As Stock Picking Comes Back In, ETF Use Goes Out

March 17, 2014 Leave a comment

Mar 13, 2014

As Stock Picking Comes Back In, ETF Use Goes Out

Here’s the latest evidence that stock picking is back: Investors are buying and selling fewer exchange-traded funds.

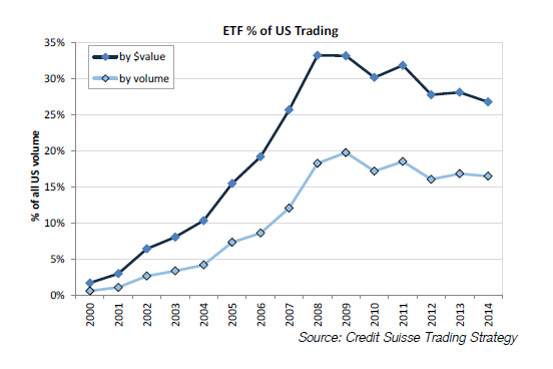

As big macroeconomic headlines recede, ETFs are falling out of favor. ETF volumes have dipped this year to about 16.5% of total equity volumes, down from 16.7% in 2013, according to analysts at Credit SuisseCSGN.VX -1.59% Trading Strategy. The data suggest that investors are increasingly favoring trades in individual stocks.

“ETF usage typically increases when macro issues dominate and correlation increases since ETFs are a convenient way to move money quickly and shift beta exposures efficiently,” the analysts write.

In 2011, when the euro-zone crisis pushed markets to and fro, ETFs made up 18.2% of total volumes. The figure hit a peak of nearly 20% in 2009, just after the financial crisis.

To be sure, ETF use did spike a few days this year when macro headlines returned to the fore. When Russia invaded Ukraine on March 3, ETF use jumped to more than 21%. When a weak manufacturing report knocked stocks on Feb. 3, the figure shot to nearly 25%.

An article in this week’s Wall Street Journal noted that such macro headlines have grown more scarce this year. As a result, correlations–the tendency of individual stocks to trade in the same direction—have declined and more investors are shifting toward active management.

Credit Suisse also highlighted the recent drop in correlations. One metric, one-month “realized” correlation within the S&P 500, is down to 25%, according to Credit Suisse.