Could London suffer a Tokyo-style house price crash?

March 14, 2014 Leave a comment

Could London suffer a Tokyo-style house price crash?

One fund manager bets that central London house prices will keep rising at ‘a trend rate of 9pc per year’ – but why would they?

10:25AM GMT 09 Mar 2014

A new investment fund aims to capture, for private investors, the apparently inexorable rise in price of London’s “prime” properties. “Prime” refers to the stucco-fronted streets clustered around Hyde Park, in the world famous and (for now) ultra-desirable districts of Knightsbridge, Mayfair, South Kensington and Belgravia.

Investors must contribute a minimum £25,000, each £1 of which will be matched with about 80p of sharia-compliant mortgage debt.

The fund manager will then buy 100 mainly one-bedroom flats in the target locations, for £1m each. They will be renovated to “add value” and let to executives and other wealthy tenants.

In five years’ time, if all goes to plan, the portfolio will be sold to an institutional investor and cash and profits returned to investors.

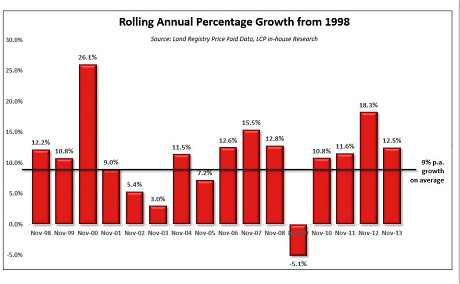

As ever, what grabs potential investors first is the impressive historic returns. The graph in the accompanying piece, right, shows yearly increases in value for this property segment over the past 16 years. Only one year – 12 months to November 2009 – posted a decline. The annual average price growth, even including this dip, is 9pc. The company behind this new fund, London Central Portfolio Ltd (LCP), says the 9pc figure is a “trend growth” going back not just 16 but 40 years.

The key to this “unique” asset class, the firm says, is its extraordinarily limited supply. There are just 200,000 properties in the target zones and a mere 500 new flats built there yearly, thanks to planning restrictions. A mere 100 transactions occur per week where eager buyers – from all over the world – bid for a precious slice of London.

The price growth is sustainable, says LCP, because of the rapidly forming queue of wealthy individuals wanting to buy. This is the “high-net-worth community of the world: Arabs, Thais, Malaysians, mainland Chinese, and others from the Bric countries” (Bric means Brazil, Russia, India and China).

These individuals want access to London’s education, shopping, or capital markets, says LCP; or they want to safeguard their assets from other, riskier territories.

So what could go wrong?

The worst property crash in modern times occurred in and around Tokyo in the late Eighties.

A frenzy of demand within the city’s limited physical terrain saw residential land prices rise 45pc between 1985 and 1986, and then, incredibly, more than double again in the next 12 months. In three, blazing years, the price of a square metre of Tokyo residential land rose 299pc. It was fuelled by credit provided by banks which in turn borrowed against their own growing stock market valuations, all of which led to the apocalyptic crash of the early Nineties. By then some unfortunate home owners – not only wealthy people – found they were saddled with mortgages 80pc greater than the value of their flats.

In London, prices have not risen by anything like as much and nor is there the toxic network of localised debt.

But LCP’s investment proposition is underpinned by the same theory, which is that a finite land supply must cause prices to rise. And as in Tokyo – where rents were controlled through legislation – gains are expected to come from capital appreciation. That adds speculative impetus, ratcheted up by the attached debt.

Yes, LCP’s fund will generate an income through rents, if it succeeds in letting all the properties, but it says “rental return is relied upon to cover a mortgage and running costs, not to generate a significant income”. This is “a capital growth play”, it says.

That puts investors at risk of the many factors that could diminish London’s appeal in the eyes of this small, albeit growing, community of super-rich. The biggest threat is a change in tax. From April 2015, UK properties owned by non-residents are already to be subject to greater taxation. Given the Government’s need for revenue – and the understandable lack of public sympathy for wealthy owners of multiple properties – aren’t further taxes likely?

At that point surely these globally mobile individuals will evaporate, along with much of the value of these assets.