NYSE Margin Debt Rises To New All Time High As Net Worth Slides To Record Low

May 29, 2013 Leave a comment

NYSE Margin Debt Rises To New All Time High As Net Worth Slides To Record Low

Tyler Durden on 05/28/2013 18:28 -0400

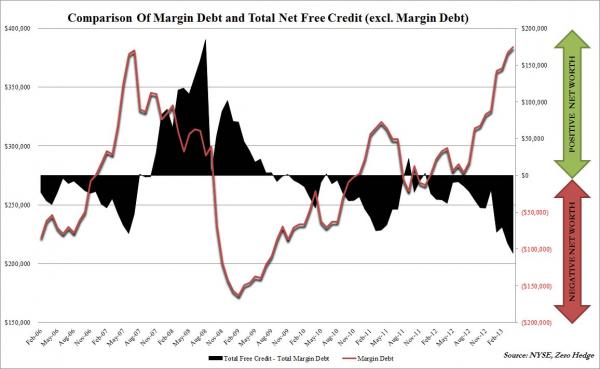

With everything else in uncharted territory: central bank balance sheets, the stock market, global debt, it was only a matter of time before that old-school indicator of exuberance – margin debt – also joined the ranks of things that are “off the charts.” Never one to disappoint (except when Waddell and Reed dumps a “massive” 75,000 ES trade which promptly kills its liquidity replenishment points of course), the NYSE has reported that April margin debt, as expected, hit all time records, just in time for the S&P’s own all time high fireworks spectacular. Rising from the just shy of summer of 2007 levels posted in March, or $380 billion, April margin debt not surprisingly rose to a record high of $384 billion. Additionally, even when netting out account credit metrics, such as Free Credit Cash and Credit Balances in margin accounts, total investor net worth just hit an all time record low of ($106) billion.

In short: investors have never been more levered.And that is only looking at legacy metrics. Recall that as per recent regulations requiring that hedge funds expose gross leverage via Form PF, just the top 50 or so HFs have gross exposure of over $1.3 trillion, which means they are levered massively more than their LP realize, and than the naive NYSE margin statistic indicates.

But that is a topic for a different day.

For now let’s just bask in the simplicity of the good old days, where NYSE margin was relevant, and not get too scared by what the true margin level in the market may actually be, especially when one takes into account the leverage on the Fed’s own balance sheet.