Chinese “1%” Threaten Lawsuit Against Canada For Shutting Visa-For-Cash Scheme

March 9, 2014 Leave a comment

Chinese “1%” Threaten Lawsuit Against Canada For Shutting Visa-For-Cash Scheme

Tyler Durden on 03/05/2014 12:34 -0500

When Canadian authorities scrapped their ‘investor visa’ scheme a month ago, we warned that the nation was removing a critical pillar of support for its real-estate bubble market. However, with an estimated 45,000 Chinese millionaires still in the queue, the wealthy hoping to get their cash out of China are not happy. As The South China Morning Post reports, a group of wealthy mainlanders has criticized the Canadian government for scrapping its investor visa scheme and are threatening legal action if the decision is not overturned – arguing “we had set aside a lot of money to meet the investment requirements and over the years passed up on many opportunities… A refund of our application fees will not make up for all the preparation put in.”

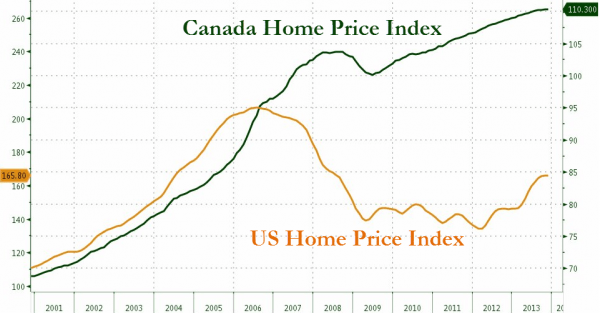

The Canada real estate bubble is alive (and well enough for now)…

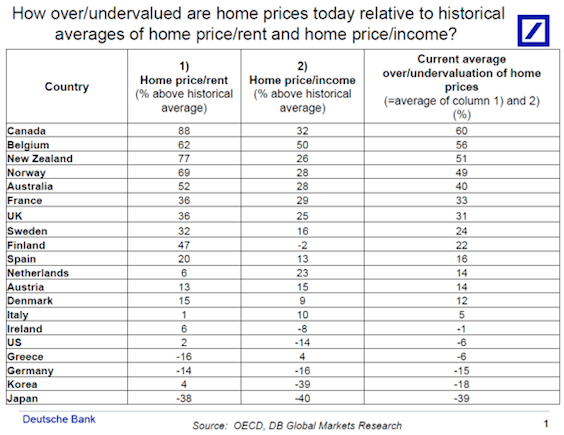

Deutsche Banks’s house-price-to-rent index says Canada has the most expensive housing market in the world – 60% over-valued…

“Canada, for example, is very open to foreign investors, which means that in an age of unprecedented global liquidity cash-rich wealthy individuals who are looking for places to park their excess funds can do so in its housing market far more easily than in Japan, with its closed system. “

As it’s home price index hardly missed a beat while the US plunged… (different scales but point is to illustrate drastic difference when financial crisis started – and where the liquidity went…)

But the scrapping of the visa scheme threatens to remove a key pillar from that:

The scheme has allowed nearly 100,000 wealthy Hongkongers and mainland Chinese to move across the Pacific since 1986.

But as The South China Morning Post reports, the Chinese are not happy,

A group of wealthy mainlanders has criticised the Canadian government for scrapping its investor visa scheme and are threatening legal action if the decision is not overturned.

More than 10 people who had applied for the visa met with reporters in Beijing yesterday to air their grievances. The group said they had wasted years of time, effort and money preparing to move to North America.

An estimated 45,500 Chinese millionaires who were still in the queue for visas will have their applications “eliminated” and their fees returned.

“We have set aside a lot of money to meet the investment requirements and over the years passed up on many opportunities,” he said.

“Moving to Canada has been a dream of mine since witnessing what happened in 1989 as a student over there on this main thoroughfare,” he said, pointing to a road passing Tiananmen Square where the crackdown on pro-democracy demonstrators took place.

“I thought Canada was a place that underpins justice, trust and democracy, but the abrupt, unilateral decision to scrap the scheme has left us very, very disappointed,” he said. “A refund of our application fees will not make up for all the preparation put in.”

Larry Wang, the president of the immigration consultancy firm that organised the meeting with reporters, said he would help applicants take legal action if the decision was not overturned.

“A sovereign country, of course, has the right to make such a move, but it’s unfathomable how a democratic and human-rights-respecting country like Canada just cut off applications like that, without regard to those who’ve been preparing for the move for years,”

In other words, we want to get our money out of this controlled nation and are upset that we were not higher on the list… especially now that we see local authorities starting to tamp down the bubble of local real estate that we have previously speculated in…