What Will It Take for the Fed to Raise Rates?

March 25, 2014 Leave a comment

What Will It Take for the Fed to Raise Rates?

SPENCER JAKAB

March 18, 2014 3:29 p.m. ET

The more things change, the more they stay the same.

At least that is the impression the Federal Reserve has given financial markets. Since short-term interest rates were set near zero more than five years ago, the timeline for raising them has been a moving target. First there was “some time” which became “an extended period.” Seeking more specifics, the market was then told rates would begin to rise in mid-2013, by late 2014 and then mid-2015.

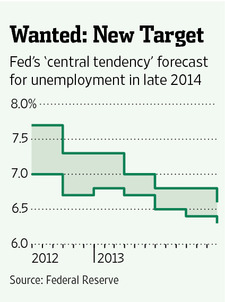

The latest threshold, an unemployment rate of 6.5%, barely below today’s level, will likely get the chop Wednesday following the Fed’s two-day meeting. Unemployment was a much higher 7.8% back in December 2012 when that target was communicated, and rate setters’ forecasts at the time show that they didn’t expect it to be reached so quickly. At present, futures markets don’t call for an increase in rates until 2015. It is a fair bet that Fed Chairwoman Janet Yellen, presiding over her first press conference in that role, won’t dash those expectations.

The question really isn’t if the Fed’s so-called forward guidance will be changed for the sixth time in as many years, but how. An obvious solution is to simply move the unemployment threshold, perhaps to 5.5%.

Another possibility would be to adopt a different threshold, with inflation taking center stage. Tuesday’s consumer-price index left the year-over-year change in core inflation, which excludes food and energy, at a level some policy makers might consider too low for comfort.

But having already scrapped so many specific dates and targets, it seems unlikely the Fed would try again. Returning to the sort of vague timeline the Fed employed in the early days of its zero-rate experiment—”extended period” and the like—also doesn’t seem to be in the cards.

Instead, expect qualitative guidance—a description of how the economy should look rather than a specific statistic. An important part of monetary policy is telegraphing policy makers’ intentions. Unfortunately, the recent efforts at transparency have forced Fed officials to go back to the drawing board repeatedly in how they communicated them.

Instead of painting themselves into a corner again, the change of leadership at the Fed is a chance to draw the same picture using broad brush strokes.