Dividend Stocks Enter New Era of Caution

July 4, 2013 Leave a comment

Updated July 2, 2013, 6:04 p.m. ET

Dividend Stocks Enter New Era of Caution

MATT JARZEMSKY

Jitters about Federal Reserve policy have made investors more cautious about stock sales by companies that pay high dividends, but the window is still open for new offerings. Investors may no longer be rushing to buy just about anything with a high yield at just about any price, as they seemed to be doing at times during the first five months of the year. Yet interest rates are expected to remain exceptionally low even if the Fed begins to scale back its stimulus efforts. That, many analysts and investors say, will continue to fuel a search for yield through dividend stocks, and provide an appetite for new offerings. At the same time, the kind of improved growth outlook that would lead the Fed to taper its easy-money policies could encourage stock sales by companies more sensitive to economic growth. Investors look to shares of these companies because they offer potential for price appreciation.New issuance by high-yielding companies is “not going to shut down, but I think it’s going to slow down,” said Andy Tuthill, head of capital markets at JonesTrading Institutional Services LLC.

“We may see less of that and more growth-oriented issuance,” he added.

For much of the first half of 2013, investors seemed to have a nearly insatiable appetite for new shares sold by high-dividend-paying companies.

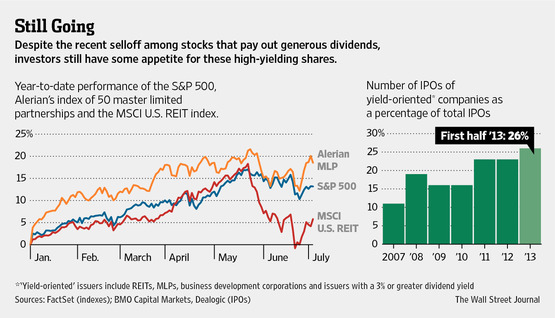

Real-estate investment trusts, master-limited partnerships and companies offering a dividend yield of at least 3% accounted for 26% of the initial public offerings in the first half of 2013, a higher share than in any full year since at least 2007, according to a BMO Capital Markets analysis of Dealogic data.

Meanwhile, yield-oriented issuers accounted for 38% of the number of stock sales from already public companies and 36% of the dollar volume of such deals, also representing high-water marks since the financial crisis, according to BMO.

Some of the biggest IPOs currently in the pipeline are in the high-dividend category. Last month, American Homes 4 Rent filed initial paperwork to become the latest in a new class of REITs that operate single-family homes as rental properties, seeking to raise up to an estimated $1.25 billion.

However, high-dividend stocks, which tend to be sensitive to changes in interest rates, have seen a pickup in volatility. The MSCI U.S. REIT index closed at a 5½-year high on May 21 before falling 16% in little over a month. The Alerian MLP index fell to a three-month low last Monday, but rebounded with a 4.7% gain over the course of the week.

Those kinds of swings can impede stock issuance because they make a company’s valuation more of a moving target, and force issuers to sell stock at lower prices.

Amid those market moves, several would-be equity issuers hit the pause button on their offerings.

Brookfield Renewable Energy Partners postponed a $288.5 million secondary stock offering last month due to adverse market conditions. Earlier in June, Colony American Homes Inc. shelved plans to offer $245 million in stock as a REIT.

Still, investors say they see higher-yielding stocks as an attractive option.

To Mark Freeman, chief investment officer at Westwood Holdings Group Inc.,WHG +0.28% which manages $15.3 billion in Dallas, higher-yielding stocks offer an opportunity for growth that can’t be found in bonds. He has been buying in stock offerings by MLPs recently.

“You’re not going to be able to live by yield alone, in this environment,” he said, pointing to the ability of MLPs to see share prices as well as payouts rise. “You need growth as well.”

And many corners of the stock market still offer yields that are competitive with U.S. bonds.

The Alerian MLP Index offers a dividend yield—or per-share income as a percentage of its price—of about 6%, according to Alerian’s website. MSCI U.S. REIT offers a dividend yield of about 3.68% as of Friday, according to FactSet. Meanwhile, bonds in the Barclays BARC.LN -0.53% investment-grade corporate-bond index are yielding 3.4% and the U.S. Treasury 10-year note is yielding about 2.5%.

“Even in the face of rising interest rates, yield equities continue to offer compelling total returns,” said Michael Cippoletti, head of U.S. equity capital markets at BMO Capital Markets.