Yelp and others involved in online reviewing say medical professionals are increasingly being caught faking customer reviews

March 9, 2014 Leave a comment

MARCH 4, 2014, 9:30 AM 3 Comments

Physician, Review Thyself

MedRite Urgent Care in Manhattan has come under Yelp’s scrutiny for soliciting fake reviews.

MedRite Urgent Care in Manhattan has come under Yelp’s scrutiny for soliciting fake reviews.

So you’re on the road and suddenly have this horrible pain in your lower middle. In the old days, your hotel would have a doctor, but those went the way of elevator operators. Your options now are the emergency room or an urgent care clinic.

Maybe, you think, a clinic will be better, faster, cheaper. But as an Internet-savvy soul, you check the online reviews first and find they run the gamut. Now you have no idea what to think. Will going to this clinic make your pain go away or make it worse?

Here’s one review of a Manhattan urgent care clinic:

“If you are about to die, go for it. Otherwise, suffer a bit and see a regular doctor later.”

But there’s also this:

“After waking up with a horrible sinus infection, I received fast, outstanding service.”

And just to balance things out, here’s a third:

“They aim to replicate the warmth and comfort of your primary care doctor’s office, and they do their best to move the process along expediently so that you can get back on your feet. … Their convenient location and clean facilities have a calming effect, and their ability to take care of your emergency is further soothing.”

Etc. etc. What this person never says is whether he actually used the place himself.

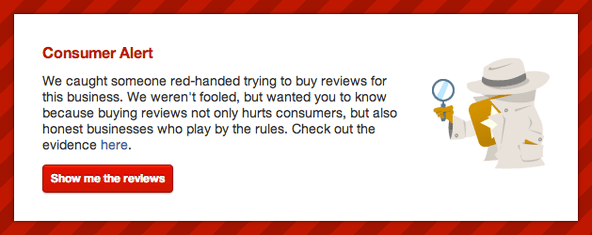

All these reviews are on Yelp for the MedRite Urgent Care facility at 919 Second Avenue. Yelp says it just caught someone trying to buy reviews for MedRite, and as a result has posted a Badge of Shame, otherwise known as a Consumer Alert, on the clinic’s page. It also put up the evidence, which is a message from someone named Sam who was offering to pay an active Yelper for a fake write-up.

A bogus review of a lousy book of poetry never killed anyone, but fake notices for a lousy doctor just might. Yelp and others in the review field say that there are increasing instances of medical folks being caught faking it. Of the 300 businesses that have received a Consumer Alert since Yelp launched the program in 2012, about 20 were medical spas, dentists, doctors, orthodontists and ophthalmologists. Eight of the 19 New York firms caught in a stingby regulators last fall either had a medical connection or dealt with people’s bodies in another way (a tanning salon).

“An error was made,” said Chaya Franklin, MedRite’s office manager. She said she didn’t know how it happened, but added: “We learned our lesson. I’m sure everyone in life would love to rewind something and redo it. Putting up a Consumer Alert is a little draconian. No one died. How long will we be punished?”

Consumer Alerts remain in place, Yelp says, for 90 days.