. According to McKinsey & Company, around 53 percent of household debt in Korea is housing-related, and this figure is more than twice that in the U.S.

Household debt surpassed 1 quadrillion won in 2013 according to the Bank of Korea (BOK). The growth in the fourth quarter was the largest at 27.7 trillion won or about 48 percent of the year’s total increase. The BOK said mortgage lending grew sharply in the fourth quarter as people sought to buy homes before the government’s temporary tax breaks on home purchases ended in December.

Economist Lee Jun-hyup at Hyundai Research Institute (HRI) said, “The government encouraged loans with low interests to spur housing demand. But whenever the government introduced housing market revitalization measures, household debt grew.”

Analysts say other aspects of the household debt problem are the worsening quality of debt, primarily of debt extended by second-tier financial firms that impose high interests, such as savings banks, and the growing number of people who borrow money from such firms for their living expenses.

In December, loans extended by such non-bank firms accounted for more than half of the total household debt at 50.03 percent, a record high, according to the BOK. People turn to these firms when banks reject their loan applications due to their low credit ratings or other reasons. However, the high interest rates also bring with it a high chance of defaulting.

Another KIF researcher, Park Sung-wook, said a growing number of people are borrowing money for household consumption and to run other businesses.

“Self-employed people borrow money for business, but most such mom-and-pop shops do not make high profits. Their failure to repay debts, if unaddressed, can become a social issue for that specific income class,” he said.

“Highly indebted people cannot spend money for other things, which is an important cause of the sluggish consumption and domestic demand.”

Solving the debt problem

The government recognizes the seriousness of the household debt issue and has vowed to address it.

“Household debt is a prolonged, chronic problem in the Korean economy. It is the main cause of financial instability and stagnant private consumption. Without addressing it, we can’t stabilize the financial market and activate domestic demand,” Deputy Prime Minister and Minister of Strategy and Finance Hyun Oh-seok said last Thursday, announcing a set of countermeasures.

Because a significant portion of household debt is related to housing purchases or leases, the policy intervention measures are therefore targeting this sector. They include among others, encouraging people to choose mortgages with long maturities and fixed interest rates. The government expects that these policy measures will successfully lower the ratio of household debt to disposable income by 5 percent by 2017.

Experts are, however, cautioning that these latest measures are hardly any different from previous ones, thereby calling into question how effective they will be in achieving the intended policy goals.

For instance, researcher Lee of HRI said policies aimed at activating the housing market conflicts with policies to address the household debt problem, therefore urging the government to find a way of balancing between the two goals. “The policies should focus on helping people who need houses to live in, not those who buy houses for the purpose of speculation, and encouraging them to borrow money at the level they can repay.”

He further said that the government’s policy measures are short term, adding that if banks tighten loans to curb the total household debt, people in the lower-income brackets with low credit ratings will simply resort to loans from second-tier financial firms or even loan sharks.

“In the long term, government policies should focus on increasing people’s disposable incomes. That’s how people can repay debt,” Lee said.

Lim at the KIF also said the policies should pay more attention to vulnerable households, that is, those in lower-income brackets.

“The current growth rate of the country, 3-4 percent, is not enough to increase the income of people in those brackets, so the debt of such people can become more serious,” he said.

“In the labor market, the demand for those people is not high because many of them are the elderly, less-educated or women. So, the government should try to create jobs for such people, even non-regular positions.”