Buffett gets the better of everyone, version 4,762

March 19, 2014 Leave a comment

Buffett gets the better of everyone, version 4,762

| Mar 14 15:12 | 16 comments | Share

We have always admired Warren Buffett’s ability to combine hard headed capitalism with incredible popularity. America’s favourite billionaire and all that.

But in his latest deal to swap shares in Graham Holdings for a Miami TV station, cash and stock, Mr Buffett appears to have come out on top once again, pushing a terrific deal for Berkshire past a board stuffed with serious people.

The key to understanding the transaction is that buying a large stake in the Washington Post in the 1970s ranks as one of Warren Buffett’s greatest ever investments.

Berkshire Hathaway paid $10.6m for a tenth of the Washington Post in 1973, when the paper was under attack from Richard Nixon, and Warren estimated its assets alone were worth $400m.

The investor joined the board for the first of two stints the following year, and over time he persuaded the company to buy back 40 per cent of its stock. He also became a close friend of Katherine Graham, the company’s chairman and chief executive, who died in 2001. A letter to Ms Graham on pension funds is reproduced in this year’s annual report.

Mr Buffett had said he would never sell, but then Jeff Bezos bought the Washington Post newspaper for $250m last year, and what was left of the conglomerate became Graham Holdings. It has been run by Katherine’s son Donald since 1991.

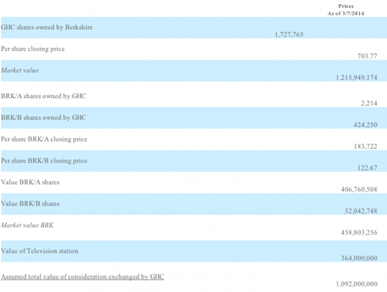

At $715 each, Berkshire’s holding of 1,727,765 shares in Graham is worth $1.2bn.

More than 99 per cent of that value is a capital gain, which,were Berkshire to sell, would trigger a tax liability at 35 per cent. Consider, also, that to sell more than a fifth of Graham Holdings in the market would mean accepting some sort of discount to the market price in return for the liquidity.

So let’s say Buffett’s alternative to doing a deal with Graham Holdings is to get around60 cents on the dollar for that $1.2bn stake.

Facing a seller in such a situation, it is an open question what price Graham’s board should consider fair for helping Berkshire to exit its investment in a way that avoids the huge tax bill. Perhaps 75 or even 80 cents on the dollar.

What Berkshire got is a lot better than that. Mr Buffett receives a Miami television station, stock in Berkshire Hathaway, and some cash, structured in a way to avoid the tax bill. As the Graham disclosure makes clear:

The Exchange is intended to qualify for non-recognition of gain and loss to Graham and to BH under Sections 355(a), 355(c), 361(a) and 361(c) of the Code (the “Intended Tax Treatment”). The “Code” shall mean the United States Internal Revenue Code of 1986, as amended.

The deal looks complicated, in that its ultimate value and exchange ratio depends on the price of Graham and Berkshire stock on the closing date. But here is the key part to understand the value transfer:

Priced as of March 7, Berkshire gets assets worth $1.092bn against its stake then worth $1.22bn, or 90 cents on the dollar.

Consider also what Buffett is getting as part of the deal – a big slug of Berkshire stock. If you assume that the conglomerate is say 10 per cent undervalued, the return rises to 94 cents on the dollar.

The difference between 94 cents on the dollar and 75 cents in this case is $225m.

Graham has held its Berkshire shares for a long time also, so it would face capital gains tax on the sale of its stake, valued above at $459m. As of the end of 2013 the unrealised gain was $287m, which taxed at 35 per cent would be a liability of $100m.There might also be a capital gain associated with the TV station, although why Graham wishes to sell that particular piece of its TV empire is not clear.

Still, the Graham Holdings board which approved this deal includes some very smart people: Christopher Davis, the chairman of Davis Selected Advisers, media mogul Barry Diller, Anne Mulcahy, former chief executive of Xerox and Richard Wagoner, former head of General Motors. So perhaps there is a compelling reason for Graham to strike this deal, which is not immediately obvious.

After all, the FT quotes the Sage thus:

“I am sure this is a mutually beneficial transaction for both companies,” said Mr Buffett, chairman and chief executive of Berkshire Hathaway. “While this transaction will greatly reduce our position in Graham Holdings, our admiration for the company and its management is undiminished.”

Although mutually beneficial doesn’t have to mean the benefits are shared equally.

Given that it is a deal stuck between a former insider and old friend of the chief executive’s family, Graham might consider explaining the deal in a little more detail. The company declined to comment further when we asked, and we’ll update this if we hear anything back from Berkshire.

—

As a post script, the tax aspect is interesting also. Mr Buffett, as chairman of Berkshire, has a duty to minimise a tax liability that would be around $400m in the event those capital gains were crystalised.

Note that Mr Buffett’s stake in Berkshire, worth $63bn, is about a fifth of the company’s $305bn market capitalisation. The value of that perfectly legal piece of tax avoidance to him personally is $80m.

Yet it has passed largely without comment that the very rich man who says he would like higher taxes on the rich has pulled off a deal designed entirely to avoid a large tax bill. America’s favourite billionaire indeed.