New Japan Index Targets High Performers; Government-Backed Stock Index Excludes Some Well-Known Firms

March 8, 2014 Leave a comment

New Japan Index Targets High Performers

Government-Backed Stock Index Excludes Some Well-Known Firms

KOSAKU NARIOKA

March 4, 2014 3:04 a.m. ET

TOKYO—Some of Japan’s cash-rich firms are starting to take action to feature on a new government-backed index of 400 companies offering higher investment returns.

The moves by firms to improve their return on investment to attain or maintain a place on the new index are an early sign that it may be successful in prodding Japan Inc. to ease its miserly grip on corporate purse strings.

The index has screened out some of the biggest names in Japanese business, such as Panasonic Corp., Nintendo Co. 7974.TO +1.86% and Daiwa Securities Group,8601.TO 0.00% serving as a wake-up call for companies and investors alike.

Even before its January launch, the JPX-Nikkei Index 400, gained the support of two government panels as an investment guide for the nation’s pension fund and as a basis for new financial products.

Synthetic rubber maker JSR Corp. 4185.TO +2.37% is among the companies that stood up and took notice of the index’s launch. JSR, already an index constituent, is looking to raise its return on equity by focusing on polymers and other core technologies, and promising applications for them.

“The index is raising tension, in a good way,” JSR chief financial officer Hayato Hirano said. “We are having to think more about capital efficiency.”

The company is targeting a return on equity of 15% by the business year ending in March 2016, compared with 10% in the 12 months ended March 2013. The firm also decided in February to purchase up to ¥5 billion ($49 million) of its own shares, a move that directly increases the return per share.

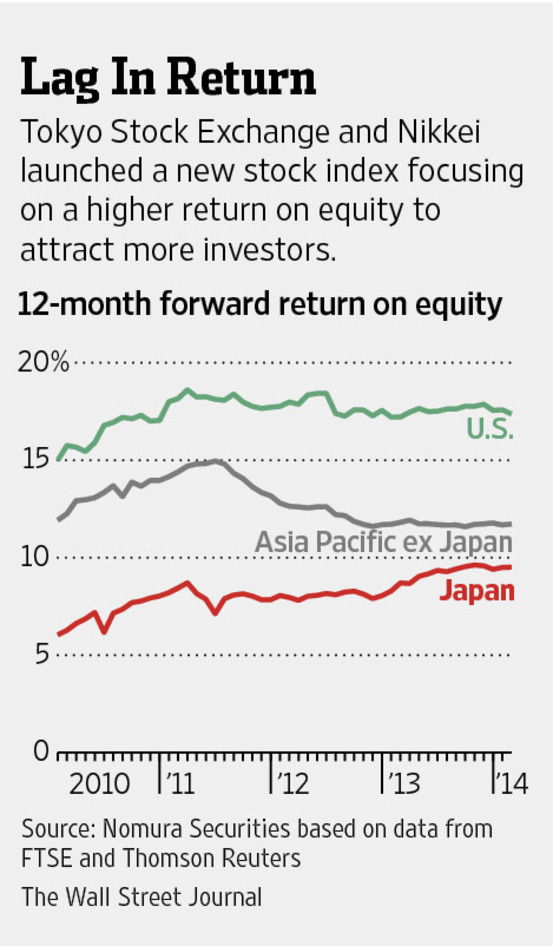

Return on equity is a measure of how well companies use shareholders’ money to generate income. Generally speaking, Japanese companies perform poorly on ROE, making just $9.5 a year for every $100 of shareholder equity, compared with $17.4 at U.S. companies and $11.7 at Asian companies, excluding those from Japan, according to Nomura Securities.

That’s because Japanese companies tend to hold on to less profitable businesses and amass cash without investing for growth or distributing to investors.

But Japanese companies may be starting to change following years of limited capital investment in the wake of the global financial crisis. Japan’s net foreign direct investments, for instance, increased 35% in 2013 from the previous year. The introduction of the index is building on this momentum.

Hitachi Chemical Co. 4217.TO +1.77% , another index member, is considering acquisitions overseas in medical and storage battery businesses, and has an M&A war chest of about Y50 billion ready for the purpose.

“Our cash position is great, but we’ve still been pinching pennies. We have to spend more,” said Hisashi Maruyama, an executive officer for finance and accounting at the firm.

Hitachi Chemical is targeting a return on equity of more than 10%, compared with about 9% currently.

Food maker Ajinomoto Co. 2802.TO +0.26% is another index constituent that is looking to keep raising its return on share investment.

“Depending on the demand (for use), this index could have considerable coercive power. We are compelled to think about ROE,” said Hiromichi Oono, head of finance at Ajinomoto Co. Mr. Oono said he wants to achieve a double-digit return on equity soon, a move that would put the company in line with other index members averaging around 11%. The firm’s rate was 7.8% as of last March.

The new index, created by the Tokyo Stock Exchange and Nikkei Inc., enjoys semiofficial backing by the government. A government panel recommended in November that Japan’s public pensions, including the giant Government Pension Investment Fund, start using the index as a stock investment benchmark. Another government panel in December called for development of financial products linked to the new index.

Currently, about ¥14 trillion ($138 billion) of GPIF stock funds are invested passively using the Topix benchmark of some 1,700 companies listed on the first section of the TSE, including unprofitable companies.

Amid all the optimism that the index will have an impact, financial officers at some firms warned there are no silver bullets to raise return on equity. They noted that relatively strong labor protection in the close-knit business society of Japan makes it difficult to lay off workers and unload underperforming assets swiftly.

Masataka Kitagawa, head of investor relations at MS&AD Insurance Group Holdings Inc.,8725.TO +0.08% which didn’t make it to the index, said it’s hard to imagine the company would stop offering certain products just because they weren’t generating much profit, particularly when there is demand from customers.

“In Japan, it’s difficult to act drastically,” he said.

It’s also yet to be seen if the new index created to attract more money to Japan will indeed lead Tokyo markets. The index is down 8% so far this year, compared with the Nikkei Stock Average’s 10% loss. GPIF officials are considering the use of the new index, but it’s not certain when they might adopt it as a benchmark or how much of the funds they might allocate to it.

Still, the new index has introduced a fresh way of evaluating companies and some are adapting to the challenge it lays down.

Fiber and composite maker Teijin Ltd. 3401.TO +2.89% made a loss last year and is not currently on the index. But it is now restructuring its loss-making segments and focusing on higher-margin operations such as health care and carbon fiber products. Teijin is expected to return to the black in the fiscal year ending in March.

“We want to further restore the earnings levels soon to a level high enough to get on the index,” said Masahiro Ikeda, head of investors relations.