China’s Credit Nightmare Explained In One Chart

March 20, 2014 Leave a comment

China’s Credit Nightmare Explained In One Chart

Tyler Durden on 03/14/2014 14:22 -0400

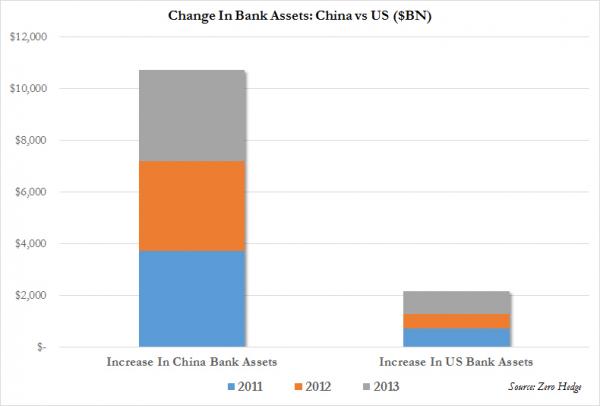

Everyone knows that after years of kicking the can and resolutely sticking its head in the sand, China is finally on the verge, if hasn’t already crossed it, of a major credit event, confirmed by the first ever corporate bond default which took place a week ago. Few, however, know just why China is in this untenable position. If we had to select one data point with which to explain it all, it would be the following: just in the fourth quarter of 2013, Chinese bank assets rose from CNY147 trillion to CNY151.4 trillion, or, in dollar terms, an increase of almost exactly $1 trillion!

By comparison, US bank assets in the same period rose by just over $200 billion, a number which consists almost entirely of the reserves injected by the Fed.

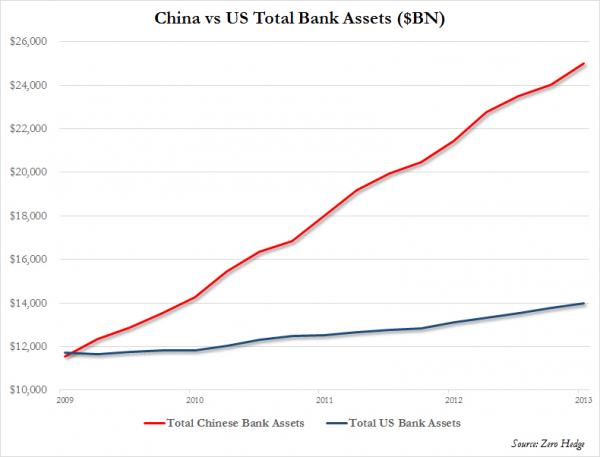

And if we had to show it in one chart, it would be the following comparison of total Chinese and US bank assets: the two lines shown below are on the same axis, and at the end of 2009, the US had just a fraction more assets than China. Since then the US has added $2.3 trillion in bank assets, exclusively thanks to the Fed’s reserve creation. As for China… total bank assets more than doubled from $11.5 trillion to a record $25 trillion! This is a number that is nearly double that of the US, and represents a pace of $3.5 trillion per year – or nearly four concurrent QEs – a rate of “financial asset” addition five times greater than in the US!

Another way of showing just the past three years:

What’s worse: China is now hooked to a “flow” pace of $3.5 trillion each and every year, just to generate an annual GDP of about 8% and declining with every passing year. Any reductions in the pace of monetary flow will have magnified implications on China’s growth, and from there, social, and globa, stability.

But what does this really mean? Simple: in this epic, unprecedented, feverish pace to “grow” the economy and create hot, if worthless, money out of assets, all assets, even “magic” assets (i.e. thin air), the following took place:

CITIC Trust tried to auction the collateral but failed to do so because the developer has sold the collateral and also mortgaged it to a few other lenders.

Until now nobody cared because defaults were prohibited in China and nobody really cared what was underneath the hood. Now, defaults are allowed and, in fact, are encouraged. Which is why suddenly everyone is starting to cast curious glances into the dark shadows where the engine is supposed to be.

They won’t like what they find.