For Investors, Emerging Debt Rethink After Biggest Decline in Five Years

July 1, 2013 Leave a comment

June 30, 2013, 4:58 p.m. ET

For Investors, Emerging Rethink

TOMMY STUBBINGTON

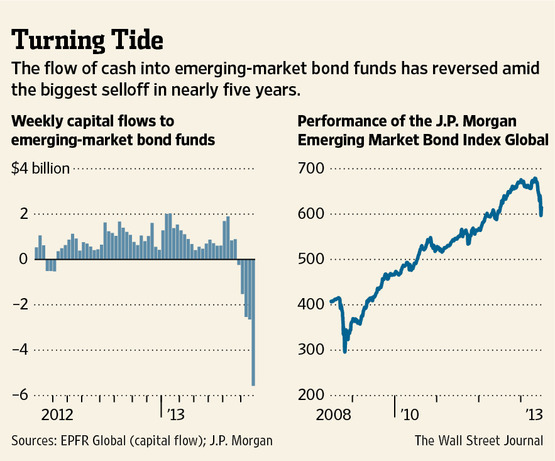

Emerging-market debt has experienced its biggest decline in nearly five years. Some investors said the selloff may not be over. And once the dust settles, money managers will have to become more discerning in figuring out which countries offer the best prospects. Prices on bonds issued in emerging economies have lost 9.5% of their value since an all-time record high hit in May, according to the J.P. MorganJPM -0.68% Emerging Market Bond Index. At their lowest point last week, they were down 12% from that peak. The pace of the selloff recalls late 2008, when emerging-market bonds fell almost 30% in less than two months. Bond prices move in the opposite direction of yields.

The latest decline was triggered by expectations the Federal Reserve was gearing up to dial back on bond purchases, a stimulus measure that injected $85 billion a month into the financial system and drove down yields on bonds of all stripes. In mid-June, Fed Chairman Ben Bernanke set out a tentative timetable for the Fed’s pullback from its bond-buying program.

The message from the Fed comes amid signs of a growth slowdown in emerging markets. In the past several years, low interest rates, easy-monetary policies and rapid growth in the developing world sent investors on a hunt for higher-yielding assets in these markets. The combination of less stimulus from the Fed and slower growth in emerging markets is reversing the flood of cash that flowed toward those nations’ debt.

“We’re not heading for an emerging-market debt crisis, but the tide is moving slowly but surely in the opposite direction,” said Sergio Trigo Paz, head of emerging markets fixed income withinBlackRock Inc.’s BLK -2.73% Portfolio Management Group.

This view is borne out by recent data. In the week to June 26, $5.57 billion left emerging-market bond funds, the largest weekly exodus on record and the fifth consecutive week of net outflows after almost a year of uninterrupted inflows, according to fund tracker EPFR Global.

Many investors said that even once the selloff abates, it is unlikely that a stampede back into developing economies will resume at the same pace.

“At the beginning of this year, markets were moving in tandem,” said Mr. Trigo Paz, who helps oversee $4 billion in emerging-market bonds. “Now, they are competing for portfolio flows.” BlackRock cut its exposure to emerging-market debt in February amid worries it was becoming overvalued, he said.

Colm McDonagh, head of emerging-market fixed income at Insight Investment, which manages $755 million of emerging-market debt, said investors generally are becoming more picky about what emerging markets they are willing to bet on.

“When markets attract new players and some of that money is deployed in a pretty indiscriminate way, the qualitative distinction can get blurred,” Mr. McDonagh said. But once markets stabilize, some emerging-market countries will begin to outshine others, rather than moving largely in lock step, he added.

Mr. McDonagh said debt issued by fiscally strong countries like Mexico and the Philippines, which hasn’t been spared during the selloff, is beginning to look attractive. Yields on bonds issued by other countries, such as South Africa, may continue to rise, he said, because the government has made little progress in narrowing a fiscal deficit.

Mr. Trigo Paz, meanwhile, is drawn to Brazil, which has removed some taxes on financial transactions in past weeks. Brazilian debt looks appealing compared with similar-yielding Indian bonds, given stronger economic fundamentals and more liquid markets, he said.

To be sure, some emerging-market bulls argue the selloff already has gone too far. Traders are being overly pessimistic about how fast the Fed will pull back on stimulus, said Tim Dingemans, a portfolio manager overseeing $80 million of emerging-market debt at Adelante Asset Management.

“We have moved from pricing that Japanese housewives buy every bond on the planet, to pricing that no one’s going to buy anything, ever,” Mr. Dingemans said, referring to the economic stimulus announced by the Bank of Japan 8301.JA 0.00% in April. “It’s gone too far,” he added.

But Mr. Dingemans said bargain-hunting investors will have to become more selective.

“We think prices are now more attractive,” he said. “But commodity exporters like Chile and Indonesia are going to continue to be under pressure. We are also worried about Turkey because of the political instability.”