Return on equity and Soviet tractor production

March 9, 2014 Leave a comment

Return on equity and Soviet tractor production

March 4, 2014 3:07 pmby Andrew Smithers

The financial information published by companies has become increasingly bogus in recent years, because of the huge incentive for modern management to produce highly volatile profits. This has been helped by the increased flexibility allowed with the change from “mark to cost” to “mark to market”.

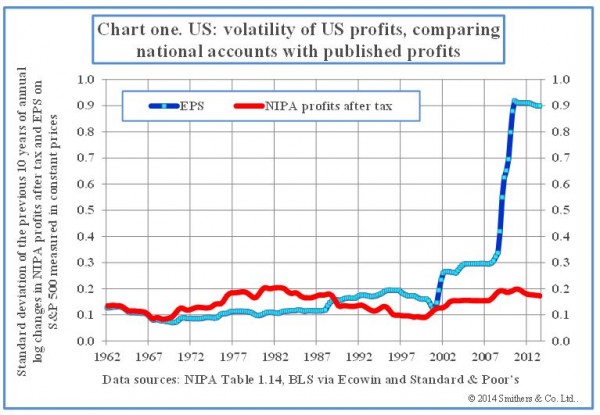

Chart one demonstrates the huge increase that has occurred in the volatility of the profits that US companies publish at a time when there has been no significant change in the volatility of profits shown in the national accounts. From 1952 to 2002 the two series had very similar volatilities but, since then, the earnings per share shown in the S&P 500 has become five times more volatile.

Why has this happened? The answer is because it pays management to have volatile profits and they can do it more easily than before with the change in accounting rules.

There has been a dramatic change in the amount and way that senior management is paid. Chart two shows that chief executive “bonuses”, which include stock options, have risen by almost four times since 1992 and, in 2008, were 83 per cent of total remuneration.

There has been a huge change in incentives and, of course, behaviour has changed with it – that is the purpose of incentives. When new chief executives are appointed, they seek to depress the level of profits on their arrival. In downturns managements that survive will do the same, arguing that profit targets which are out of reach provide no incentive. This is usually accepted, so the target is “rebased”.

Write-offs reduce companies’ equity and increase future profits. A write-off is not just an admission that profits have been overstated, it is a promise to try and overstate them in the future. Return on equity rises because equity is reduced and future profits are increased. Companies with high RoE are praised by analysts and this is reflected in the reputation of their management and directly or indirectly in their pay.

This encourages bad practice and poor outcomes. RoE in anglophone economies has begun to resemble tractors in communist Russia. Just as targets for production encouraged the output of vast numbers of tractors which broke down, so targets for RoE serve to improve the published figures at the expense of a decline in the information they convey.